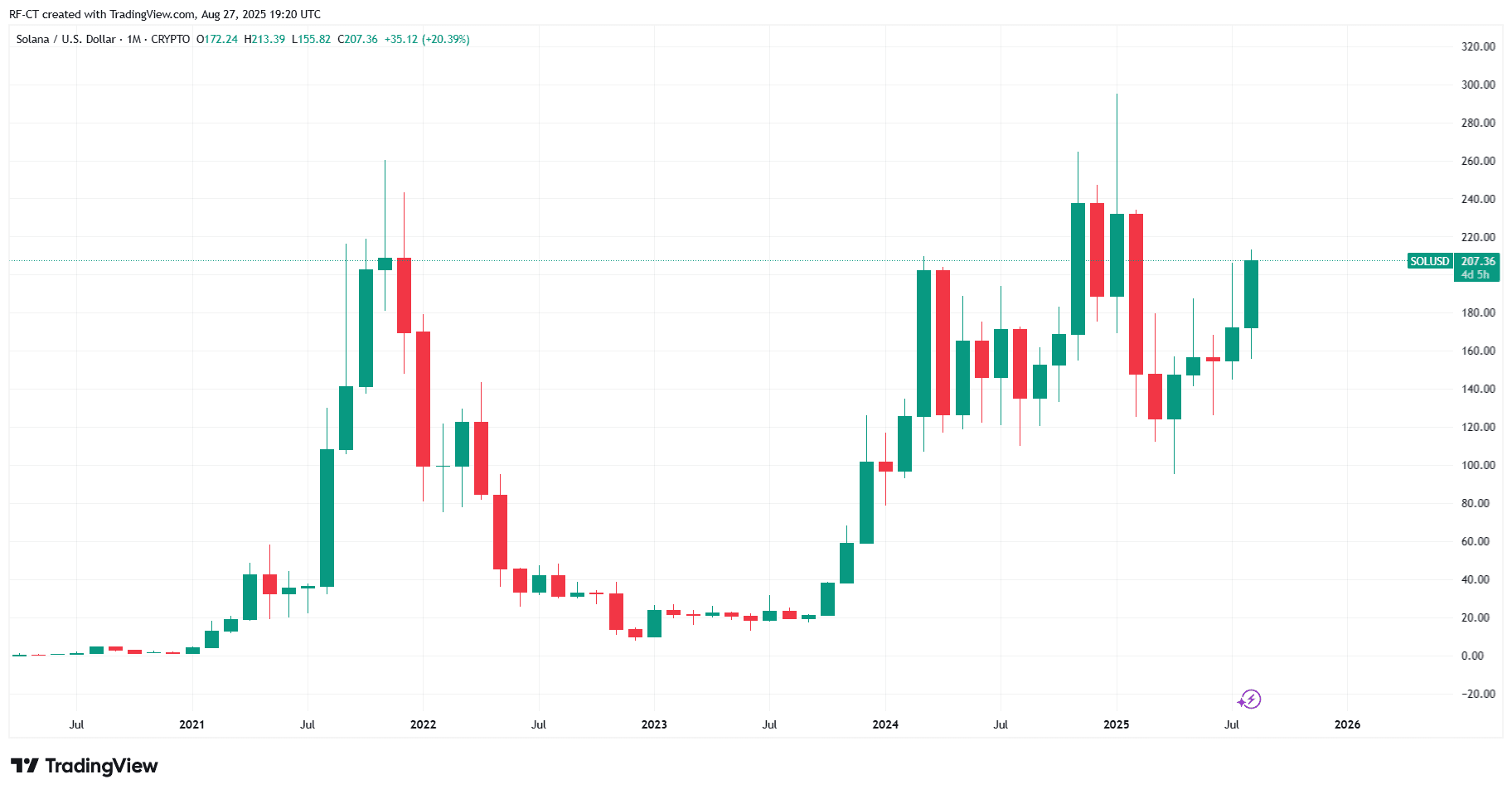

Solana Price Prediction: Can SOL Break $215 and Surge Toward $300?

Solana (SOL) is once again in the spotlight, testing critical resistance levels around $205–$215 amid a surge in institutional flows. Analysts are projecting that a breakout could propel its price toward the $300 zone if key technical thresholds hold. At the same time, Solana treasuries remain modest in staking activity, adding a layer of strategic caution to the bullish narrative.

By TradingView - SOLUSD_2025-08-27 (YTD)

By TradingView - SOLUSD_2025-08-27 (YTD)

SOL Pressing Key Resistance Around $205–$215 Spectrum

Today, Solana’s price finds itself at a strategic juncture . Technicals show heavy trading activity near the $205–$215 range, a zone that, if breached, could unlock significant upside momentum. Futures volumes have soared—one source notes $50 billion in SOL futures exchanged recently—indicating heightened market interest and potential for breakout moves.

Institutional Flows Could Fuel the Next Leg Up

Institutional demand is stepping into the foreground. Pantera Capital’s plan to raise up to $1.25 billion to build a “Solana Co.” public treasury signals deep conviction in SOL’s upward trajectory. This kind of strategic accumulation could provide the launchpad for SOL to breach resistance levels with authority.

SOL Price Prediction: $300 Within Reach

Multiple sources align on a bullish scenario if resistance gives way:

- BraveNewCoin forecasts a breakout above $207 could validate a rally toward $300, with $176 as downside buffer and $210–$215 acting as the defining test.

- CoinStats notes that solid support at $188 and a breakout could take SOL to $215–$220, with longer-term aspirations reaching $295.83.

- FXEmpire points out that with futures surging and SOL exceeding $200, the next leg could be underway ﹘ potentially setting the stage for fresh all-time highs.

By TradingView - SOLUSD_2025-08-27 (5D)

By TradingView - SOLUSD_2025-08-27 (5D)

Putting it all together, if SOL clears the $215 barrier decisively , a move toward $300 seems fully within the realm of possibility.

Staking Activity Remains Surprisingly Low

Even as price action heats up, Solana treasuries continue to underutilize staking opportunities. The majority of institutional SOL remains un-staked, potentially limiting passive yield accumulation and pointing to cautious treasury strategies in a volatile environment.

Balancing Bullish Momentum with Risk Factors

Although optimism runs high, the downside risk remains if SOL fails to hold the $200–$202 level:

Analysts warn that dropping below this threshold could keep SOL rangebound—or worse, lead to a dip toward $150, with a break below $190 possibly targeting $170.

Meanwhile, others highlight strong whale accumulation and ecosystem buybacks pushing toward $250–$295 levels, reinforcing the bullish thesis if momentum sustains.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Systemic Risks of Celebrity-Backed Memecoins: How Retail Investors Are Exploited in the Crypto Speculation Era

- Celebrity-backed memecoins exploit retail investors through centralized allocations, pre-distributed tokens, and market manipulation tactics. - Projects like Kanye West’s YZY and TRUMP tokens see insiders extract millions via liquidity traps while 83% of retail wallets suffer losses. - Academic studies confirm 82.6% of high-return meme coins use wash trading and liquidity pool inflation to artificially inflate prices. - Regulatory gaps allow celebrities to evade accountability despite SEC investigations,

Why Tapzi (TAPZI) Is the Most Promising GameFi Altcoin for 5,000x Returns by 2030

- Tapzi (TAPZI) redefines GameFi with skill-based competition, blockchain scalability, and utility-driven tokenomics, contrasting speculative meme coins. - The platform's BNB Chain integration enables gasless transactions, while 5% token allocation to player rewards ensures organic growth without inflation. - Presale reached 35% of its hard cap in 48 hours, with early investors acquiring tokens at $0.0035, projecting 171% returns before 2030's 5,000x target. - By targeting the $180B gaming market through f

South Korea's Institutional Bitcoin Adoption: A Strategic Inflection Point for Asian Crypto Markets

- South Korea launches Bitplanet, its first institutional-grade Bitcoin treasury with $40M in debt-free capital, signaling a strategic shift toward digital asset management. - The move aligns with regional trends as Japan and Singapore advance crypto adoption, redefining Bitcoin’s role as a corporate reserve asset amid geopolitical and demographic risks. - Bitcoin’s 0.94 Sharpe Ratio (2023–2025) and $132.5B in ETF assets highlight its institutional legitimacy, outperforming traditional assets while mitigat

Tornado Cash Legal Defense and the Future of Decentralized Innovation: Navigating Regulatory Uncertainty and Market Resilience

- Tornado Cash case highlights legal challenges of applying traditional finance laws to decentralized blockchain protocols. - Roman Storm's conviction for unlicensed money transmission and Treasury's sanctions reversal reveal fragmented regulatory approaches. - Market response shows privacy tools' resilience, with TORN token surging 75% after sanctions lifted in March 2025. - DeFi adoption grows (312M users, $247B TVL) as privacy-focused protocols integrate compliance tools like AI-driven AML analytics. -