Corporate Bitcoiners eye Thailand as gateway to $3.8 trillion ASEAN Bitcoin treasury play

An international consortium led by Sora Ventures, UTXO Management, and Kliff Capital has met with former Thai prime minister Thaksin Shinawatra in Bangkok to advance Thailand’s role as a hub for Bitcoin as a treasury asset across ASEAN.

The meeting brought together executives from AsiaStrategy (Nasdaq: SORA), Nakamoto, Moon Inc., and Kliff Capital alongside Thaksin, who currently advises the Malaysian prime minister on ASEAN affairs, to explore positioning Thailand at the center of regional digital asset reserve development.

The consortium is building on a model already tested in Japan through Metaplanet, often described as Asia’s version of Strategy (formerly MicroStrategy).

As Metaplanet pivoted part of its treasury into Bitcoin in 2024 with Sora Ventures as a core backer, triggering rapid valuation gains that validated structured Bitcoin allocation in corporate reserves. This approach has since evolved into what Sora has termed “MicroStrategy 2.0,” a strategy combining direct holdings with structured yield products aimed at both institutional and retail investors. The model was first outlined at Consensus Hong Kong earlier this year.

The meeting in Bangkok comes as AsiaStrategy, created from Sora Ventures’ merger with Nasdaq-listed Top Win, accelerates its expansion across Asia’s public markets. The group has executed acquisitions of listed companies in Thailand and South Korea, positioning them as vehicles for Bitcoin treasury deployment.

In July, the consortium completed a tender offer for DV8, a Thai-listed firm, with nearly complete warrant participation that raised approximately THB 241 million, or $7.4 million, to support a pivot into digital asset strategies. Around the same time, the group acquired South Korea’s SGA Co. for roughly $25 million, extending its presence beyond Thailand.

The Bangkok discussions focused on aligning these corporate treasury initiatives with national policy. Thaksin emphasized that a Bitcoin-based digital asset reserve could strengthen Thailand’s long-term financial stability, promote financial inclusion, and attract international capital under a regulated framework.

His involvement ties digital asset strategy to ASEAN-level policy ambitions, given his advisory role with the Malaysian government. The consortium argues that integrating Bitcoin into sovereign-style treasury strategies can create resilience and modernization pathways for economies in Southeast Asia, a region of over 680 million people.

ASEAN’s ten member states collectively represent an economy worth over $3.8 trillion, emphasizing the scale of reserves that a Bitcoin treasury strategy could tap into.

AsiaStrategy functions as the listed investment platform, giving the consortium a public-market presence with access to international capital flows. AsiaStrategy is also experimenting with integrating Bitcoin payments into its retail subsidiaries.

The strategy is modeled on treasury shifts that previously lifted Metaplanet’s valuation by thousands of percent in Japan, showing how Bitcoin allocation can become a driver of equity performance. In DV8’s case, cash reserves grew by 38% following the pivot, while yield-per-share improved by 13%.

Proponents argue this demonstrates how structured Bitcoin treasuries can deliver measurable shareholder benefits while aligning with broader state-level ambitions. Metaplanet and its allies view such moves as both corporate finance innovation and strategic positioning for national economies.

The Bangkok initiative marks the first step toward formal alignment between Thailand’s political leadership and the digital asset treasury consortium.

For investors, the parallel development of corporate vehicles like DV8 and public platforms like AsiaStrategy presents a pathway for exposure to Bitcoin as a strategic reserve asset within a regulated market.

Thailand could establish itself as ASEAN’s central hub for digital asset treasury, leveraging foreign capital and domestic regulatory clarity. The meeting with Thaksin formalizes political support for this agenda, positioning the consortium to embed Bitcoin strategies into corporate and national finance across the region.

The post Corporate Bitcoiners eye Thailand as gateway to $3.8 trillion ASEAN Bitcoin treasury play appeared first on CryptoSlate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

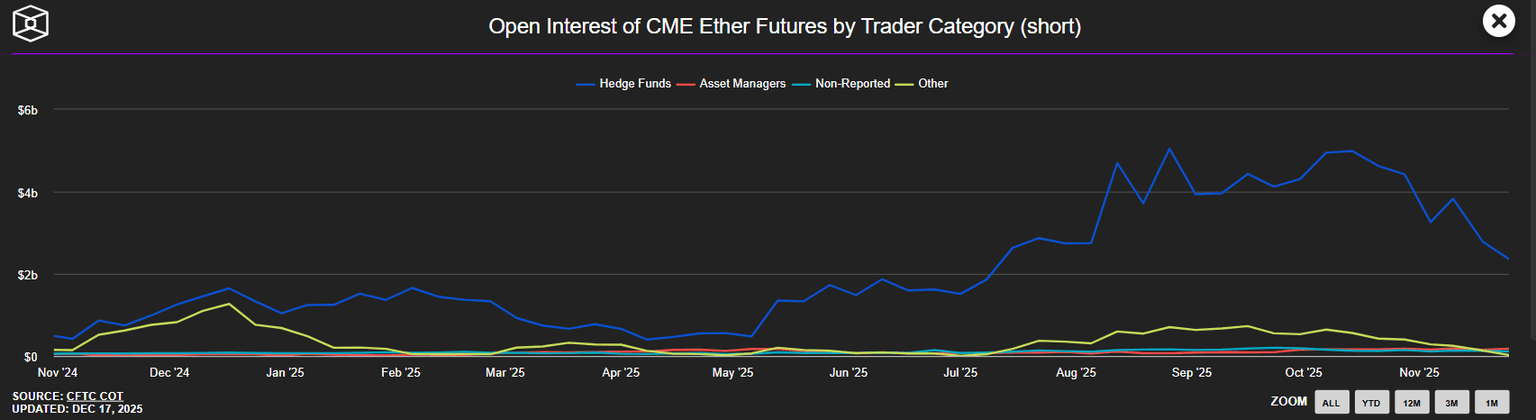

Ethereum Price Prediction: Liquidations Increase, ETH Short Positions Decrease

Revolutionary Move: Brazil’s B3 Exchange to Launch Major Tokenization Platform in 2026

Traders ponder a bottom as Bitcoin falls back to this week's lows below $86,000