Fistbump (FIST), a token from the BNB Chain ecosystem, is facing a potential liquidity crisis. The token had an outsized rally, with signs of whales cashing out on the hype.

Fistbump (FIST) is a token that heated up in the past few days, sparking fears of a potential rug pull. Multiple on-chain analysts suggest FIST may be facing a sudden liquidity crisis, as whales use the short-term hype to cash out.

FIST currently depends only on PancakeSwap pairs for most of its liquidity. This also means the token can return to its relatively inactive state if the biggest liquidity providers move on, or whales cash out. Despite its years-long history, FIST never gained listings on centralized exchanges.

FIST staged a rally after three years of inactivity

The FIST project is no stranger to rapid crashes, following its initial launch at the end of July 2022. FIST immediately spiked to a peak of $3.36, then erased most of its value, drifting under a penny for years. FIST is one of the rare tokens to move after a prolonged bear market, and even briefly trade above its all-time record at $3.52.

FIST staged a vertical rally after years at sub-penny prices. This time, the project received new warnings about a potential liquidity crunch and another deep correction. | Source: Coingecko

FIST staged a vertical rally after years at sub-penny prices. This time, the project received new warnings about a potential liquidity crunch and another deep correction. | Source: Coingecko

After being almost forgotten, the FIST project suddenly showed activity, and miraculously recovered its price range above $3.20 within days. FIST received hype from former holders, but also dire warnings about a potential crash similar to the one in 2022.

Multiple sources launched warnings that FIST was showing signs of whales cashing out following the long period of trading at a low range. The current trading pairs available may also dry out if the liquidity pools are drained.

Because FIST was launched back in 2022, during boom times, it created a commotion and was widely adopted. FIST reached a total of 226,842 wallets, the majority of which suffered severe losses. Some FIST owners apparently held through the 2022-2023 bear market.

FIST shows on-chain warning signs of insider control

FIST tokens are mostly concentrated on a single PancakeSwap pair, which carries over 95% of volumes. The asset reached $30M in daily volumes, an anomalous activity level.

As of August 28, the leading trading pair still held over $7M in available liquidity. However, that liquidity is mostly dependent on a single whale provider. The top liquidity provider carried over 77% of the pair’s liquidity, based on DexScreener data.

During the latest rally, multiple whales cashed out around $600K each, with no single entity showing large-scale earnings. However, if retail and new buyers join, older holders may try to cash out.

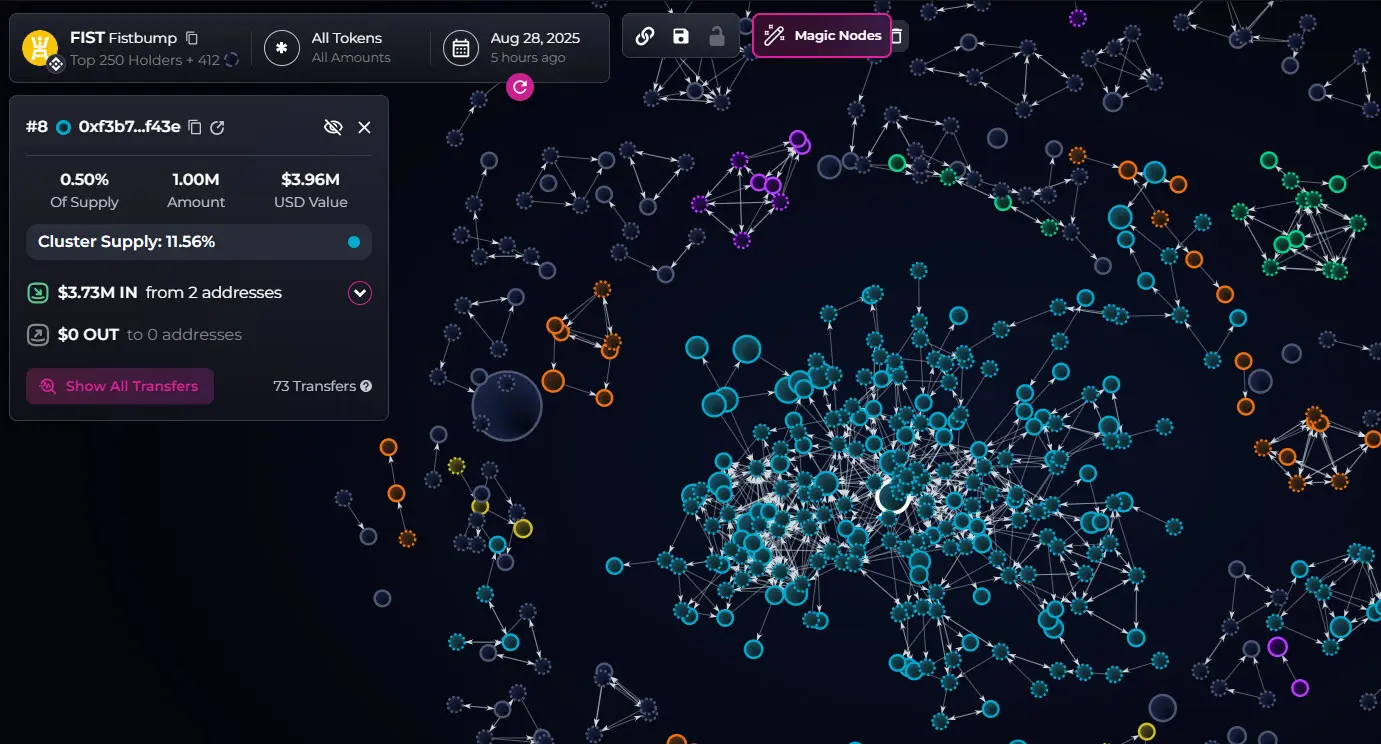

Additionally, FIST shows signs of insider holdings. Although there are a few significant whales with big wallets, the top 20 holders are connected in a wallet cluster, based on Bubblemaps data.

FIST is not held by outright whale-sized wallets, but the top addresses are connected in a large wallet cluster holding over 11% of the supply. | Source: Bubblemaps

FIST is not held by outright whale-sized wallets, but the top addresses are connected in a large wallet cluster holding over 11% of the supply. | Source: Bubblemaps

The Fistbump project is also busy advertising its FST Swap decentralized exchange. Despite the hype, the FST Swap exchange still advertises the FIST token under a ‘parody account’.

Fistbump started its aggressive marketing on social media during the 2025 bull market. The token aims to position itself as a DeFi hub in the BNB Chain ecosystem, while still trading with a risk similar to a new meme token. Despite the goal of ‘making FIST great again’, the token raises multiple red flags after its near-vertical rally, which happened during an overall market reversal for BTC and other leading coins.

Want your project in front of crypto’s top minds? Feature it in our next industry report, where data meets impact.