Aave Horizon: Bridging RWAs and DeFi to Unlock Trillion-Dollar Institutional Liquidity

- Aave Horizon, launched by Aave Labs in 2025, bridges real-world assets (RWAs) with DeFi by tokenizing U.S. Treasuries, CLOs, and funds for stablecoin borrowing. - The $26B tokenized RWA market, led by Ethereum, benefits from Horizon's Chainlink NAVLink oracle, enabling real-time collateral valuation and institutional compliance. - Institutions like BlackRock and JPMorgan leverage Horizon to deploy $19B in capital via arbitrage and leveraged strategies, outperforming traditional finance efficiency. - Regu

The financial landscape is undergoing a seismic shift as institutional capital increasingly migrates to decentralized finance (DeFi) platforms. At the forefront of this transformation is Aave Horizon, a groundbreaking initiative launched in 2025 by Aave Labs to bridge real-world assets (RWAs) with DeFi. By enabling institutions to tokenize and leverage traditional assets like U.S. Treasuries, collateralized loan obligations (CLOs), and money market funds as collateral for stablecoin borrowing, Horizon is unlocking a new era of capital efficiency and yield generation. For investors, this represents not just a technological innovation but a systemic reimagining of how institutional liquidity is deployed in the digital age.

The RWA-DeFi Convergence: A $26 Billion Market's Next Frontier

The tokenized RWA market has surged past $26 billion, with Ethereum dominating 51% of the sector. Aave Horizon's architecture—built on Aave V3 and designed to evolve into a custom Aave V4 deployment—positions it as a critical infrastructure layer for institutional-grade on-chain lending. By integrating Chainlink's NAVLink oracle, the platform ensures real-time net asset value (NAV) data for tokenized assets, addressing a key barrier to institutional adoption: accurate collateral valuation. This innovation allows institutions to borrow stablecoins like USDC , RLUSD, and GHO against tokenized assets without sacrificing compliance or transparency.

Consider BlackRock's BUIDL fund, which holds $2.4 billion in tokenized U.S. Treasuries. Traditionally, such assets would remain illiquid or require intermediaries to access credit. With Horizon, these holdings become collateral for instant stablecoin liquidity, enabling institutions to deploy capital into yield-generating strategies—such as cross-protocol arbitrage or leveraged DeFi positions—without selling the underlying assets. This dynamic is a stark contrast to traditional finance, where capital deployment is often constrained by operational inefficiencies and intermediation costs.

Capital Efficiency Gains: From Case Studies to Systemic Impact

Aave Horizon's impact is best understood through its capital efficiency metrics. In Q2 2025, the platform facilitated $19 billion in institutional capital redeployment, with Aave retaining 19.74% of total funds within its ecosystem. This figure underscores Horizon's role as a hub for multi-protocol strategies, where institutions use tokenized RWAs to generate yield across DeFi and traditional markets. For example, a $4.6 billion DeFi treasury managed via Aave V3 executed complex capital reallocation strategies, including borrowing stablecoins to fund positions in other protocols while managing risk through diversification.

The platform's hybrid model—combining permissioned compliance checks (via non-transferable aTokens) with permissionless liquidity pools—has attracted major players like Centrifuge, Circle , and Superstate. These partnerships provide access to high-grade collateral, such as AAA-rated CLOs and short-duration Treasury funds, further diversifying institutional use cases. The result is a system where capital is no longer siloed in traditional markets but flows freely across on-chain and off-chain ecosystems.

Regulatory Tailwinds and Institutional Adoption

Aave Horizon's success is also fueled by regulatory developments. The SEC's proposed innovation exemption and the FDIC's 2025 guidance easing crypto engagement for banks have reduced barriers for institutions to participate in tokenized markets. For instance, JPMorgan and Apollo have already begun deploying tokenized private credit instruments (e.g., Apollo's ACRED) on Horizon, achieving yield amplification of up to 16% through leveraged strategies on platforms like Morpho and Kamino. These use cases highlight how Horizon is not just a lending protocol but a foundational layer for institutional-grade financial innovation.

Moreover, Horizon's profit-sharing mechanism with the Aave DAO—though contentious—signals a long-term commitment to aligning incentives between DeFi and institutional stakeholders. While debates persist over token fragmentation, the platform's ability to attract $2.4 billion in tokenized Treasuries and $7.5 billion in tokenized private credit assets in Q2 2025 demonstrates its immediate value proposition.

Investment Implications: Positioning for the Next Frontier

For investors, Aave Horizon represents a unique opportunity to capitalize on the convergence of RWAs and DeFi. The tokenized RWA market is projected to grow into a multi-trillion-dollar asset class, driven by institutional demand for liquidity and yield. Aave's dominance in this space—bolstered by its $66 billion TVL on Aave V3—positions it as a key beneficiary of this trend.

However, risks remain. The debate over Horizon's standalone token and potential misalignment with the Aave DAO's long-term incentives could create volatility. Additionally, regulatory uncertainty, though improving, persists. Investors should monitor the SEC's finalization of the innovation exemption and the FDIC's ongoing guidance for signals on institutional adoption.

Conclusion: A New Paradigm for Institutional Capital

Aave Horizon is more than a technical innovation—it is a paradigm shift in how institutional capital is deployed. By bridging RWAs and DeFi, the platform is unlocking liquidity in assets that were previously illiquid or underutilized, while offering yield generation opportunities that outperform traditional markets. For investors, this represents a compelling case to allocate capital to DeFi infrastructure and tokenized asset ecosystems. As the RWA market matures, Aave's role as a bridge between traditional finance and decentralized systems will only grow, making it a cornerstone of the next financial revolution.

The time to act is now. As institutions increasingly adopt tokenized assets and DeFi tools, the winners will be those who recognize the systemic potential of platforms like Aave Horizon.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Germany unveils Nvidia supercomputer, says Europe is closing AI gap with US and China

Share link:In this post: Germany launched Jupiter, an Nvidia-powered supercomputer, now the fourth-fastest in the world. Chancellor Friedrich Merz said the machine helps Europe compete with the US and China in AI. The US GAIN AI Act may block future exports of high-end chips like Nvidia’s to foreign countries.

Authors compound Apple’s AI struggles with fresh content use lawsuit

Share link:In this post: Authors Grady Hendrix and Jennifer Roberson sued Apple, alleging their books were used without consent to train its OpenELM AI models. The lawsuit claims the iPhone maker relied on pirated datasets and failed to seek permission, compensate or credit the authors. Microsoft, Meta, OpenAI, and Anthropic also face lawsuits over alleged misuse of copyrighted works for AI training.

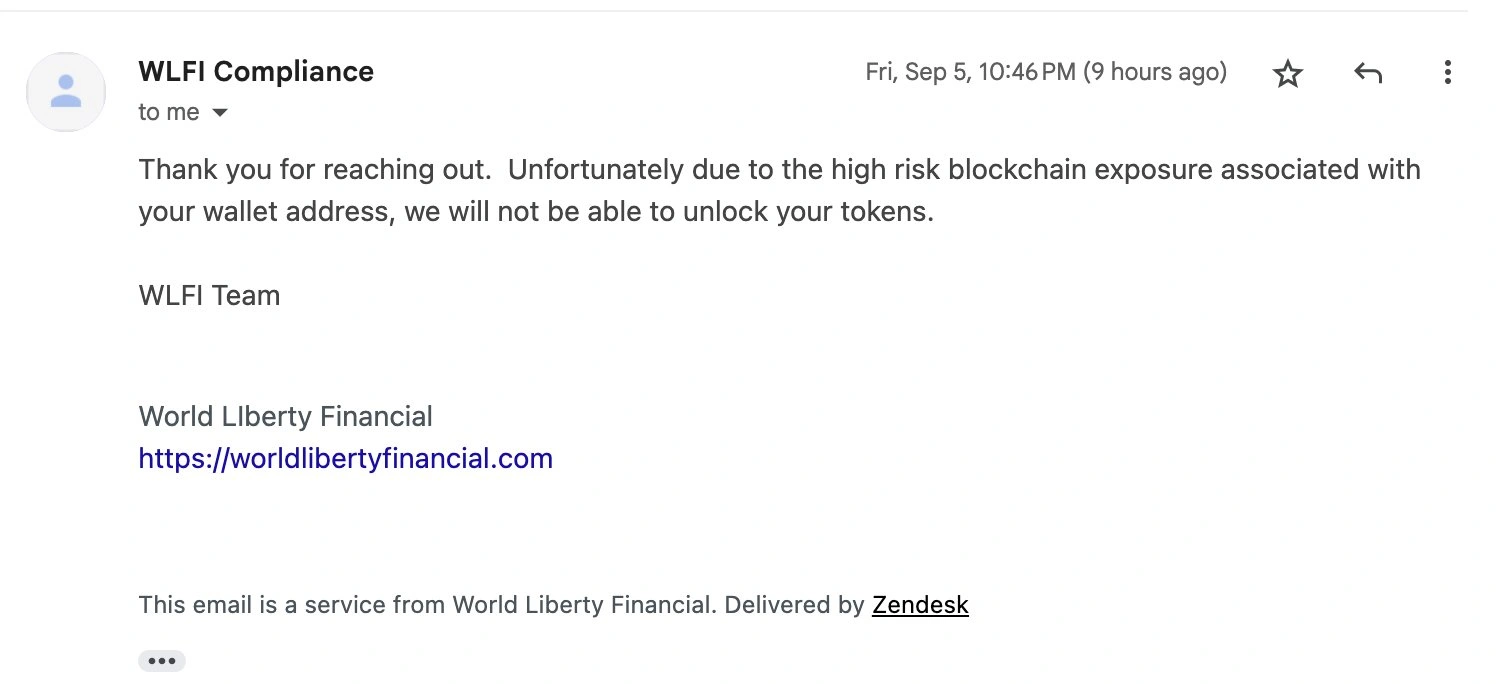

Trump-linked WLFI attracts criticism for ‘debanking users’ with token freezes

Share link:In this post: WLFI is getting some heat as Justin Sun’s frozen WLFI has started to be compared to debanking users. Sun claimed about 600 million tokens on September 1 and has accused WLFI of freezing those tokens after a blacklisting on Thursday. Another investor claims his funds were also locked after a risk assessment that only happened post-distribution.

A Review of Major Market Crashes in Crypto History

The cryptocurrency market often experiences low performance and high volatility in September. Historical crash data shows that the decline rate has gradually slowed, dropping from an early 99% to 50%-80%. Recovery periods vary depending on the type of crash, and there are significant differences between institutional and retail investor behavior. Summary generated by Mars AI. The content generated by the Mars AI model is still being iteratively updated for accuracy and completeness.