Bitcoin ETFs See $219M Inflow After Six-Day Outflows

- Main event, leadership changes, market impact, financial shifts, or expert insights.

- ETF interest rebounds with $219.1M inflow.

- Institutional demand surges despite BTC volatility.

US spot Bitcoin ETFs received $219.1 million in net inflows on August 25, ending a six-day outflow streak. Key funds leading these inflows include Fidelity’s FBTC, BlackRock’s IBIT, and Ark’s ARKB, showcasing renewed market interest.

Resurgence in Bitcoin ETF Inflows

US Bitcoin ETFs experienced renewed interest on August 25, 2025, as $219.1 million flowed in, flipping a six-day outflow streak. Fidelity, BlackRock, and Ark Invest accounted for the majority, indicating potential institutional confidence in cryptocurrency.

Key players such as Fidelity’s FBTC saw $65.6M, BlackRock’s IBIT attracted $63.4M, and Ark’s ARKB pulled in $61.2M. Source . These significant inflows reflect strategic moves by major financial entities aiming to capture value amid volatile BTC markets.

Market Implications

The financial impact includes a surge in ETF inflows which signals bullish sentiment despite Bitcoin’s price declines. Both institutional and individual investors contributed, reflecting potential optimism about the asset’s future performance. Larry Fink, CEO of BlackRock, said, “Bitcoin has caught everyone’s attention and is an asset we believe to be durable.”

This ETF movement suggests positive momentum for Bitcoin, even as price volatility persists. Market dynamics point to retail and institutional engagement enhancing liquidity and potentially dampening negative sentiment.

Potential outcomes include continued growth in institutional investments or stabilization in BTC prices. Historical trends reveal inflows often precede market upturns, though caution remains due to unresolved macroeconomic conditions impacting cryptocurrency stabilization.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AiCoin Daily Report (August 26)

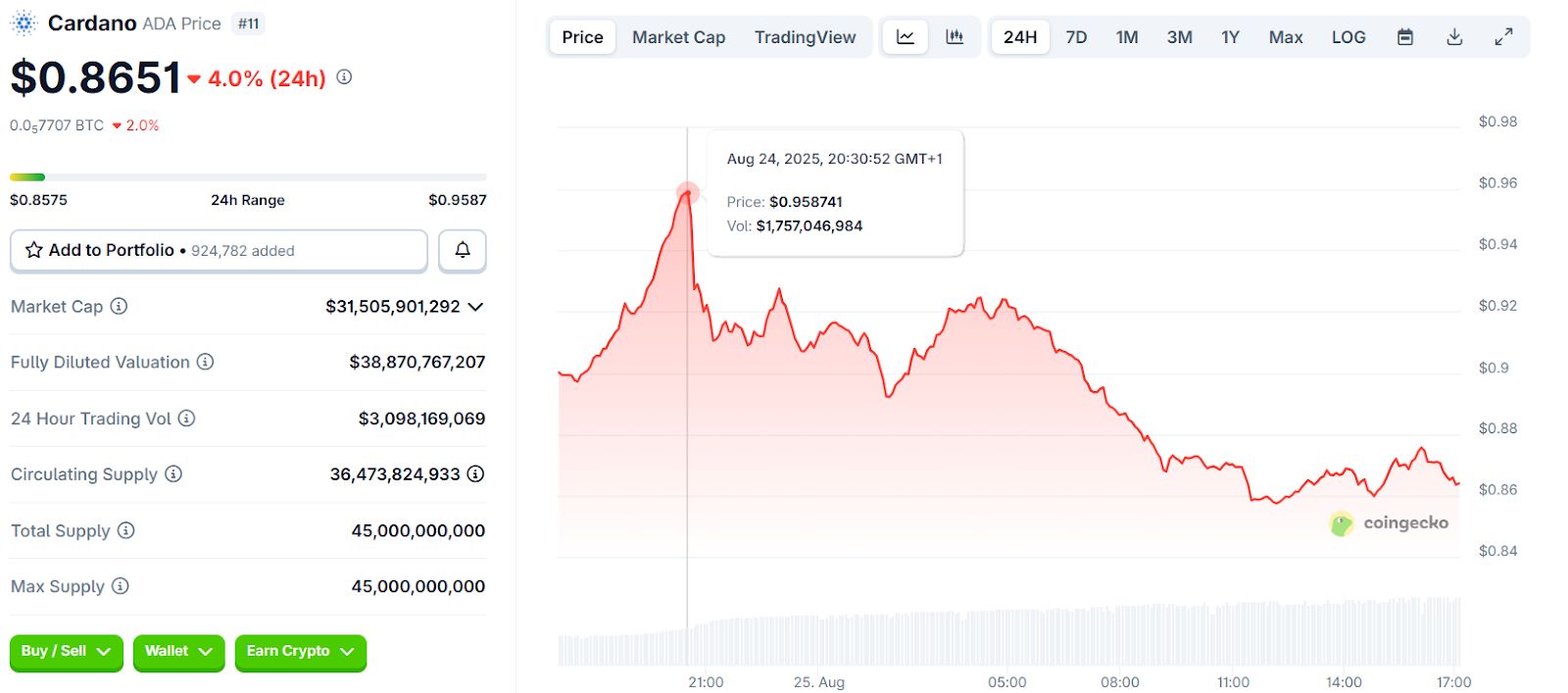

Cardano Latest News: Why ADA Holders Are Seeing Traction Moving Into Trending Altcoin Remittix

Disrupting the Price Mystery: Where Does Blockchain’s Enduring Value Come From?

If we measure success by speculation, we are building sandcastles. If we measure success by infrastructure, we are laying the cornerstone.