"Trust crisis" erupts! U.S. long-term Treasury bonds face sell-off, but is the market still too complacent?

Trump's fatal attack on the Federal Reserve's independence is prompting investors to sell off long-term U.S. Treasuries, causing the U.S. Treasury yield curve to steepen to its widest level in nearly three years. A dangerous era of "fiscal dominance" may have already arrived...

On Tuesday, long-term U.S. Treasury bonds were sold off as investors grew concerned that President Trump’s attempt to fire a Federal Reserve governor could undermine confidence in the world’s most important central bank.

This sell-off pushed the gap between yields on long- and short-term U.S. bonds to its widest level in nearly three years. Investors are betting that heightened political pressure will lead to lower rates in the short term, but higher rates in the future, as Federal Reserve officials will then be forced to combat higher inflation.

Earlier, Trump announced that he would fire Federal Reserve Governor Cook, “effective immediately,” citing allegations of mortgage fraud. Removing Cook would allow the U.S. president to select a replacement who is more open to rate cuts.

On Tuesday, the dollar weakened and the yield on two-year U.S. Treasuries fell to 3.7%, as investors anticipated downward pressure on the Fed’s policy rate. The yield on 30-year U.S. Treasuries at one point rose by 0.06 percentage points, and the gap between the two exceeded 1.2 percentage points—close to the three-year intraday high set during market turmoil after Trump’s announcement of “Liberation Day” tariffs in April.

Later on Tuesday, the yield on 30-year U.S. Treasuries retreated, rising to 4.91%.

Marieke Blom, Chief Economist at ING, said, “If successful, this would be a significant weakening of the Fed’s independence. When central bank independence is lost, people pay a high price in the form of higher inflation and higher interest rates.”

Goldman Sachs said on Tuesday morning: “We believe the market’s reaction to these headlines reflects a broader risk-off sentiment toward U.S. assets, rather than just a purely dovish policy shock.” It added: “Challenges to the Fed’s independence pose a clear downside risk to the dollar.”

In recent months, investors have grown increasingly uneasy over Trump’s criticism of Fed Chair Powell, his temporary appointment of Stephen Milan, and the firing of senior statistical officials. For decades, central bank independence and reliable economic statistics have been the cornerstone of developed markets, while U.S. Treasuries provide the benchmark rates underpinning trillions of dollars in financial assets.

Elizabeth Warren, the top Democrat on the Senate Banking Committee, accused Trump of an “authoritarian power grab,” while legal scholars said the White House would have to prove in court that there was cause to fire Cook.

Ed Al-Hussainy, Senior Rates Analyst at Columbia Threadneedle Investments, said, “I view the actions taken by the White House to pressure and intimidate Powell and Cook as part of a strategy aimed at weakening and ultimately eliminating the Fed’s statutory independence.”

Fraser Lundie, Global Head of Fixed Income at Aviva Investors, said, any government that “shows institutional arrangements are unstable and directly at risk of political influence” will see its currency weaken, its government bond yield curve steepen, and the so-called risk premium on long-term debt rise.

On Tuesday, the dollar fell 0.3% against a basket of peer currencies including the euro and the pound. So far this year, the dollar has depreciated by more than 9%, as Trump’s trade and broader policies have affected the U.S. economic outlook and investor sentiment toward the U.S.

Economists and investors say Trump’s pressure on the Fed is the most prominent example of the so-called “fiscal dominance” era, in which central bank policy is increasingly dictated by the government’s need to keep borrowing costs low to service massive debts. Deutsche Bank analyst George Saravelos said:

“In our view, there is no doubt that the Fed is now facing an increasing risk of fiscal dominance, but what surprises us more is that the market is not more concerned about this, and investors are too complacent about the risk.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AiCoin Daily Report (August 26)

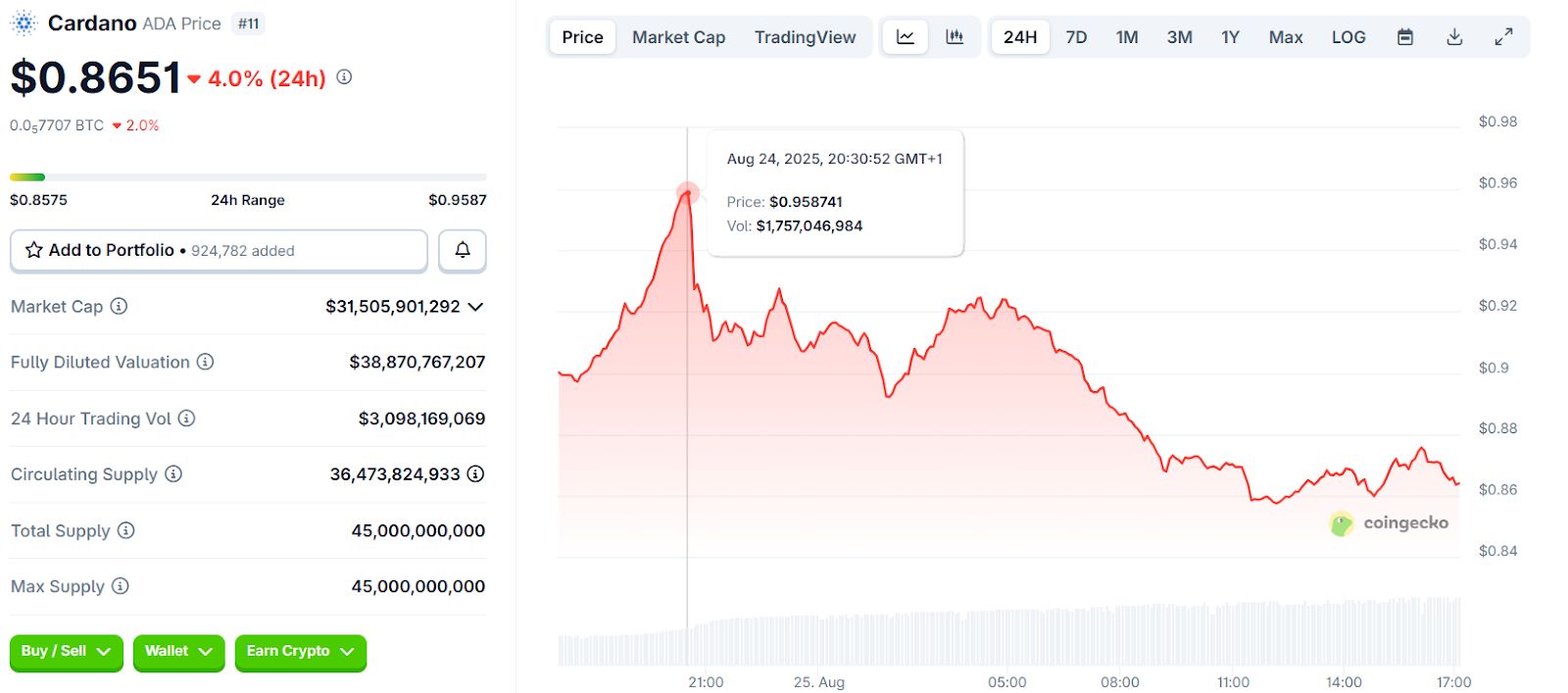

Cardano Latest News: Why ADA Holders Are Seeing Traction Moving Into Trending Altcoin Remittix

Disrupting the Price Mystery: Where Does Blockchain’s Enduring Value Come From?

If we measure success by speculation, we are building sandcastles. If we measure success by infrastructure, we are laying the cornerstone.