Metaplanet Acquires 103 BTC, Strengthening Treasury Position

- Metaplanet Inc. strengthens Bitcoin holdings with a new purchase.

- 103 BTC acquired, boosting total to 18,991 BTC.

- Positions Metaplanet as a major BTC corporate holder globally.

Metaplanet Inc., a Tokyo-based company, has acquired an additional 103 Bitcoin worth approximately $12 million, bringing its total holdings to 18,991 BTC.

This acquisition strengthens Metaplanet’s position as a major global Bitcoin holder, reflecting increased institutional interest and potentially influencing Bitcoin market dynamics.

Metaplanet’s Strategic Bitcoin Acquisition

The recent purchase places Metaplanet as the seventh-largest publicly disclosed Bitcoin holder globally. This move shows the firm’s commitment to expanding its BTC holdings, echoing similar strategies by other major corporations. Gerovich’s latest tweet on Twitter might provide further insights into the company’s strategy.

Funding was raised through the issuance of stock acquisition rights. This method supports the financial strategy of capital reallocation towards Bitcoin, aligning with the company’s long-term growth objectives.

Industry Influence and Market Implications

This acquisition reflects ongoing trends of corporations opting for Bitcoin-centric treasuries. Metaplanet’s approach may influence other companies considering similar strategies. Its inclusion in the FTSE Japan Index emphasizes its growing influence in global markets.

Analysts anticipate potential market reactions to Metaplanet’s expanding BTC reserves. The company’s strategy could drive further institutional adoption in Japan, supported by performance metrics like BTC Yield and gain rates enhancing shareholder value.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin futures demand rises even as BTC sells off: What gives?

Bitget Debuts First-Ever RWA Index Perpetuals Featuring Major Real-World Assets

Cap Labs attracts capital with EigenLayer-backed credit model

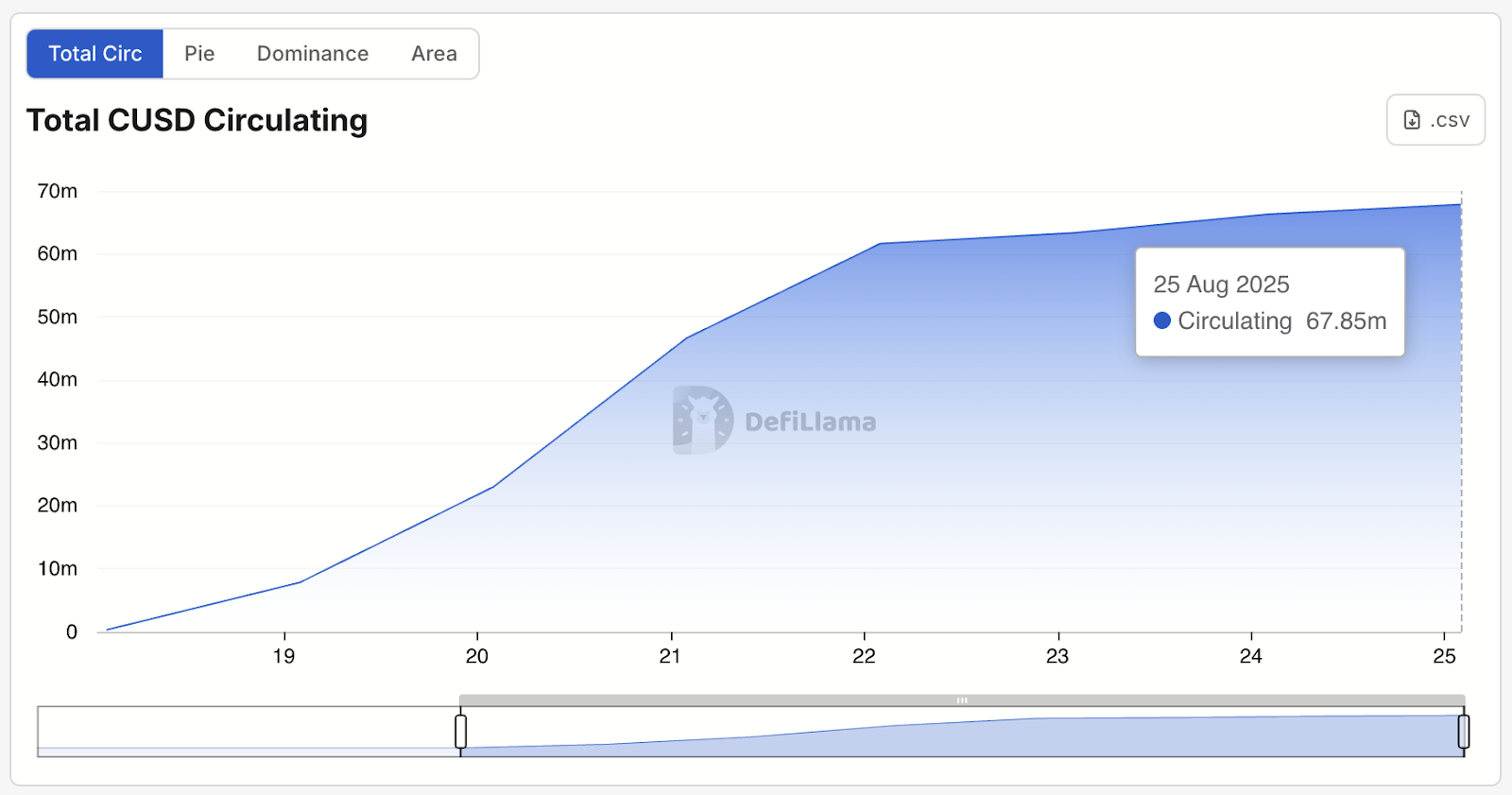

The GENIUS-compliant cUSD stablecoin surges past $67M in one week

US Economic Events Likely to Impact Crypto Prices