Crypto exchange- products (ETPs) recorded $1.43 billion of outflows last week. This brought an end to a two-week bull rally that brought in inflows of $4.3 billion.

At the same time, most of the crypto coins were in red. Bitcoin had nosedived from above $116,000 on Aug.18 to $112,000 by the end of the trading week, while Ether dropped below $4,100 on Tuesday after starting the week at around $4,250.

Bitcoin ETPs contributed the most outflows

CoinShares’ head of research, James Butterfill, said the $1.4 billion in outflows from crypto funds were the biggest losses since March 2025. According to him, the Fed influenced these losses as investors anticipated a normal hawkish tone by Jerome Powell at Jackson Hole.

However, Powell hinted at upcoming rate cuts, which sparked $594 million of inflows. In addition, trading volumes in ETPs surged to $38 billion. This is about 50% above the year-to-date average.

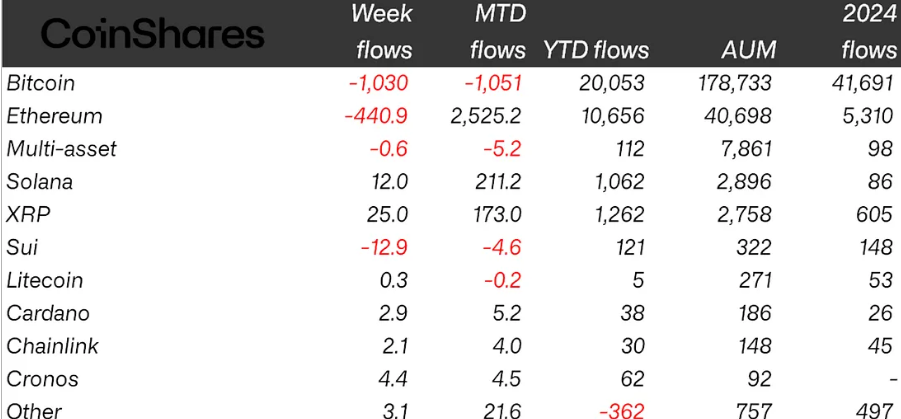

Crypto ETP flows by asset as of Friday. Source: CoinShares

Crypto ETP flows by asset as of Friday. Source: CoinShares

Bitcoin ETPs contributed the most outflows, totaling more than $1 billion. On the other hand, Ethereum’s mid-week recovery limited its outflows to $440 million. In the last 30 days, Ethereum has recorded $2.5 billion of inflows, while Bitcoin has recorded $1 billion of net outflows. This has lifted Ethereum’s share of year-to-date asset-under-management inflows to 26%. This is higher than Bitcoin’s 11%.

Meanwhile, XRP recorded the largest inflows at $25 million, followed by Solana with $12 million and Cronos with $4.4 million. Sui recorded outflows of $12.9 million, and Ton experienced outflows of $1.5 million.

The crypto industry’s influence evolves

The crypto market is in the red even after a dovish tone from the Fed chairman. This is the first time Powell has considered lowering interest rates since Trump took office. Unexpectedly, this excitement has not lasted long.

Unlike earlier market correlations, FUD and FOMO, traders are making personal decisions away from the Fed, which still affects the market. To that end, an OG whale sold 24,000 BTC in a batch of transactions just a few hours apart, coins with a market value of more than $2.7 billion. Bitcoin tanked as a result, dropping from $115,000 to $111,000.

Now, the concern centers on how a transaction like this can have such a calamitous impact on Bitcoin’s price in the first place. More so after a major announcement by Fed’s Powell. Are whales the main players now? Interestingly, some investors believe this whale may be selling off their BTC and snapping up ETH instead, and following in the footsteps of institutional ETF traders.

As reported by Cryptopolitan, Japanese investment firm Metaplanet purchase of an additional 103 BTC, which brought the firm’s total holdings to 18,991 BTC, still suggests growing adoption and confidence despite price dips. However, currently, the market is at a standstill. The crypto coins are either steady or have shown minor declines in 24hours.

ETH, which had just hit a new all-time high for the first time in almost four years, faced selloffs with the second-largest crypto coin dropping to $4,583. On-chain data now shows that it is 6.9% down from the record price established just hours earlier. Now, the $5,000 projections look like they are cruelly out of reach.

KEY Difference Wire : the secret tool crypto projects use to get guaranteed media coverage