Ripple Partners with SBI for RLUSD Launch in Japan

- Ripple and SBI plan RLUSD stablecoin launch in Japan.

- Anticipated market and regulatory shifts by 2026.

- XRP prices remain stable despite partnership news.

Ripple and SBI Holdings have announced plans for SBI VC Trade to distribute Ripple’s RLUSD stablecoin in Japan, aiming for a Q1 2026 launch.

The initiative underscores Japan’s regulatory progress on stablecoins, yet XRP’s price declined, suggesting market ambivalence despite Ripple’s ongoing efforts to integrate blockchain with traditional finance.

Ripple and SBI Holdings have announced a memorandum of understanding for SBI VC Trade to distribute RLUSD stablecoin in Japan. The target launch is set for Q1 2026, marking a significant milestone in stablecoin adoption.

Ripple and SBI Holdings, led by CEOs Brad Garlinghouse and Yoshitaka Kitao, respectively, are spearheading this initiative. RLUSD, Ripple’s first stablecoin, was launched in December 2024 and aims to bridge traditional and decentralized finance systems.

The impact of this initiative is likely to be profound in Japan. The country has recently shown openness to stablecoins, as demonstrated by the approval of its first yen-denominated version, laying the groundwork for RLUSD’s potential success.

Financially, while XRP’s price has not surged following this announcement, industry experts anticipate new economic dynamics in the Japanese stablecoin market. This could lead to increased liquidity and expansion of blockchain technology adoption in the region.

SBI’s collaboration with Ripple aligns with its blockchain strategy, including ongoing partnerships with Circle and Startale. These strategies underline their pursuit of expanding blockchain services in Japan, particularly in tokenization and digital finance.

On a regulatory front, Japan’s updated stablecoin regime could significantly attract institutional interest. Ripple and SBI’s collaboration exemplifies a strategic approach to aligning financial products with evolving legal frameworks, enhancing security and compliance measures.

RLUSD is designed to be a true industry standard, providing a reliable and efficient bridge between traditional and decentralized finance. – Jack McDonald, SVP, Ripple

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

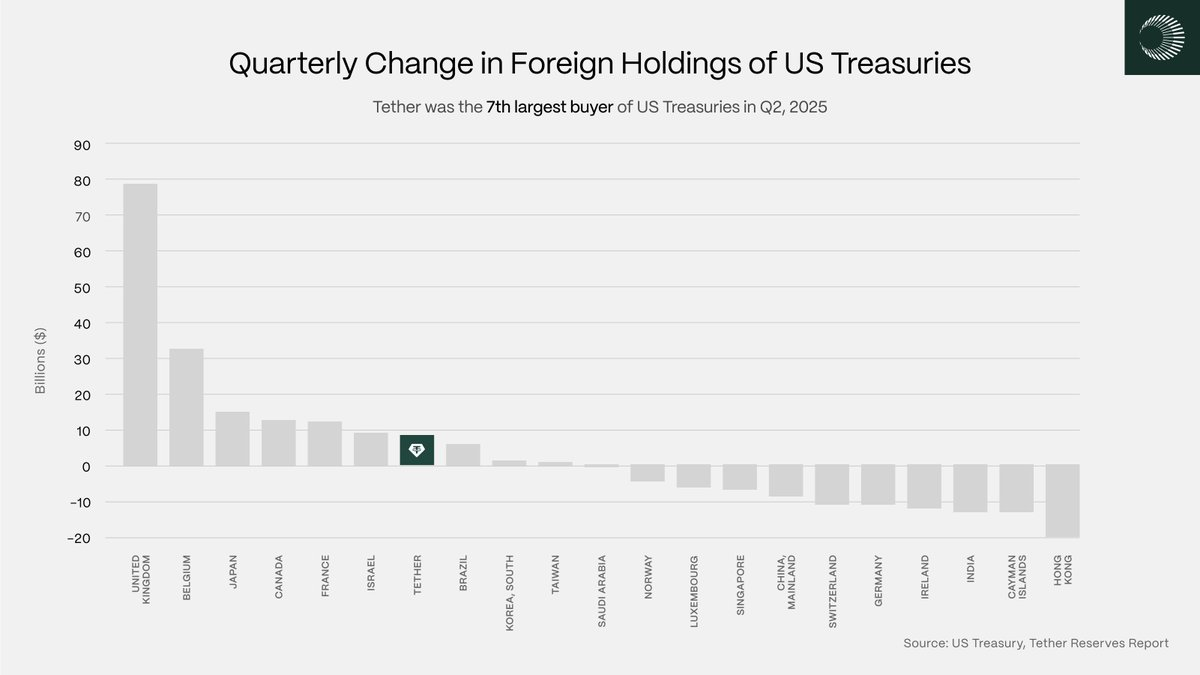

Tether: Quasi-sovereign allocator

Tether’s ascent as a top-10 foreign buyer of Treasurys signals stablecoin issuers are no longer just liquidity users

Powell’s Jackson Hole speech sparks renewed momentum amid rate‑cut hopes

BTC and ETH rally on dovish Fed signals

DOJ Clarifies Liability for Open Source Developers

Bitcoin Volatility Reaches 38% Amid Institutional Support