US proposes revival of 18th century law so Trump can deputize private citizens to fight crypto scammers

US Representative David Schweikert has introduced legislation granting the President authority to act against crypto criminals operating abroad.

The bill, filed as House Resolution (H.R. 4988), invokes the rarely used concept of “letters of marque and reprisal,” which is a legal instrument dating back to maritime warfare.

Historically, such letters authorized privateers to attack and seize enemy ships during wartime, providing governments a way to retaliate against foreign aggression.

Under Schweikert’s proposal, the mechanism would extend into the digital domain. The legislation would allow private individuals or companies to act on behalf of the United States to recover stolen assets or disrupt cybercriminal operations targeting US interests.

These private actors could be instructed to use “all means reasonably necessary” to seize assets or detain foreign actors, including those linked to state-sponsored cybercrime networks.

Meanwhile, any letter issued under the measure would require a security bond to enforce accountability and ensure compliance with its directives.

Schweikert said:

“Our current tools are failing to keep pace. This legislation allows us to effectively engage these criminals and bring accountability and restitution to the digital battlefield by leveraging the same constitutional mechanism that once helped secure our nation’s maritime interests.”

The proposal is currently under review by the House Committee on Foreign Affairs and must pass both chambers before it can reach the President for approval. If enacted, it would create an entirely new framework for US engagement in cross-border crypto crime enforcement.

Potential impact

If HR 4988 becomes law, the US could shift from relying primarily on intelligence-gathering to actively deploying private actors in cybercrime interventions.

This move comes amid growing frustration with the surge in high-profile crypto hacks. In 2025 alone, state-sponsored groups such as North Korea’s Lazarus Group have orchestrated major attacks, including a $1.5 billion exploit on Bybit in February and breaches targeting other major platforms like India’s CoinDCX.

Law enforcement agencies have struggled to apprehend the perpetrators or recover stolen funds, exposing crypto investors and the platforms.

Considering this, Schweikert said:

“Americans deserve protection from digital predators who exploit outdated laws and hide in foreign jurisdictions. This proposal harnesses innovation and constitutional authority to respond to the modern crisis of cybercrime.”

The post US proposes revival of 18th century law so Trump can deputize private citizens to fight crypto scammers appeared first on CryptoSlate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Established projects defy the market trend with an average monthly increase of 62%—what are the emerging narratives behind this "new growth"?

Although these projects are still generally down about 90% from their historical peaks, their recent surge has been driven by multiple factors.

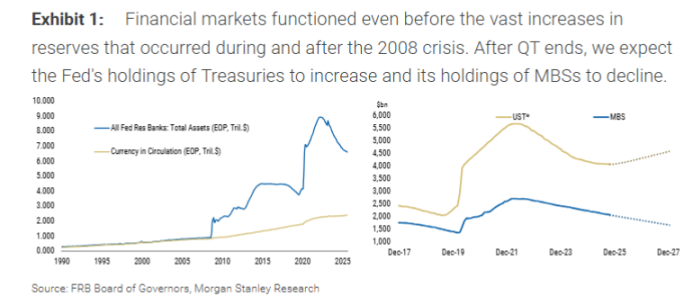

Morgan Stanley: Fed Ending QT ≠ Restarting QE, Treasury's Debt Issuance Strategy Is the Key

Morgan Stanley believes that the Federal Reserve ending quantitative tightening does not mean a restart of quantitative easing.

Massive Whale Activity Boosts Anticipation for Pi Network’s Price Surge

In Brief A whale resumed purchases, accumulating 371 million PI coins worth over $82 million. Pi Network is strengthening infrastructure with AI and DeFi enhancements. Technical indicators suggest a possible upward move in the PI coin value.

Standard Chartered Drives New Wave of Crypto-Powered Card Payments

In Brief Standard Chartered partners with DCS to introduce the stablecoin-based DeCard in Singapore. DeCard simplifies cryptocurrency transactions for everyday purchases akin to traditional credit cards. With regulatory backing, DeCard plans to expand beyond Singapore to a global market.