No altcoin season? Global interest falls as market signals turn weak

The long-anticipated altcoin season does not seem to be edging closer as previously positive market signals flip bearish.

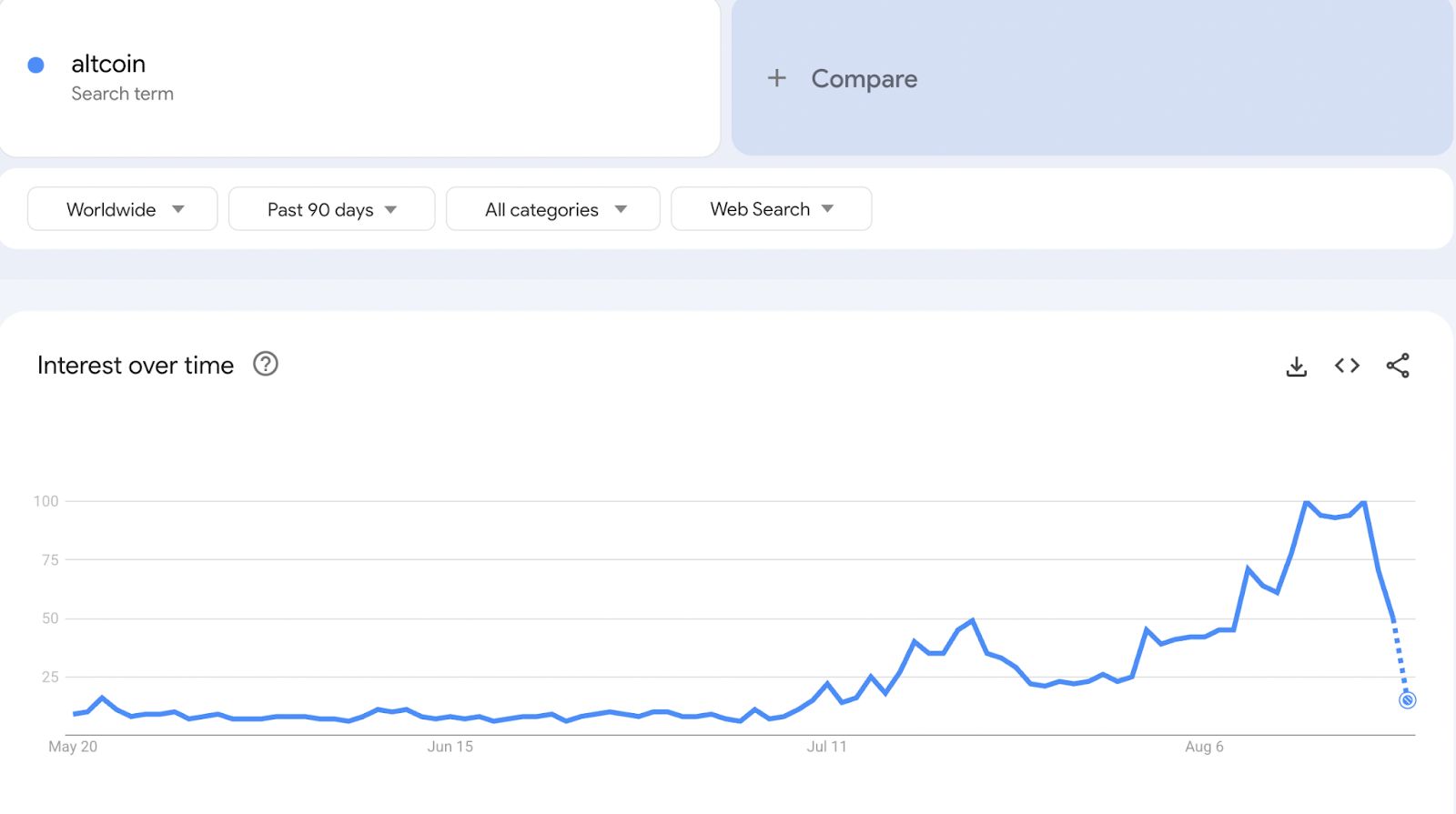

- Global Google search interest for “altcoins” fell sharply to a score of 15, down from 100 earlier this month.

- The Altcoin Season Index has dropped to 41, significantly below the 75 threshold needed to signal a confirmed breakout.

Global search interest in altcoins has declined sharply over the past few weeks. According to Google Trends data on Aug. 20, worldwide search interest for the term “altcoins” sits at a score of 15, down from a peak of 100 earlier this month.

At the time, searches surged after several months of muted activity, marking an all-time high and fueling expectations that strong momentum was returning to the sector.

Chart showing declining search interest for altcoins | Source: Google

Chart showing declining search interest for altcoins | Source: Google

Several altcoins also posted gains during that period, joining a brief market rally that saw Bitcoin ( BTC ) reach new highs above $124,000 and Ethereum ( ETH ) climb past $4,700. The latest plummet now reverses the score to their July lows, signaling that momentum is once again cooling and dampening expectations for the long-awaited altcoin season.

Adding weight to the bearish sentiment, the Altcoin Season Index has similarly dropped. CoinMarketCap data shows the score at 41, down from 47 just days ago, continuing a broader decline from its peak of 55 in July. The index usually needs to reach 75 or above to signal a confirmed altcoin season, and the current figures indicate that the market is still lagging.

This cooling momentum is reflected across the broader market, with major altcoins such as ETH, SOL ( SOL ), XRP ( XRP ), and BNB ( BNB ) posting double-digit losses on the week.

Why is the altcoin season stalling?

Historically, Bitcoin’s rally to new highs has often fueled bullish sentiment in the altcoin sector, as investors rotate capital into smaller-cap tokens, igniting what is known as the “altcoin season.” However, this pattern has not held in the current cycle. Bitcoin continues to maintain strong market dominance, and its recent gains have largely been concentrated in its own price movement.

Analysts attribute this shift to the evolving source of funds driving Bitcoin’s rally. Unlike previous cycles fueled by retail enthusiasm, the current surge is primarily driven by institutional investors, including corporate treasuries and exchange-traded funds .

This class of investors tends to hold long-term, dampening market volatility and reducing the capital rotation that historically fueled altcoin surges.

Still, optimism isn’t entirely lost. Some market watchers believe that metrics like Google search interest are not enough to gauge market sentiment in the ongoing cycle, stressing that the overall market set up remains positive.

A recently published Coinbase report noted that an altcoin rotation could still occur in the coming months, citing improving market liquidity, rising institutional demand for Ethereum, and a projected decline in Bitcoin’s dominance as factors supporting a positive outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vitalik: Sorting Out the Differences Among Various L2s

L2 projects will become increasingly heterogeneous.

Bitcoin’s Current Correction: At the End of the “Four-Year Cycle,” Government Shutdown Intensifies Liquidity Shock

A Citi report indicates that the liquidation event in the crypto market on October 10 may have damaged investors' risk appetite.

Institutional Outflows Hit Bitcoin and Ether ETFs as Solana Demand Accelerates

Bitcoin Price Stalls Below $105K Amid Heavy Selling and Pending Tariff Ruling