KAIA Surges 12% as Demand Builds — Is $0.20 the Next Target?

KAIA’s 12% surge, strong CMF, and rising futures open interest hint at continued rally, possibly reaching $0.20.

KAIA has emerged as one of the top-performing altcoins over the past 24 hours, surging more than 12% amid heightened market activity.

Technical and on-chain indicators point to increasing buying pressure, suggesting the altcoin may be poised for further gains.

KAIA Rally Builds Steam

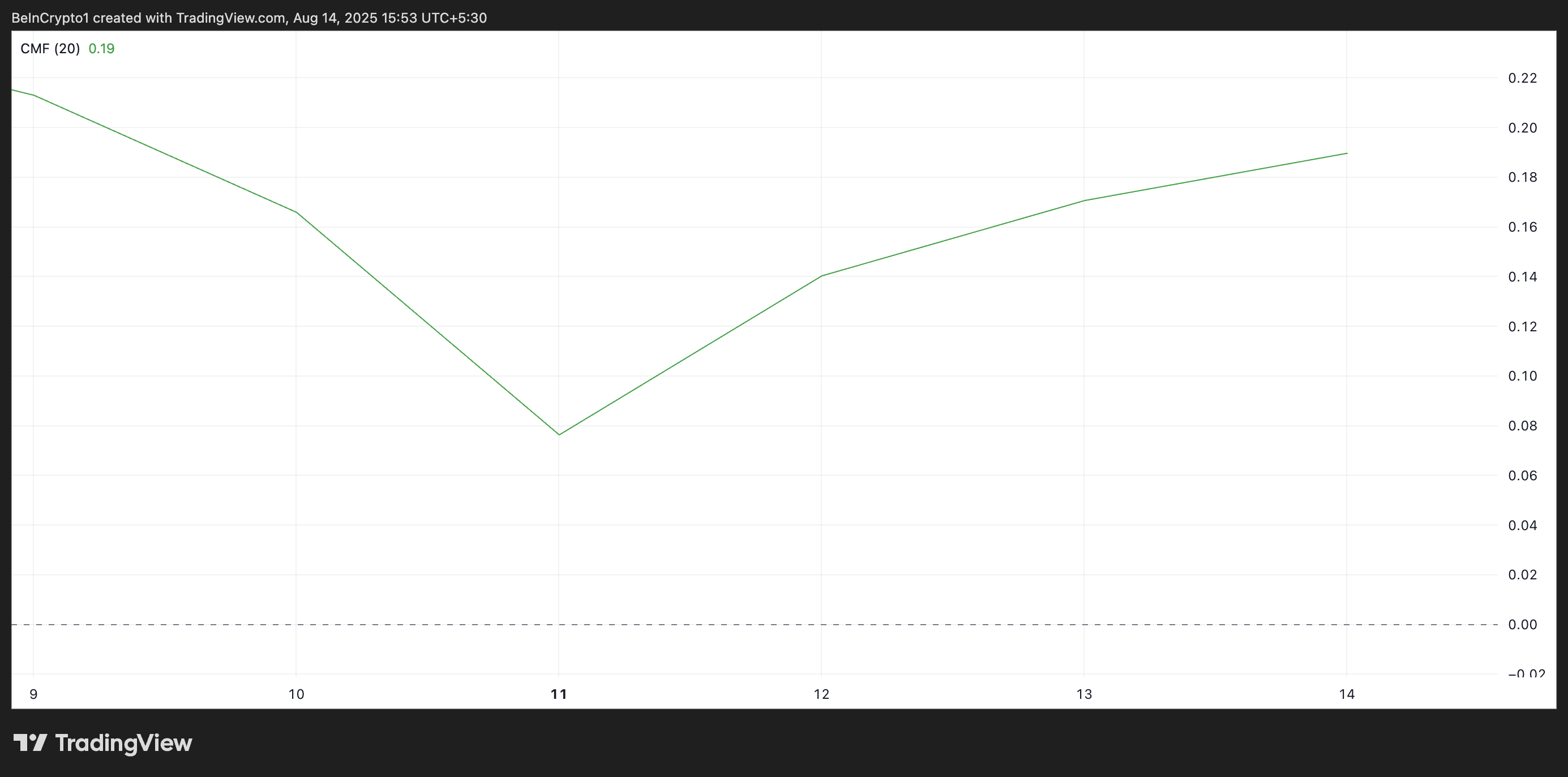

Readings from the KAIA/USD one-day chart show an uptick in the altcoin’s Chaikin Money Flow (CMF), signaling strong investor demand. As of this writing, the CMF stands at 0.19 and is trending upward.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

KAIA CMF. Source:

TradingView

KAIA CMF. Source:

TradingView

The CMF indicator tracks the flow of capital into and out of an asset over a specific period. It combines price and volume data to assess whether an asset is being accumulated or distributed.

Positive CMF readings above zero indicate that the asset is closing more frequently in the upper range of its price during the measured period, suggesting buyers are in control. Conversely, negative readings point to selling pressure.

For KAIA, the persistent climb in its CMF hints that bullish momentum is gaining traction. This lays the foundation for another leg up in the near term.

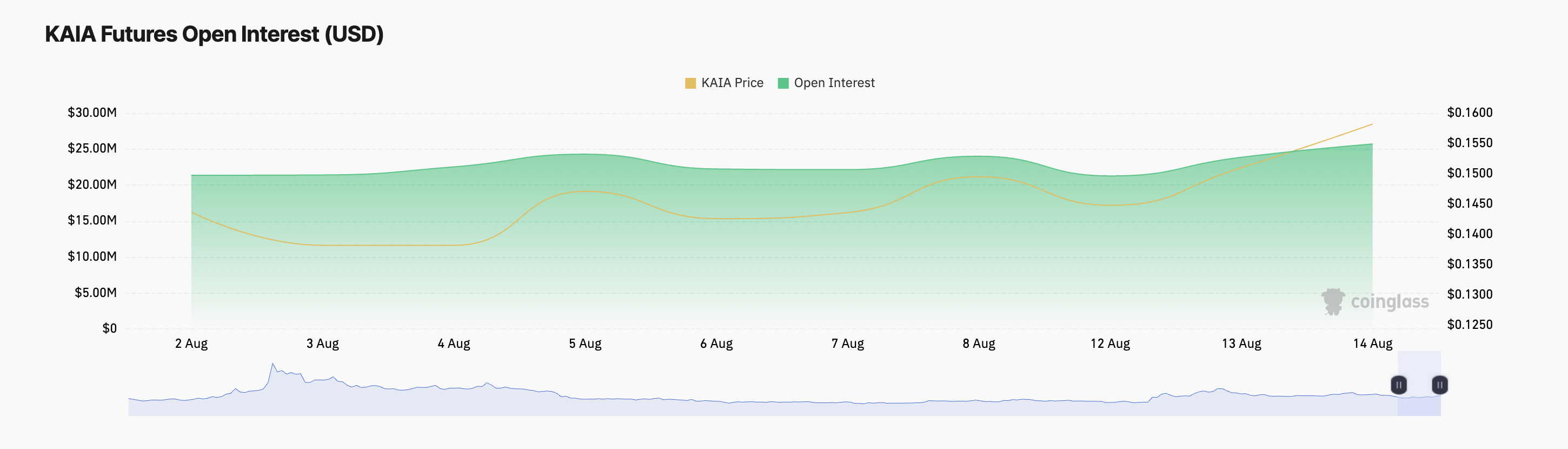

Additionally, its futures open interest has been climbing, confirming market optimism. According to Coinglass, this is at $25.71 million at press time, up nearly 10% over the past day.

KAIA Open Interest. Source:

Coinglass

KAIA Open Interest. Source:

Coinglass

An asset’s futures open interest measures the total number of outstanding futures contracts that have not yet been settled. When it rises alongside a price increase, it signals that new money is entering the market to support the prevailing trend, rather than liquidation-driven moves.

In KAIA’s case, the uptick in open interest suggests that traders are opening fresh long positions, supporting the bullish outlook above.

KAIA Eyes Fresh Gains if $0.1869 Support Holds

At press time, KAIA trades at $0.1684, resting above the support floor at $0.1869. If buying continues and this price floor strengthens, it could drive KAIA to $0.1869. Should demand increase at this level, it could push KAIA toward the $0.20 mark.

KAIA Price Analysis. Source:

TradingView

KAIA Price Analysis. Source:

TradingView

Conversely, a dip in accumulation could trigger a breach of the $0.1640 support. If this happens, KAIA could decline further to $0.1480.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC drops back to $10,000?! Bloomberg senior expert gives the most pessimistic prediction

![[Bitpush Daily News Selection] Reuters: Nasdaq will officially apply for 5×23 hour trading; Trump says he will consider pardoning bitcoin application Samourai developer Keonne Rodriguez; Forbes: Musk's net worth surpasses $670 billions; Bitcoin network activity drops to its lowest level in 12 months](https://img.bgstatic.com/multiLang/image/social/827b4aebc0d89b499c415cc58b0e5a041765791361179.png)