CRV Price Surges Past $1 Despite Founder’s $42 Million Token Sell-Off

Curve Finance’s CRV holds above $1 despite heavy founder sales, supported by record user growth, high trading volumes, and bullish technical signals that could push it toward $1.30 in the short term.

Curve Finance (CRV) has become the center of market attention as the token’s price recently crossed the $1 mark for the first time.

CRV’s short-term breakout comes amid significant developments tied to the founder’s large token sales.

A Short Recovery of CRV

Data from BeInCrypto shows that Curve DAO’s CRV briefly broke above $1 before correcting downward. During this period, the project experienced several notable events.

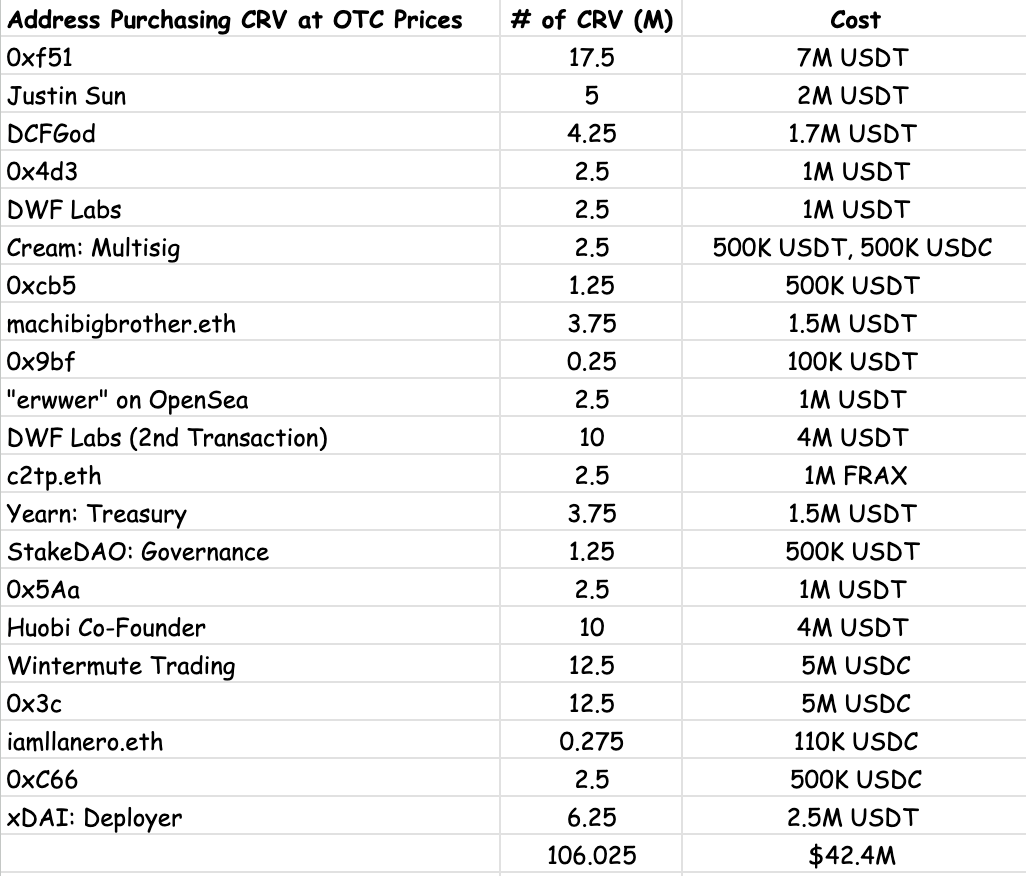

Curve’s founder is reported to have sold 106 million CRV through OTC “handshake” deals, which generated approximately $42.4 million for the founder.

Suspicious transactions linked to Curve’s founder. Source:

Suspicious transactions linked to Curve’s founder. Source:

Despite significant selling pressure, Curve Finance’s performance in the first half of 2025 shows growth. Information shared with BeInCrypto reveals that the platform recorded a trading volume of $62.5 billion.

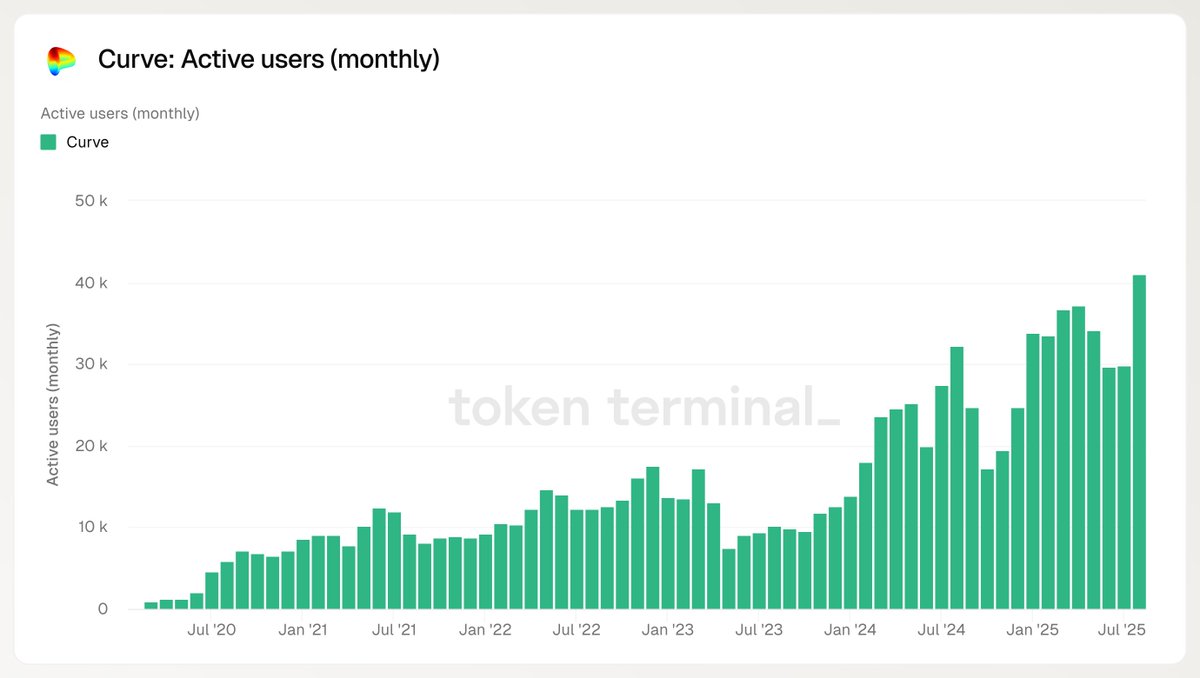

Furthermore, data from Filippo indicates that Curve has reached a record high in monthly active users, surpassing 40,000. While the platform has not adopted a token buyback strategy like some other projects, some analysts believe CRV outperforms buyback efforts by implementing initiatives that directly enhance user value.

Curve active users. Source:

Curve active users. Source:

From a technical perspective, CRV’s breakout signals are becoming more evident. CrediBULL Crypto noted that short-term supply zones above the current price have been “battered,” creating room for further upside.

“I think it’s time for us to finally break through,” said CrediBULL Crypto.

CRV technical analysis. Source:

CRV technical analysis. Source:

Rick Barber believes breaking and holding above the downtrend line is an extremely bullish signal. After crossing $1, CRV’s next price targets are $1.08, $1.16, and $1.30.

Analyst Geo Metric also emphasizes the importance of closing the daily candle above $1 to confirm momentum—especially if a “Superfecta” (diamond symbol) buy signal appears on the daily chart.

Technically, breaking the $1 mark is psychologically significant and paves the way for a new rally. If buying pressure continues and negative factors do not resurface, CRV could fully reach—and even surpass—the $1.30 level in the short term.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

VIPBitget VIP Weekly Research Insights

Ethereum and its ecosystem are set to remain in the spotlight in 2025, driven by accelerating institutional adoption and network upgrades. As the world's leading smart contract platform, ETH has benefited from billions of dollars in ETF inflows, fueling a steady price climb. Potential upside catalysts include the Pectra upgrade to enhance performance, large-scale tokenization of real-world assets (RWA), explosive growth in Layer 2 solutions such as Base, and the reduction in circulating supply of the burn mechanism. Ecosystem tokens like Lido (the leader in liquid staking) and Ethena (an innovator in synthetic stablecoins) are also poised to benefit. Institutional participation from major players like BlackRock further boosts demand for DeFi and staking products. As a result, the overall market cap of the ecosystem is expected to continue growing, attracting increasing amounts of mainstream capital.

Hong Kong Regulators Caution on Stablecoin Volatility Risks

Hong Kong SFC Enhances Virtual Asset Custody Standards

TeraWulf Secures $1.8 Billion Backing from Google