Fundstrat Adds Ethereum to Its "Magnificent Seven & Bitcoin" Recommended Investment Strategy

According to Jinse Finance, financial market research firm Fundstrat has announced the inclusion of Ethereum in its "Magnificent Seven & Bitcoin" recommended investment strategy, describing it as the biggest macro trading opportunity over the next 10–15 years. Tom Lee, Fundstrat co-founder and head of research—often referred to as the "Wall Street Wizard"—previously stated that the main driving force is Wall Street's move toward blockchain, spurred by the GENIUS Act and crypto initiatives from the U.S. Securities and Exchange Commission. Currently, most stablecoins and Wall Street blockchain projects are built on Ethereum. Data shows that since the beginning of this year, Ethereum has risen by 40.4%, outperforming Bitcoin's 27.7%. Sean Farrell, Fundstrat's head of digital asset research, expects Ethereum's price to reach $10,000 by the end of the year, with the potential to climb as high as $12,000–$15,000, indicating significant room for further growth.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

700 Million USDT Transferred from an Exchange to Tether Treasury

Analyst: ADA Expected to See a Massive 150% Bullish Rally in the Coming Weeks

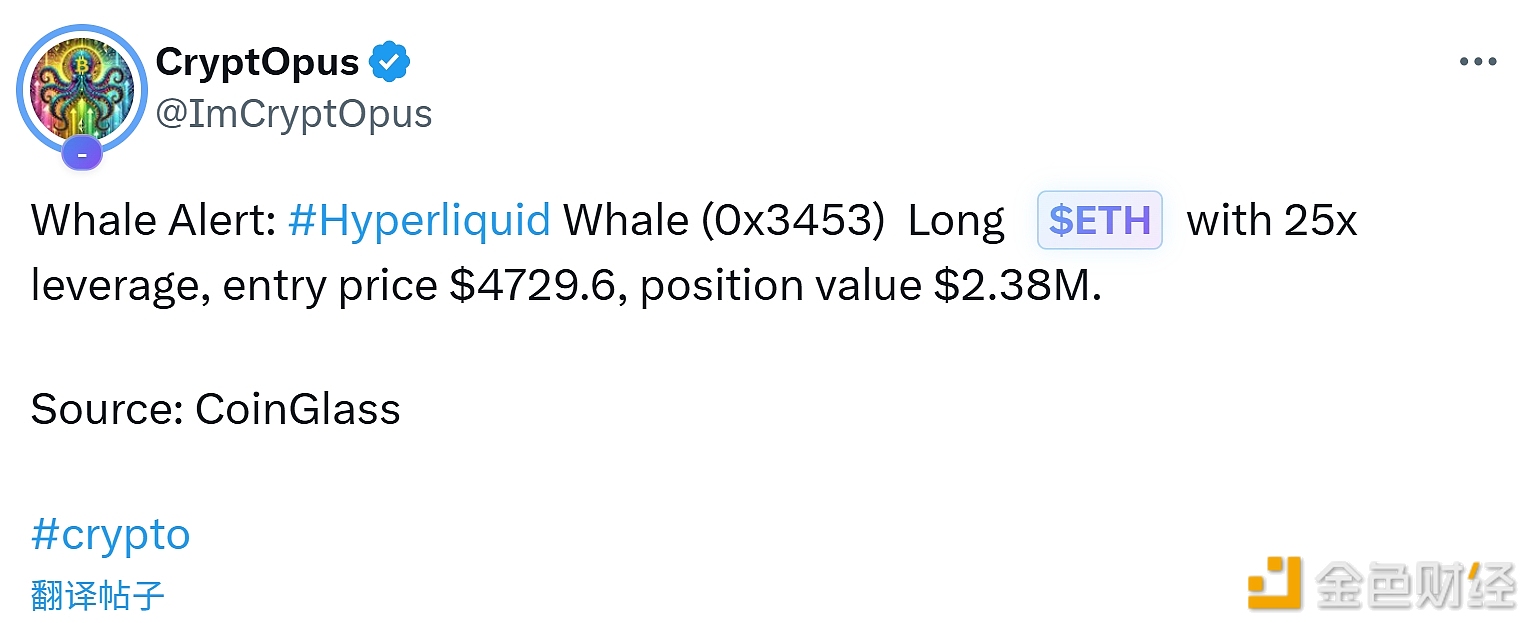

A major whale goes long on ETH with 25x leverage at an entry price of $4,729.6