Trump Jr.-tied firm raises $50M for crypto, mining as Bitcoin peaks

Thumzup Media Corporation, a social media marketing-turned-crypto-buying firm, plans to boost its crypto holdings and get into crypto mining after raising $50 million from investors.

Thumzup said on Wednesday that it would expand its crypto-related strategy “to include large-scale cryptocurrency mining and targeted blockchain investments.”

The company said it will use some of the $50 million it raised from a $10 per share offering on Tuesday into “state-of-the-art cryptocurrency mining infrastructure” and was engaging with mining technology providers “to accelerate the buildout.”

The firm currently holds 19.1 Bitcoin after buying it for the first time in early January, joining a trend of public companies that have bought up cryptocurrencies in the hopes of boosting their share price.

Donald Trump Jr., the son of US President Donald Trump, bought 350,000 shares of the company, then valued at nearly $3.3 million, according to a regulatory filing in early July, deepening the Trump family’s already expansive interest in the crypto industry.

Bitcoin hits new peak as it nears $125,000

Thumzup’s planned buys come just as Bitcoin has climbed to an all-time high of over $124,000, with traders hoping it will propel over $125,000.

Bitcoin hit a record peak of $124,128 just before 12:40 am UTC on Thursday, according to CoinGecko. It’s since slightly cooled to $123,683, gaining 3.6% over the past 24 hours.

Thumzup said in early July that, in addition to Bitcoin, it planned to buy up Dogecoin , Litecoin (LITE), Solana, XRP, Ether, USDC, with its board later allowing it to hold up to $250 million total worth of crypto.

Thumzup shares lift after the bell

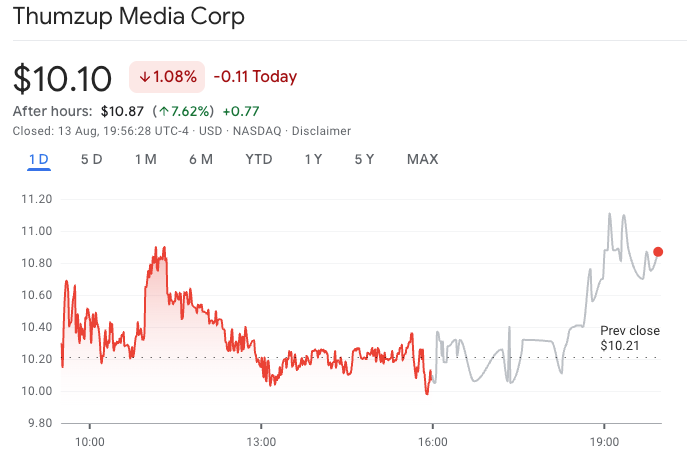

Shares in Thumzup (TZUP) saw a 7.62% gain in after-hours trading on Wednesday to $10.87 after closing the trading day at a loss of nearly 1.1%.

Thumzup shares lifted after the bell on Wednesday. Source: Google Finance

Thumzup shares lifted after the bell on Wednesday. Source: Google Finance

Thumzup has gained nearly 194.5% so far this year and its most recent all-time high was recorded on Aug. 8 at $15.46.

However, its stock price dropped nearly 33% to $10.40 when it opened for trading on Monday after announcing it would publicly offer non-voting convertible preferred stock, which it later changed .

Sweden’s H100 Group boosts Bitcoin holdings

Bitcoin and crypto treasury firms have continued to scoop up cryptocurrencies despite crypto prices continuing to rise.

Stockholm-based health technology firm H100 Group said on Wednesday that it purchased 45.8 BTC, bringing its total holdings up to 809.1 BTC.

H100 said it spent an average of under 1.14 million Swedish krona ($119,090) per Bitcoin for a total cost of 52.18 million Swedish krona ($5.47 million).

It puts H100 as having the 42nd largest Bitcoin holdings among publicly-traded firms globally and cements its fourth-place among EU companies, led by Germany’s Bitcoin Group SE with 3,605 BTC, according to BitcoinTreasuries.NET.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ApeCoin price forecast: weak bullish momentum signals risk ahead

What next for Avantis price after the 73% recovery?

Payment processor Zelle taps stablecoins for cross-border payments

Pump.fun Acquires Padre to Bolster Trading Capacity