3 Made In USA Coins to Watch for the Second Week of August

These three altcoins could see gains this week, with key resistance levels and technical signals at play.

The US CPI data scheduled to be released this week will be a key moment for the crypto market, as it could impact the tokens for good or for worse. Some crypto tokens that have been noting bullshness this past week might manage to stay afloat or even continue rallying.

In line with this, BeInCrypto has analysed three Made in USA coins for investors to watch.

Stacks (STX)

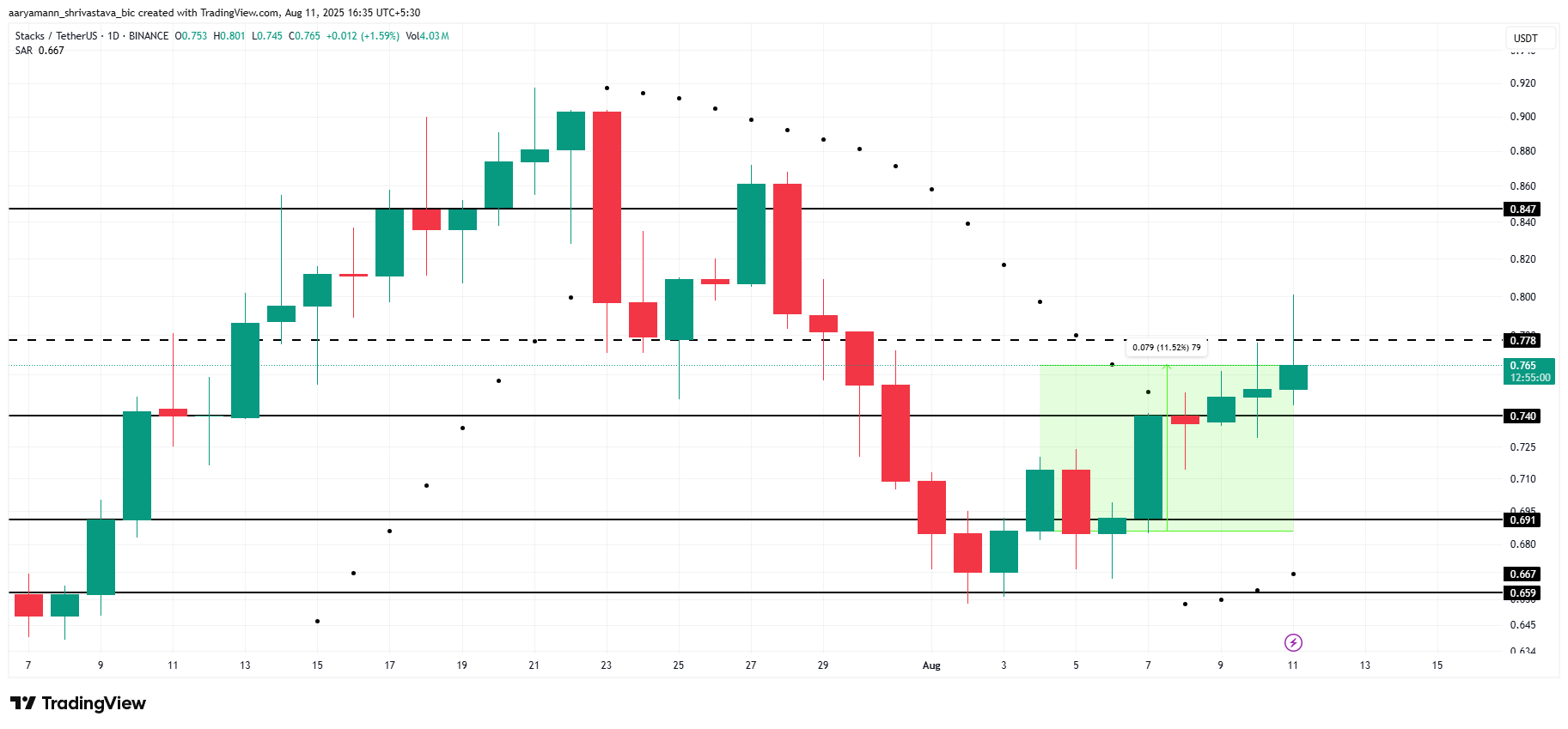

STX price has risen 11.5% over the past week, signaling a shift from bearish to bullish. While the rally hasn’t been dramatic, the Parabolic SAR indicator is currently sitting beneath the candlesticks, showing an uptrend.

This shift indicates that the altcoin may be preparing for further upward movement.

The bullish momentum could help STX push past the $0.778 resistance level, potentially reaching the next resistance at $0.847. This would mark a multi-week high and strengthen the case for further growth.

A successful breakout above this resistance could lead to increased buying pressure and continued upward movement.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

STX Price Analysis. Source:

TradingView

STX Price Analysis. Source:

TradingView

However, if STX fails to breach the $0.778 resistance, it may face downward pressure. A break below the $0.740 support level could signal a reversal, with STX dropping to $0.691.

Such a move would invalidate the current bullish outlook, signaling a potential decline in price.

Aerodrome Finance (AERO)

AERO price has risen 51% over the past week, currently trading at $1.17. The altcoin is facing resistance at $1.21, a level it has yet to breach.

A successful breakout above this resistance could signal continued upward momentum, but the market remains cautious at this key level.

The exponential moving averages (EMAs) formed a Golden Cross towards the end of July, signaling bullish momentum. This technical pattern could drive AERO past the $1.21 resistance, aiming for $1.35.

AERO Price Analysis. Source:

TradingView

AERO Price Analysis. Source:

TradingView

However, if AERO fails to break through $1.21, the altcoin could decline. Failure to breach this resistance could lead the price back down to $1.00, erasing recent gains.

Such a move would invalidate the current bullish outlook, signaling a potential reversal in price direction.

Lumia (LUMIA)

LUMIA has posted a 28% rise in the last seven days, moving from $0.288 to $0.369. The altcoin has emerged as one of the best-performing Made in USA coins, attracting investor attention.

This recent surge indicates strong market interest and potential for further growth in the short term.

Currently, LUMIA is facing resistance at the $0.370 level. The Ichimoku Cloud shows bullish momentum gaining strength, which could be pivotal for breaking through this barrier.

If LUMIA can surpass $0.370, it could target the next resistance at $0.385, continuing its upward trend and maintaining positive momentum.

LUMIA Price Analysis. Source:

TradingView

LUMIA Price Analysis. Source:

TradingView

However, if the US Consumer Price Index (CPI) report is disappointing, LUMIA’s price may face downward pressure. A failure to hold above $0.370 could lead to a drop to $0.346 or below, erasing recent gains. Such a shift would invalidate the bullish thesis, signaling a possible market correction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SEC Faces Deadline for Grayscale XRP ETF Decision

Ethereum Bulls Remain Unfazed: Analyzing Market Confidence After $232 Million Liquidation

Ethereum’s price is fluctuating around $3,700, influenced by US credit and labor data, with traders cautiously avoiding high leverage. Whale activity indicates limited bearish sentiment, but there is insufficient confidence in a rapid rebound. No warning signals have been observed in the derivatives market, and a recovery will require clearer macroeconomic signals. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

BNY Mellon Empowers Crypto Ecosystem with Robust Infrastructure

In Brief BNY Mellon enhances its crypto ecosystem role through infrastructure services, not its own coin. The bank supports stablecoin projects instead of launching an altcoin amid positive market conditions. BNY Mellon prioritizes infrastructure over token issuance, promoting collaboration and ecosystem strength.