- Dogecoin trades at $0.2381, up 17.5% in seven days, with support at $0.2307 and resistance at $0.2409.

- Historical patterns show extended consolidations on rising bases before significant breakouts.

- Current steady volumes mirror previous pre-breakout conditions in earlier bullish cycles.

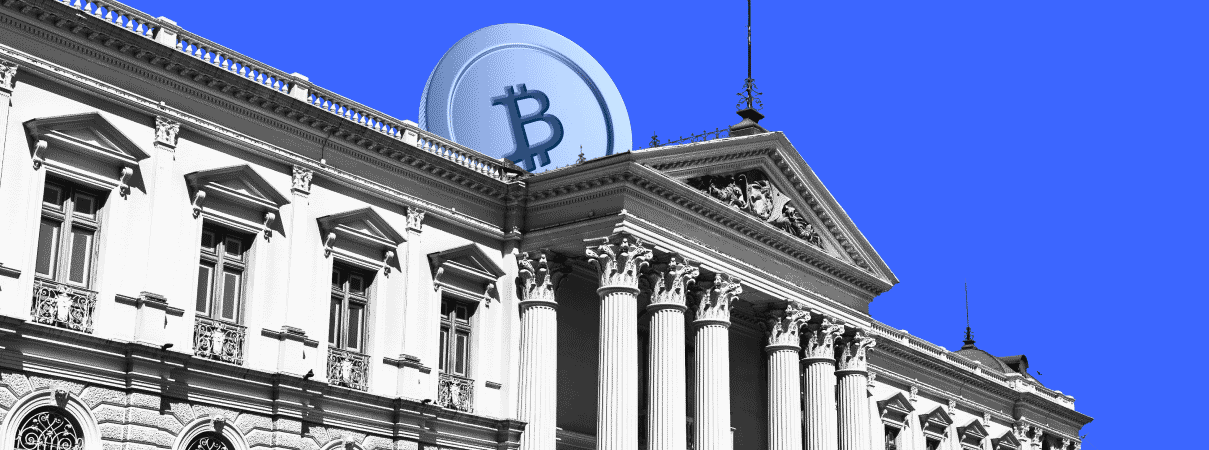

Dogecoin’s long-term price chart continues to display recurring technical structures, highlighting a sequence of extended consolidations followed by steep upward movements. The current setup suggests that the asset is nearing a similar phase seen in previous cycles. The token has a current price of $0.2381, with a 17.5% increase in the seven-day period.

Its 24-hour price range is still within the range of $0.2307 and 0.2409 reflecting a test of both immediate support levels and resistance levels. Interestingly, the historical chart shows three different areas that involved price consolidations on a rising base, and consequently robust price expansions, each subsequent price expansion having a higher starting point than the preceding one.

Historical Structure and Current Price Position

Between 2014 and 2017, Dogecoin formed a broad base before moving sharply higher. A similar structure appeared from late 2018 to early 2021, followed again by a rapid rise. In each instance, the market established a horizontal or slightly rising support before the next significant move.

The present phase shows price holding above a gradually rising trendline, echoing prior setups. This base currently aligns with the $0.2307 level, which has acted as short-term support. Maintaining this zone appears essential for sustaining current momentum.

Resistance Testing and Narrow Trading Range

The immediate resistance is positioned at $0.2409, which remains within reach after recent gains. Price fluctuations over the past day have stayed between the established support and resistance, creating a narrow intraday range. This compression often precedes higher volatility, as seen in prior phases of the chart.

The long-term visual pattern indicates that price has historically broken upward once such resistance levels have been challenged repeatedly. The green upward legs on the chart illustrate the magnitude of prior advances, underscoring the size of earlier breakouts from similar consolidation points.

Volume and Price Relationship in the Current Phase

Trading volumes in recent sessions have remained steady while price holds near its upper boundary. This stability mirrors earlier conditions where a consistent base allowed the market to absorb selling pressure before directional moves.

The pattern also suggests that Dogecoin’s long-term trend has maintained higher lows with each cycle, as illustrated by the progressively higher purple support lines. If resistance levels remain under pressure, price behavior could align with the historical structure displayed in the chart, where a gradual build-up was followed by a vertical price movement.