Ethereum Bulls Target $4K Amidst Technical Momentum

- Ethereum surges past $4,000 with strong network activity.

- Bulls focus on maintaining momentum.

- Technical indicators suggest potential corrections.

Ethereum surged past $4,000 recently, pushing upward amid increased network activity and strong technical momentum, sparking debates over sustainability amid signs of overbought conditions.

This surge matters as it tests long-term resistance levels, potentially affecting market sentiment and related assets while investors assess sustainability in light of technical indicators.

Ethereum’s price has recently jumped above $4,000, driven by significant technical momentum and increased network activity. The focus now turns to the rally’s sustainability as traders explore Ethereum’s breakout in zones unseen since 2021.

Bulls are targeting higher resistance levels, with many noting the importance of maintaining above the psychological mark. Key players in the Ethereum community, including developers, continue active updates to reinforce network strength without public comments on price action.

The surge in Ethereum directly impacts prices and influences related altcoins, such as ARB and OP. DeFi governance tokens and others tied to smart contracts are also witnessing sympathetic moves, reflecting increased market activity and focus.

Analyst caution arises due to technical indicators like the weekly RSI nearing overbought levels. This positions traders to closely watch for possible corrections while leveraging Ethereum’s strong momentum for potential gains.

Market participants observe Ethereum’s ability to hold support near $3,950–$4,000 critical for sustained bullish sentiment. Strong institutional inflows and active developer discussions signal a positive outlook but necessitate cautious optimism.

Potential financial outcomes include heightened volatility in DeFi markets and the likelihood of price pullbacks. Historical trends suggest altcoin rallies and corrections have followed previous Ethereum price milestones, underscoring the importance of strategic trader positioning during this surge.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

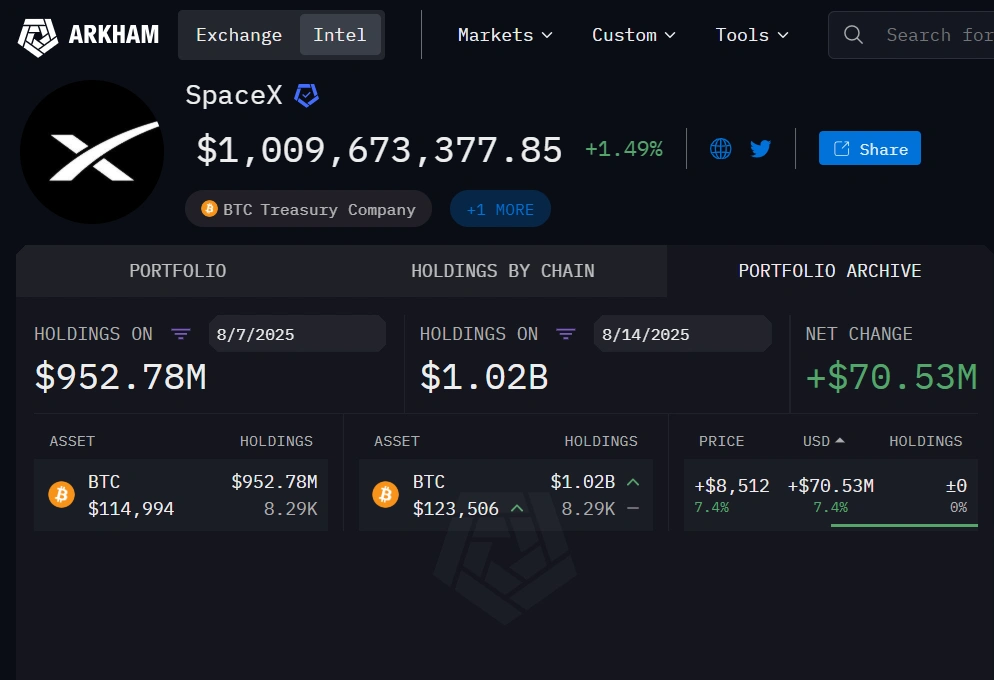

Norway hands Musk Tesla boost as SpaceX BTC holdings expand past $1B

Share link:In this post: Tesla’s sales in Norway have surged despite growing discontent among Norwegians regarding Elon Musk’s political stance. SpaceX’s BTC holdings have crossed the $1 billion mark again. Tesla’s deep ties in Norway influence its consistent sales numbers, but it is slowly losing its dominance as more rivals make headway.

Musk tips Google to dominate AI as it commits extra $9B to Oklahoma AI, cloud infrastructure

Share link:In this post: Elon Musk says Google currently has the highest probability of leading AI due to its compute and data advantage. Google will invest $9 billion in Oklahoma to expand AI and cloud infrastructure over the next two years. The plan includes a new Stillwater data center campus and expansion of its Pryor facility.

Nvidia partner Foxconn reports strong surge in AI server sales

Share link:In this post: Hon Hai Precision Industry (Foxconn) reported a 27% increase in Q2 profits, driven by sales in its AI server business. The company reported a net income of NT$44.36 billion for the period, surpassing an average analyst projection of NT$36.14 billion. It also expects significant growth in Q3 and the rest of the year.

US PPI beats estimates with 3.3% annual gain in July

Share link:In this post: US PPI jumped 3.3% in July, the highest annual gain since February. Monthly PPI rose 0.9%, blowing past the 0.2% forecast. Service costs surged, led by machinery wholesaling and portfolio fees.