Erebor’s Tech Billionaires to Use Political Friends for Crypto Bank Approval

Erebor, a new crypto bank, aims for fast approval by leveraging political connections. While it could boost crypto, concerns about favoritism and corruption loom over its success.

Erebor, a nascent crypto bank, recently circulated a fundraising memo claiming that it expects a bank charter in half the normal time. If approved, the bank will integrate stablecoins at a foundational level.

Several of Erebor’s tech billionaire founders are Trump allies with direct connections to the relevant regulators. This memo outright stated that their “political network will get this done” at extreme speeds.

Erebor: Crypto’s Next Big Bank?

Since the SVB collapse in 2023, the Web3 industry hasn’t enjoyed a dedicated tech-specific bank. Last month, a group of prominent tech billionaires announced plans to fill this gap by launching Erebor, a new bank with greater emphasis on crypto.

According to a recent scoop, this institution is planning to win regulatory approval much faster than expected.

Apparently, Erebor issued a recent fundraising memo claiming that the crypto bank will be fully operational by the end of the year.

Normally, this process could take a year or longer, so Erebor’s investors are openly suggesting that it’ll win regulatory approval twice as fast.

How is this possible? Several of its leading tech/crypto investors, such as Peter Thiel and Anduril founder Palmer Luckey, have become close Trump allies. “Palmer’s political network will get this done,” the memo claimed.

Furthermore, the institution is banking on increased cooperation between crypto and TradFi.

The OCC, which handles bank charters, has grown closer to the industry in recent months. Its current Chair, Jonathan Gould, is a former Bitfury executive with noteworthy connections to Erebor.

The memo directly claimed that Erebor’s co-founders have a “unique connectivity to banking regulators,” specifically naming Gould.

In a press statement, an OCC representative didn’t directly address these claims of favoritism:

“The OCC carefully considers every bank charter application submitted based on the facts of the application and consistent with its statutory and regulatory requirements,” an OCC spokeswoman told Business Insider.

Pros and Cons of Approval?

To be fair, the crypto industry could definitely use a bank catered to its interests. Erebor plans to become “the most regulated entity conducting and facilitating stablecoin transactions,” integrating Web3 at all layers.

If it proves successful, the institution could represent a major platform for TradFi’s integration with crypto.

However, the political corruption angle isn’t likely to win the industry’s reputation any favors. The crypto industry is under a lot of flak for significantly boosting President Trump’s net worth through business deals.

If “Palmer’s political network” gets Erebor a bank charter in half the usual time, how is that going to look to outside observers?

In the long run, accusations of corruption and bribery could become a serious problem. The crypto industry could benefit from this bank, but the expedited timetable seems unnecessary.

This fundraising memo might be bluster, and the speedy approval could never materialize. If it does, however, it may become a major scandal.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

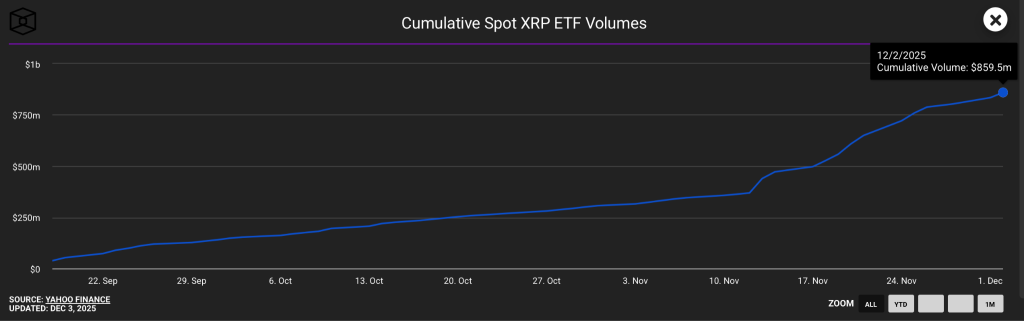

XRP ETF Flows Hit Record High—What It Means for XRP Price

Ethereum Hits New All-Time High for TPS Ahead of Fusaka Upgrade

Pi Network News: Expert Says ‘Sleeping Giant’ Fails to Wake As Stalled Protocol 23 Raises Doubts