Vitalik Buterin Reveals What Could Go Wrong as Companies Push All-In on Ethereum

Companies are increasing Ethereum reserves with billions in funding, but Vitalik Buterin warns that excessive leveraging could cause catastrophic consequences, putting ETH’s future at risk.

Public companies are intensifying their efforts to raise funds to boost their Ethereum (ETH) reserves, with Vitalik Buterin expressing support for ETH treasury firms.

However, the Ethereum co-founder also warned about the dangers of excessive leveraging. He cautioned that if treasuries become overly leveraged, it could lead to catastrophic consequences for Ethereum.

Companies Push Forward with Multi-Billion Dollar ETH Treasury Plans

on firms’ ETH treasury pivot, and the trend continues. Fundamental Global Inc. has taken a significant step by filing an S-3 registration statement with the US Securities and Exchange Commission to raise $5 billion for its Ethereum treasury.

The firm’s securities offering may include common stock, preferred stock, depositary shares, debt securities, warrants, and units. The company plans to use the funds raised primarily for ETH acquisition.

This comes after Fundamental Global kicked off its ETH reserve strategy and announced that it raised $200 million through a private placement.

“Today marks the beginning of FG Nexus’s mission to unlock Ethereum’s full potential as the ultimate reserve asset. This capital positions us to execute our ETH treasury strategy at scale with a target of 10% stake in the Ethereum Network,” Fundamental Global CEO Kyle Cerminara stated.

Meanwhile, SharpLink Gaming, the second-largest public holder of ETH, disclosed that it raised $200 million. The funds were raised through a direct offering, with four global institutional investors leading the round at a price of $19.50 per share.

Notably, after this, the firm acquired 10,975 ETH, valued at $42.79 million. According to OnChain Lens, SharpLink Gaming’s total ETH holdings now stand at 532,914, valued at $2.07 billion.

Similarly, Cosmos Health has secured a $300 million funding deal with an institutional investor through convertible promissory notes. The funds will support the company’s Ethereum treasury strategy, with ETH assets custodied and staked via BitGo Trust.

The Risks of Institutional Involvement in Ethereum: Buterin’s Concerns

The initiatives highlight companies’ commitment to increasing ETH exposure. The rising momentum also brings numerous benefits.

In a recent episode of the Bankless podcast, Buterin explained that ETH treasury companies offer multiple ways for people to access Ethereum, which is beneficial, especially considering individuals’ varying financial situations and incentives. He stated that,

“The social aspect of coordinating around ETH just being an asset that companies can have as part of their treasury is good and valuable..giving people more options is good. There is definitely valuable services that are being provided there.”

But, is there any downside to so much institutional involvement in ETH? Well, yes, but only if firms over-leverage themselves.

“If you woke me up three years from now and told me that treasuries led to the downfall of ETH, then, of course, my guess for why would basically be that somehow they turned it into an overleveraged game,” Buterin noted.

He also detailed a scenario in which a drop in ETH’s price could lead to forced liquidations, triggering a chain reaction of further price declines. This could ultimately result in significant losses and damage to Ethereum’s credibility.

“But I think the people in Ethereum in general, even including the people doing finance in Ethereum, are responsible people. These are not Do Kwon followers that we’re talking about,” Buterin added.

Thus, the growing trend of corporate Ethereum treasuries has undeniable benefits, including increased exposure and liquidity for ETH. However, as Buterin warns, the risks of over-leveraging these treasuries cannot be ignored.

While ETH’s potential as a reserve asset is significant, these institutions must approach it with caution and responsibility to avoid jeopardizing the network’s future.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Market Frenzy: How Will Regulation Impact the Future?

Ethereum supply plummets, how will the market react?

Magic Eden undergoes an epic transformation into entertainment!

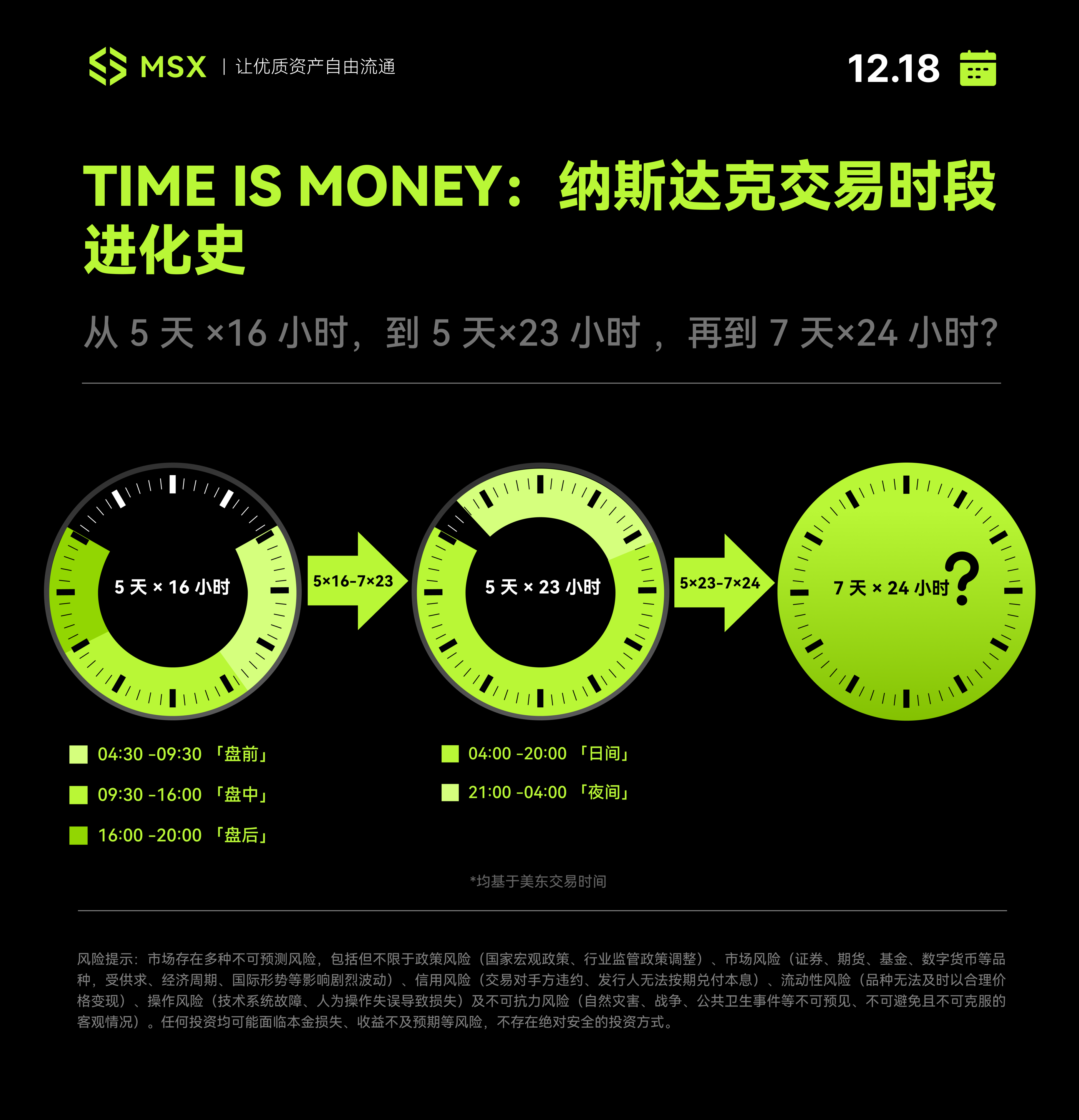

U.S. stocks sprint toward "never closing": Why is Nasdaq launching the "5×23 hours" trading experiment?