Whales Scoop $2.6 Million in PENDLE as USDe Loop Goes Live—Dip First or Breakout?

PENDLE is up as whales add over $2.6 million in 24 hours. But while the token eyes a rally continuation, on-chain data suggests a short-term dip could let new buyers enter cheaper before the next leg up.

Pendle (PENDLE) has rallied over 27% in the past 24 hours, following its new integration with Ethena (ENA). The collaboration enables a high-yield strategy using Pendle’s principal tokens and Aave’s borrowing markets, allowing users to loop stablecoins like USDe for fixed yields as high as 8.8%.

As capital flooded into the new pools, both ENA and PENDLE surged, pulling in whales and traders.

But even with this rally in motion, on-chain data hints that the next leg may not be immediate, and buyers might get a cheaper entry before the rally resumes.

Whales Accumulate $2.6 Million in Pendle After ENA Loop Goes Live

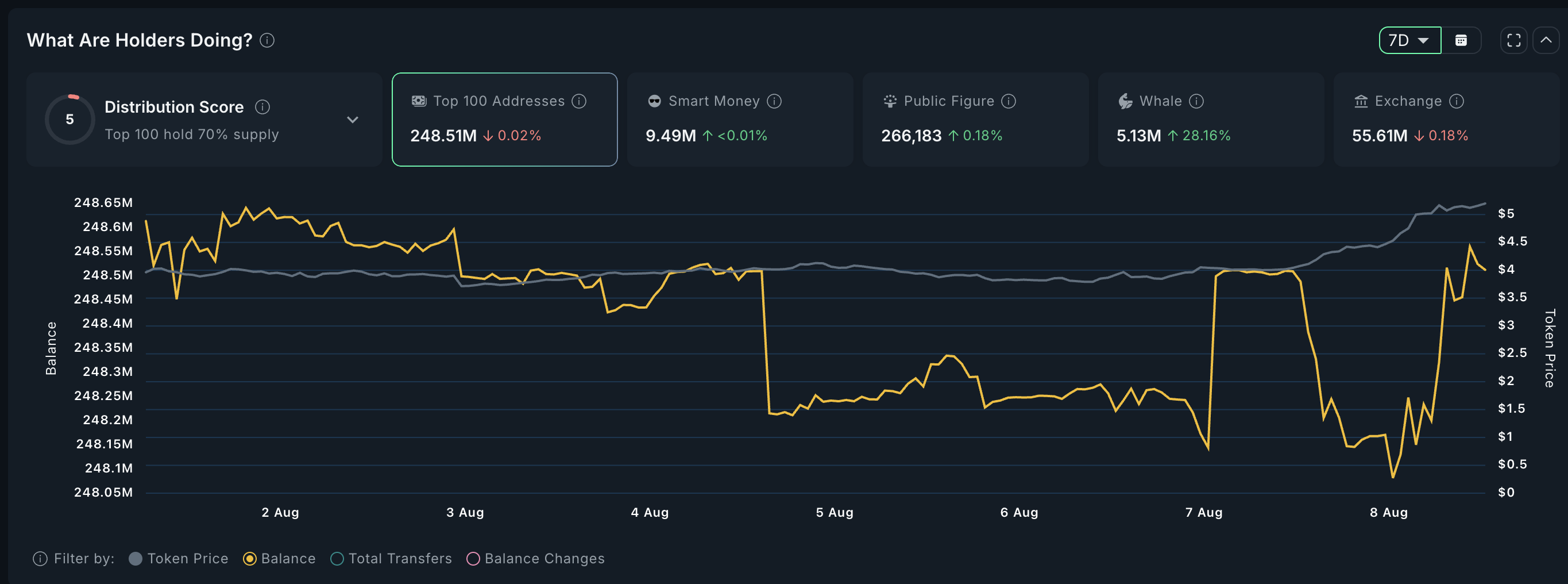

Whale activity exploded shortly after the ENA collaboration was announced. Over the past 24 hours, whales increased their PENDLE holdings by 11.08%, pushing their stash to 5.13 million tokens. This means they’ve bought approximately 513,000 new tokens, worth over $2.60 million at current prices.

Pendle whale accumulation (daily window)

: Nansen

Pendle whale accumulation (daily window)

: Nansen

This buying spree started before the rally as the whales were proactively buying PENDLE over the past seven days. This shows that the recent rally wasn’t just sentiment-driven but had major buying action driving it.

Pendle whale accumulation (weekly window):

Nansen

Pendle whale accumulation (weekly window):

Nansen

One reason behind the renewed whale interest is the growing use of a strategy involving Ethena’s USDe, Pendle, and Aave. This loop lets users borrow USDe on Aave and deposit it into Pendle to earn fixed yields that are higher than the borrowing cost, making it a profitable trade.

These pools are launching initially with limited capacity:• $100M cap for sUSDe (Sep ‘25)So be sure to get in early! pic.twitter.com/vYJzqDSRYQ

— Pendle (@pendle_fi) August 7, 2025

As more capital enters this loop, Pendle sees an increase in total value locked (TVL) and protocol fees. That boost in platform activity is likely why whales are buying in; they might be expecting sustained demand for Pendle’s yield products to support further upside for the token.

However, one subtle sign of caution has emerged. Exchange data shows a small uptick in PENDLE reserves (on the 24-hour timeline), indicating a slight increase in tokens sent to exchanges.

While not a major red flag yet, it’s worth watching, especially since whales are still accumulating. It could be a short-term signal of incoming profit-taking or consolidation, even if long-term conviction remains intact.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Pendle Price Action and RSI Suggest Short-Term Cooldown Before Next Breakout

Pendle’s price structure remains bullish. It’s trading inside a clear ascending channel, and has already broken past key resistances, now hovering around $5.23. If momentum holds, the next major target sits at $5.88, a potential 12% move from current levels.

PENDLE price analysis:

TradingView

PENDLE price analysis:

TradingView

But while the structure is bullish, momentum might be cooling slightly.

Between July 22 and August 8, PENDLE made higher highs in price, but the RSI (Relative Strength Index) formed a lower high. This mild bearish divergence suggests buyers may be losing strength, at least temporarily. RSI also hasn’t entered the oversold zone yet, which often happens before continuation breakouts.

That means a quick consolidation phase could play out before another breakout. Key support zones to watch are $5.03 and $4.74. A dip into this range wouldn’t invalidate the bullish setup; it may just offer buyers a better entry before the rally resumes.

However, if PENDLE breaks cleanly above $5.27, it would likely invalidate the short-term pullback scenario. In that case, the rally could extend toward higher levels without much resistance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Volatility Weekly Review (November 17 - December 1)

Key metrics (from 4:00 PM HKT on November 17 to 4:00 PM HKT on December 1): BTC/USD: -9.6% (...

When all GameFi tokens have dropped out of the TOP 100, can COC reignite the narrative with a Bitcoin economic model?

On November 27, $COC mining will be launched. The opportunity to mine the first block won't wait for anyone.

Ethereum's Next Decade: From "Verifiable Computer" to "Internet Property Rights"

Fede, the founder of LambdaClass, provides an in-depth explanation of anti-fragility, the 1 Gigagas scaling goal, and the vision for Lean Ethereum.

The reason behind the global risk asset "Tuesday rebound": a "major change" at asset management giant Vanguard Group

This conservative giant, which had previously firmly resisted crypto assets, has finally compromised and officially opened bitcoin ETF trading access to its 8 million clients.