ETH stocks soar pre-market as ETH rallies 5%: are they replacing ETFs as the go-to ETH play?

U.S. stocks tied to Ethereum treasuries surged in pre-market trading today, driven by Ethereum’s 5.5% price rally and record highs in on-chain metrics. Here’s what this momentum might mean for Ethereum ETFs.

- U.S. ETH-linked stocks, including SBET, BMNR, and BTCS, surged in pre-market trading today with gains up to 10%.

- The premarket enthusiasm is likely fueled by Ethereum’s 5.5% price surge and strong on-chain activity, incl. record transaction volumes and nearly 30% of ETH supply now staked.

- Analysts say that ETH treasury stocks may be a better buy than ETH ETFs, with SBET standing out due to its normalized NAV multiples and strong liquidity.

U.S. stocks linked to Ethereum ( ETH ) treasury and strategy concepts are rallying in early Thursday trading, led by SharpLink Gaming (SBET), BitMine Immersion Technologies (BMNR), and BTCS Inc. (BTCS), surging 8%, 8% and 10% respectively in pre-market activity. Other notable pre-market gainers include:

- Coinbase (COIN): up 3.77%

- Circle (CRCL): up 3.52%

- MicroStrategy (MSTR): up 1.43%

- Bit Digital (BTBT): up 5.52%

Today’s pre-market enthusiasm follows yesterday’s rally in ETH-linked stocks, accompanied by a wave of media attention on ETH treasuries — including Tom Lee’s viral appearance on Bankless and a crypto.news interview with Sharplink co-CEO Joseph Chalom .

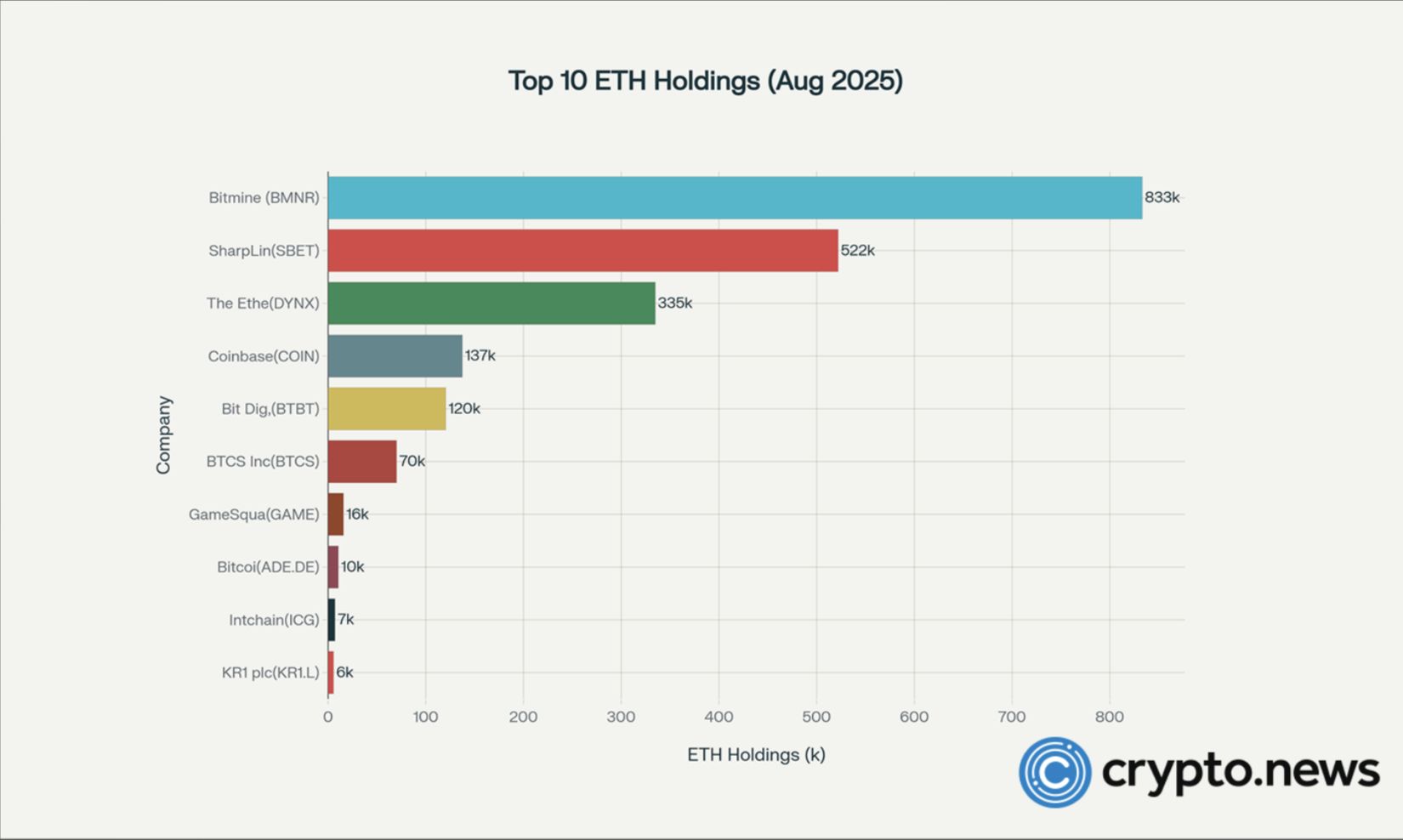

Interestingly, several of the top pre-market gainers today are also among the largest corporate holders of Ethereum. According to newly released data from crypto.news, BMNR and SBET currently sit atop the list of ETH treasury holders among publicly traded firms, with 833K ETH and 522K ETH respectively.

Source: crypto.news

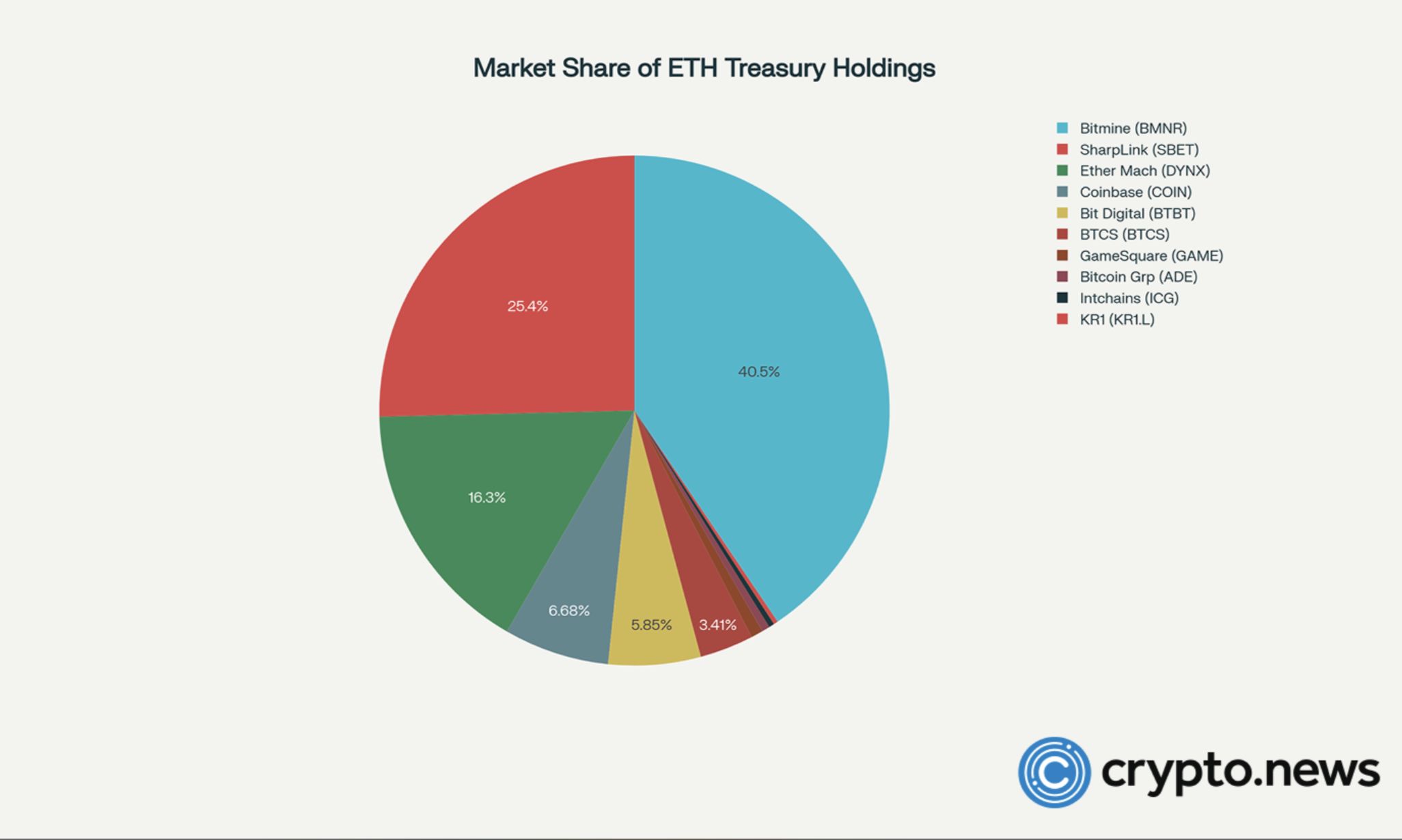

Source: crypto.news

Together, these two firms control over 65% of the total market share of institutional ETH holdings — 40.5% and 25.4% individually.

Source: crypto.news

Source: crypto.news

What’s driving today’s pre-market rally in ETH-linked stocks?

The pre-market momentum is likely fueled by ETH’s 5.5% gain over the past 24 hours, pushing its price to $3,818 — more than double Bitcoin’s ( BTC ) 2% increase during the same period.

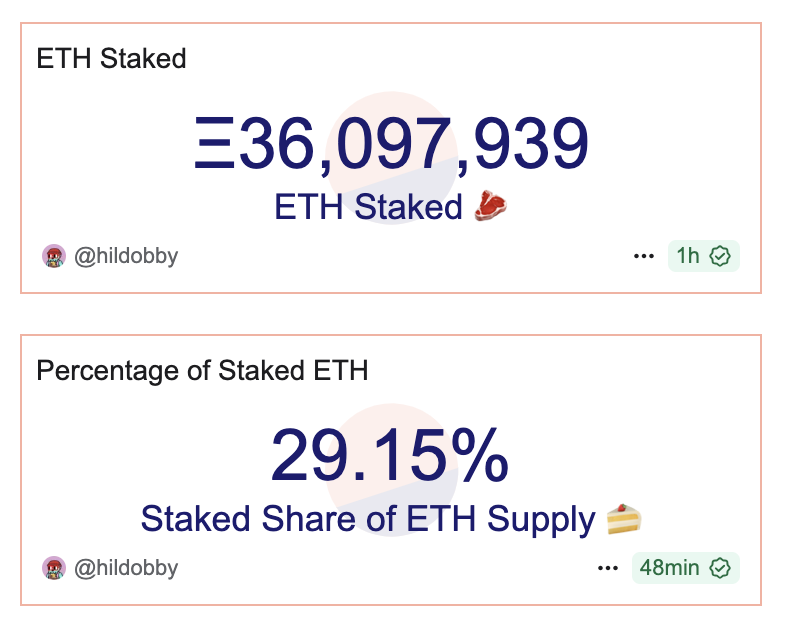

Source: DuneAnalytics

Source: DuneAnalytics

It may also be buoyed by Ethereum ’s strengthening on-chain metrics — with transaction volumes hitting a one-year high and over 36 million ETH (nearly 30% of the total supply) now staked. The rally follows recent SEC guidance suggesting that certain forms of liquid staking may not constitute securities offerings, easing regulatory concerns around Ethereum staking protocols.

Are ETH treasury stocks the new ETF trade?

The rally may also reflect a broader investment thesis gaining traction on Wall Street: that companies holding Ethereum on their balance sheets are becoming more attractive than spot ETH exchange-traded funds. According to Standard Chartered analyst Geoff Kendrick, ETH treasury stocks offer both regulatory advantages and more compelling valuations, particularly as their NAV (net asset value) multiples normalize.

Kendrick noted that since June, both ETH treasury firms and ETFs have accumulated roughly 2,000 ETH each—representing about 1.6% of Ethereum’s circulating supply. However, publicly traded firms provide investors with additional upside through flexible capital structures and potential operating leverage, unlike passive ETF products.

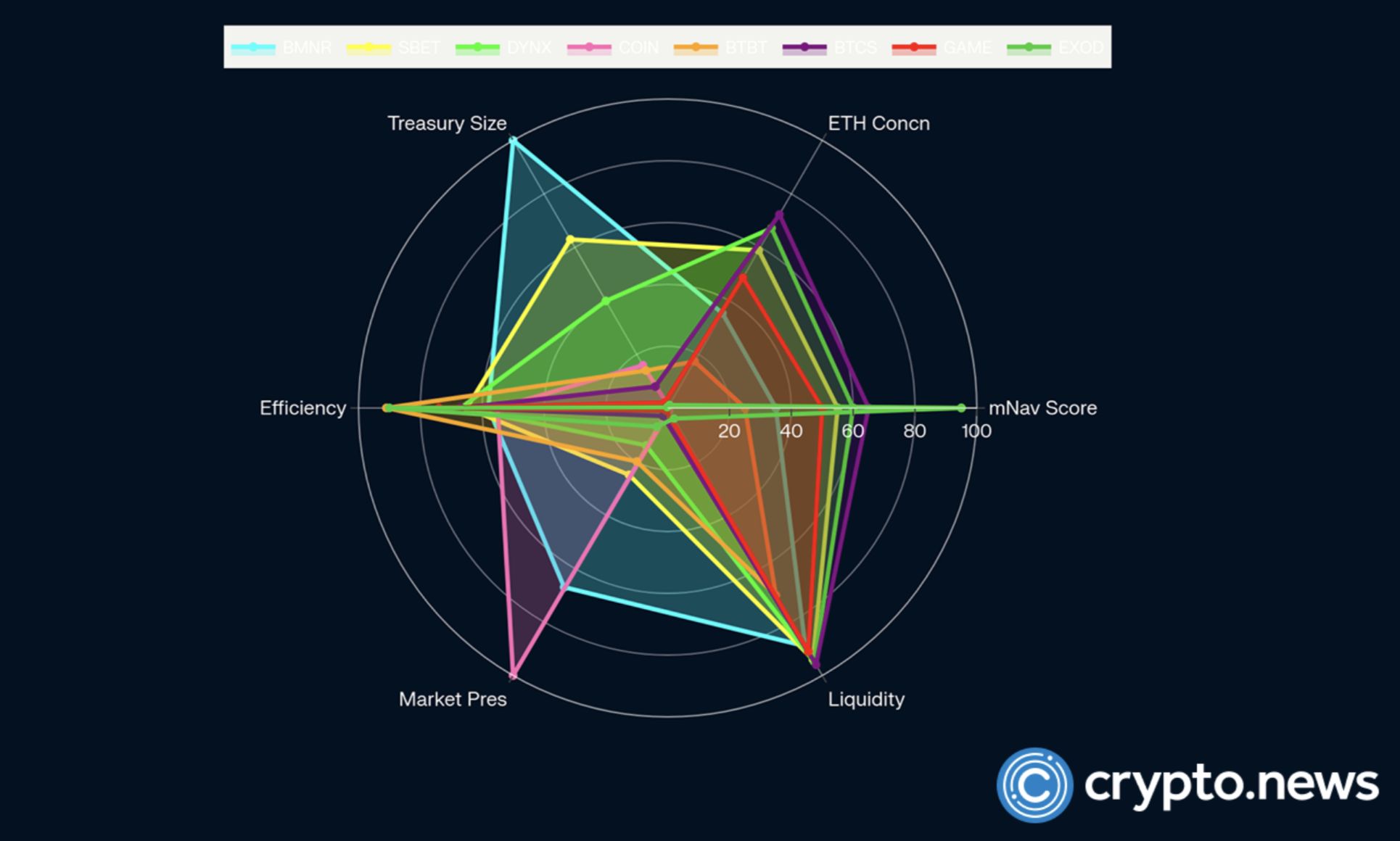

However, not all ETH treasury stocks are created equal. According to a radar analysis from crypto.news, companies like BitMine and SharpLink lead not only in treasury size but also in liquidity and efficiency, making them more investable from an institutional perspective. SBET, in particular, shows a strong balance across ETH concentration, efficiency, and liquidity — a trio that could support sustainable valuation growth.

SBET’s potential for further growth is further enhanced by its recent launch on Injective , which markedly increases its liquidity and broadens accessibility for investors.

Source: crypto.news

Source: crypto.news

With SBET now positioning itself as “ the most trusted corporate holder of ETH ,” investors may be witnessing the early stages of a structural shift away from Bitcoin-centric treasury models toward Ethereum.

As SharpLink co-CEO Joseph Chalom aptly put it in the recent crypto.news interview : “ETH is a productive asset in a productive platform […] giving us far greater flexibility to bring investors value than BTC treasury companies.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How to catch market manipulation in altcoins before they crash

Bitcoin 'bull run is over,' traders say, with 50% BTC price crash warning

Price predictions 10/17: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, HYPE, LINK, XLM

Bitcoin Falls as Short Sellers Step In