Today’s Outlook

1、Trump’s reciprocal tariff implementation has been postponed by one week to August 7.

2、US Initial Jobless Claims for the week ending August 2 will be released today; previous: 218k.

Macro & Hot Topics

1、CME FedWatch: Probability of a Fed rate cut in September is 93.6%. The odds of the Fed keeping rates unchanged in September are 6.4%, with a 93.6% probability of a 25 bps rate cut. For October, only a 2% chance for unchanged rates, 33.9% for a cumulative 25 bps cut, and 64% for a cumulative 50 bps cut.

2、US White House: Trump to impose an additional 25% tariff on Indian goods; India pledges retaliation. Trump signed an executive order for an extra 25% tariff on Indian goods in response to India’s ongoing purchases of Russian oil. Oil prices spiked intraday following the news. The Indian government called the new US tariffs "unfair, unreasonable, and unwarranted" and vowed to defend national interests, reaffirming its stance on Russian oil imports.

3、LD Capital Founder: Expect rate-cut-driven rally after mid-August, recent dips are buy opportunities. Yihua Yi, founder of LD Capital, wrote on X: "Amid macro factors like US equities and tariffs, ETH is consolidating. I expect a rate-cut rally to begin in mid-August, with a clear bull market trend. All recent dips are buy opportunities—patience is key. I’ve observed the success of Galaxy Digital while we at LD Capital focused on the capital business and missed the chance to build deeper digital infrastructure. Lesson learned on patience and long-term focus."

4、Ethereum On-Chain Volume Hits $238B in July, Highest Since December 2021. According to The Block, Ethereum’s on-chain volume reached $238B in July, up 70% month-on-month—the highest since December 2021. The network processed 46.67M transactions (a new monthly record) and 17.55M active addresses, nearing all-time highs. The 7-day MA for daily active transactions approached 1.66M, close to May 2021 peak. ETH ended July at $3,700, the highest in years.

Market Overview

1、BTC & ETH: Choppy short-term, mixed market action; $167M liquidated in the past 24 hours, mostly shorts.

2、Nasdaq up 1.2%, Apple jumps 5% and gains another 3% after hours; USD slips, oil retraces sharply from highs.

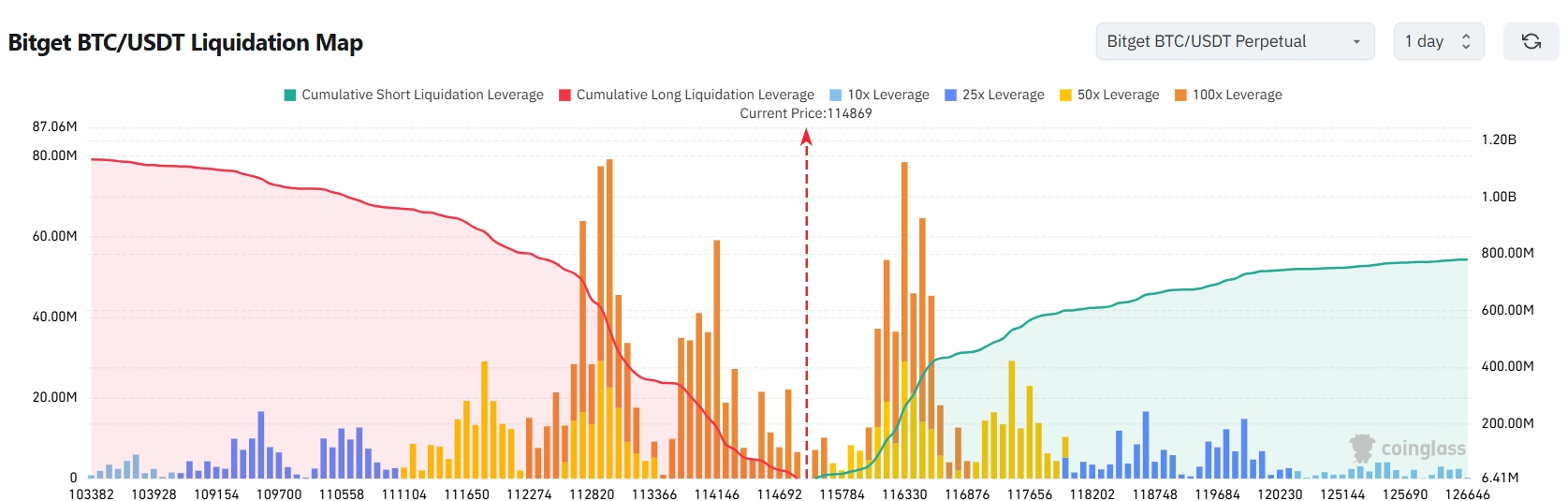

3、Bitget BTC/USDT Liquidation Map: At current $114,879, a 2,000-point drop to $112,879 could trigger over $680M in long liquidations; a 2,000-point rally to $116,879 could cause over $452M in short liquidations. Long-side risk greatly outweighs short. Leverage management is strongly advised to avoid mass liquidations during volatility.

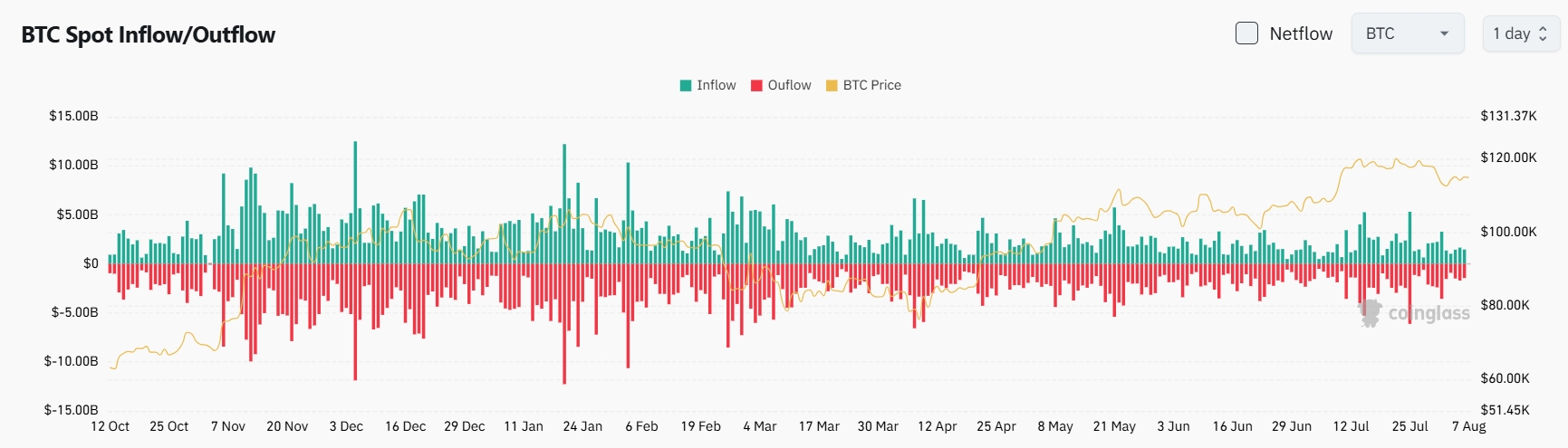

4、BTC Spot Flows (24h): Inflows of $1.46B, outflows of $1.42B, net inflow of $40M.

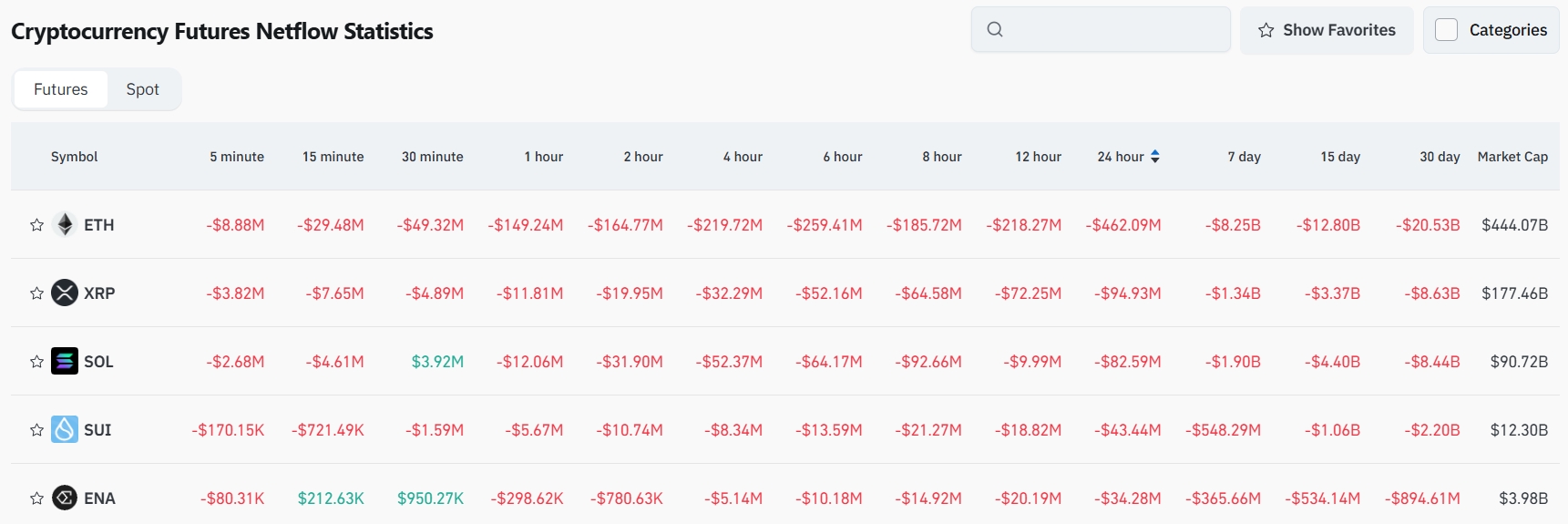

5、Contract Trading Net Outflows: ETH, XRP, SOL, SUI, ENA lead 24h net contract outflows—potential trading opportunities.

Institutional Views

News Highlights

1、Trump says US to impose ~100% tariff on chips & semiconductors.

2、Philippine regulators restrict access to unregistered crypto exchanges.

3、Fed’s Kashkari: Two rate cuts this year still seem likely.

4、Indian government: US tariffs are "unfair and unreasonable", will defend national interests.

Project Updates

1、Orca DAO proposes staking 55,000 SOL and launching a 2-year ORCA buyback program.

2、SBI Holdings files for ETFs investing in XRP and Bitcoin in Japan.

3、ConsenSys CEO: “42” is the answer to the Linea TGE date.

4、Data: 64 ETH treasury entities now hold over 3 million ETH, 2.52% of total supply.

5、Live trading platform Sidekick launches Sidekick Foundation and unveils tokenomics.

6、Stride: Staking operates normally; exploring new revenue streams beyond Cosmos.

7、KGeN Phase 1 live, rKGEN claim and staking now open.

8、SBI applies for two crypto ETFs in Japan, focusing on XRP and BTC.

9、Ethereum on-chain volume for July hits $238B, highest since Dec 2021.

10、Ethereum Foundation updates on L1 scaling, including new hires and mainnet gas limit increases.

X Hot Topics

1、Michael Liu: How to Know if You Should Long or Short a New VC Token? Two Simple Rules After a new VC-backed token launches, it’s easy to determine its bias. First, compare the launch price to the previous funding round: if it opens high, it’s often for exit liquidity; if it opens low, it’s typically to let airdrop farmers sell low and accumulate cheap tokens to squeeze shorts. Second, look at airdrop generosity: if Twitter is filled with angry airdrop hunters, it means the airdrop is tight and token supply is controlled—it’s usually more bullish for longs. Combine these two filters to avoid most airdrop and VC dump traps. Read more:

https://x.com/Michael_Liu93/status/1952774636615479388

2、Phyrex: “Trump-style Resilience” Dominates the Market, BTC Turnover Down Shows Confidence The market’s rally isn’t driven by major news but by Trump–Fed dynamics. Trump’s renewed promise of direct cash handouts shows his willingness to support the economy at any cost. Although recession risk remains, the probability is being deferred by Trump’s economic moves. BTC’s turnover rate has dropped significantly, signaling stable market sentiment—concerns of recession are now sidelined. US stocks show strong correlation with BTC, highlighting improved risk appetite. Technically, BTC hasn’t tested major support, with the $110k region’s consensus support holding firm and strong buying interest present. Read more:

https://x.com/Phyrex_Ni/status/1953184196433986049

3、Unipcs (aka 'Bonk Guy’): How Did USELESS Get Here? On Recent Criticisms and Attacks Recently, $USELESS has come under increasingly organized attacks, likely due to its dominant PvE project status in the BonkFun ecosystem, making it a prime target. Criticisms have even been directed at Bonk Guy himself. The recent price corrections reflect a natural and healthy consolidation—shaking out weak hands, securing early profits, and paving the way for future rallies. USELESS’s strength lies in its unique PvE narrative and community momentum—and it’s precisely this blue-chip meme potential that makes it a target. Launchpad rivalry or competitors’ suppression will not change its long-term value. Read more:

https://x.com/theunipcs/status/1953088797282857333

4、Millionaire Eric: The Value in "Predictable" Tokens—ENA as a Model The most valuable assets are never just pump-and-dump plays; they respect technicals and signals. Even if you miss one leg up, you’ll always have another chance to re-enter—because "structure matters". ENA, for example, consistently respects EMAs and key supports, making it one of the rare, highly tradable “rule-based” tokens. Their ultimate patterns tend to be a strong one-sided rally, a full shakeout, then a reshuffle. If the trend supports it, tokens like ENA are always worth monitoring. Read more:

https://x.com/CycleStudies/status/1953108787877048349