In his latest market analysis on August 1, 2025, seasoned analyst Ali Martinez identified significant price levels for altcoins Cardano $0.704046 ( ADA ), Pepe, and Chainlink $16 ( LINK ). Martinez noted that Cardano seems to be echoing its previous bullish pattern in a more gradual manner, while Pepe might face a downtrend if it fails to reclaim a crucial support level. Additionally, his charts suggest that Chainlink maintains a positive outlook above the $13 mark.

Cardano’s Cyclical Breakout Signal

Martinez’s weekly ADA coin chart reveals a price formation at around $0.76 akin to the early 2020 rally. At that time, a climb from $0.15 propelled the price to over $3 in just a few months. Martinez highlighted that while the model is progressing at a slower pace this time, the volume is beginning to recover in tandem. Market participants closely monitoring this structure could potentially catch an early breakout.

Fibonacci extension lines propose potential targets at $1.15, $1.78, and $3.09. However, Martinez cautioned that if weekly closures fall below $0.50, the anticipated bullish scenario might be postponed.

Crucial Levels for Pepe and Chainlink

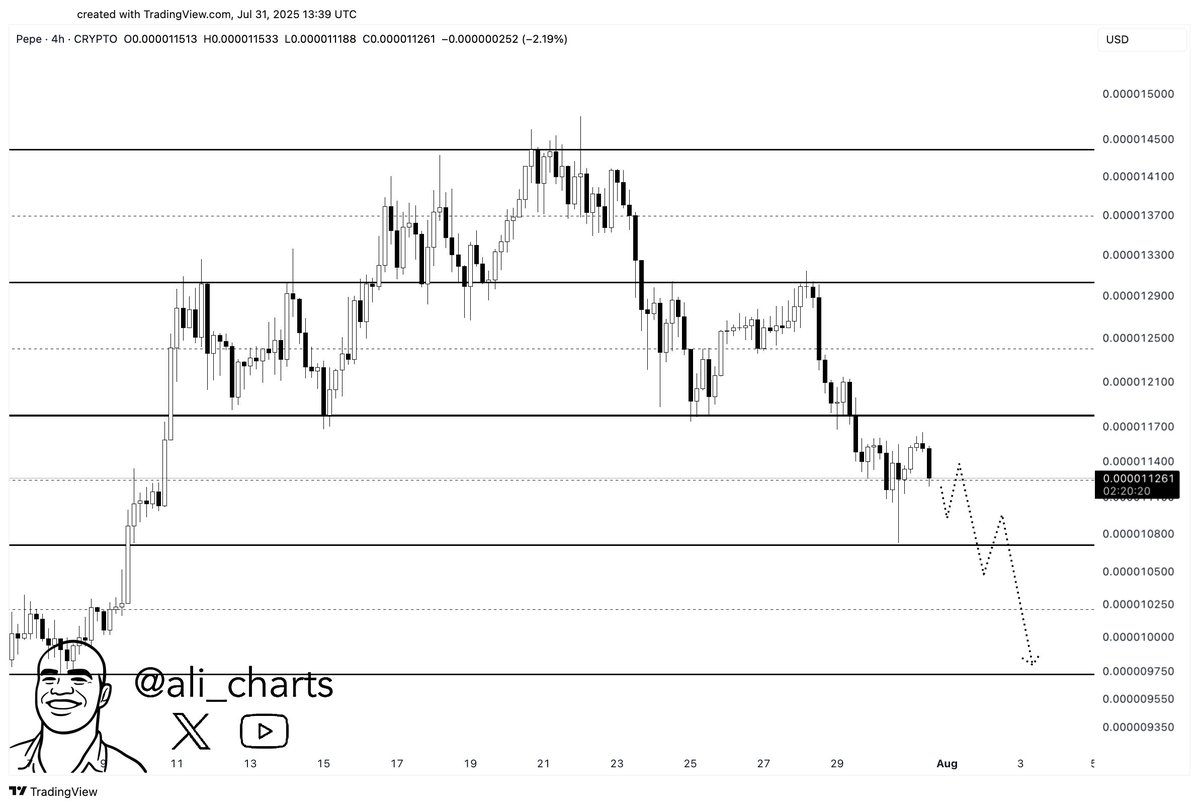

In his four-hour PEPE chart, Martinez observed that the price is striving to maintain a horizontal band around $0.0000118. The analyst warned that if this area is not confirmed as support again, sellers might target $0.0000108 initially and $0.0000097 for a more extended period. He cautioned that such a breakdown could replace short-term optimism with fear and panic, potentially leading to deeper declines.

Martinez’s three-day Chainlink chart indicates that the ascending channel base at $13 has not yet been breached. According to CryptoAppsy’s data, the altcoin ‘s price is currently hovering around $17.6. Martinez suggested that a move upward could see resistance between $20.18 and $29.24, offering opportunities for profit-taking. Conversely, if the price breaches the channel’s upper boundary, it could target an ambitious $46.85. However, closures below $13 would undermine the bullish scenario.