PUMP Eyes Rebound as Whales Go “Dip Shopping,” Scoop Up 5.4 Billion Tokens

PUMP price has slid 18% amid retail selling, yet whales are aggressively buying the dip, adding 5.4 billion tokens. Could this spark a rebound?

PUMP’s price has dropped sharply, sliding over 18% in the past 24 hours, even as whales have turned aggressive buyers.

On-chain data shows a clear divergence between retail selling pressure and big wallet accumulation, creating a potential setup for a rebound if whale demand manages to outpace exits.

Retail Selling Clashes With Whale Demand

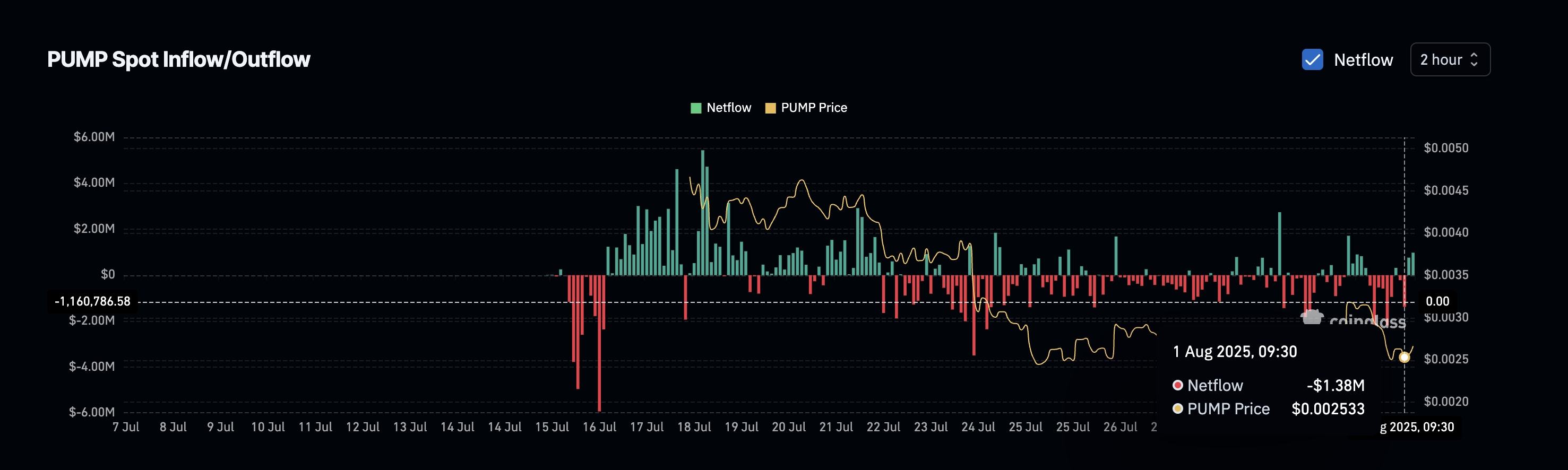

Coinglass data shows that retail traders are offloading PUMP into exchanges, with netflows flipping from a $1.38 million outflow to nearly $1 million positive within hours. This quick change signals heightened selling activity from smaller holders, fueling the latest price dip.

PUMP price and increasing inflows:

Coinglass

PUMP price and increasing inflows:

Coinglass

However, while retail is exiting, whales are positioning differently. In the past 7 days, whale wallets added 5.4 billion PUMP tokens, a 35.8% jump in their holdings, bringing their total stash to 20.7 billion tokens.

Whale buying PUMP (weekly timeframe):

Nansen

Whale buying PUMP (weekly timeframe):

Nansen

Despite whales picking up a major PUMP token stash, the exchange netflows continued to remain flat across 24-hour and 7-day charts. This validates retail’s bearish viewpoint and lingering sell-side pressure.

Whale buying PUMP (daily timeframe):

Nansen

Whale buying PUMP (daily timeframe):

Nansen

Daily whale activity also rose 3.21% in the last 24 hours, showing consistent appetite for the dip.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

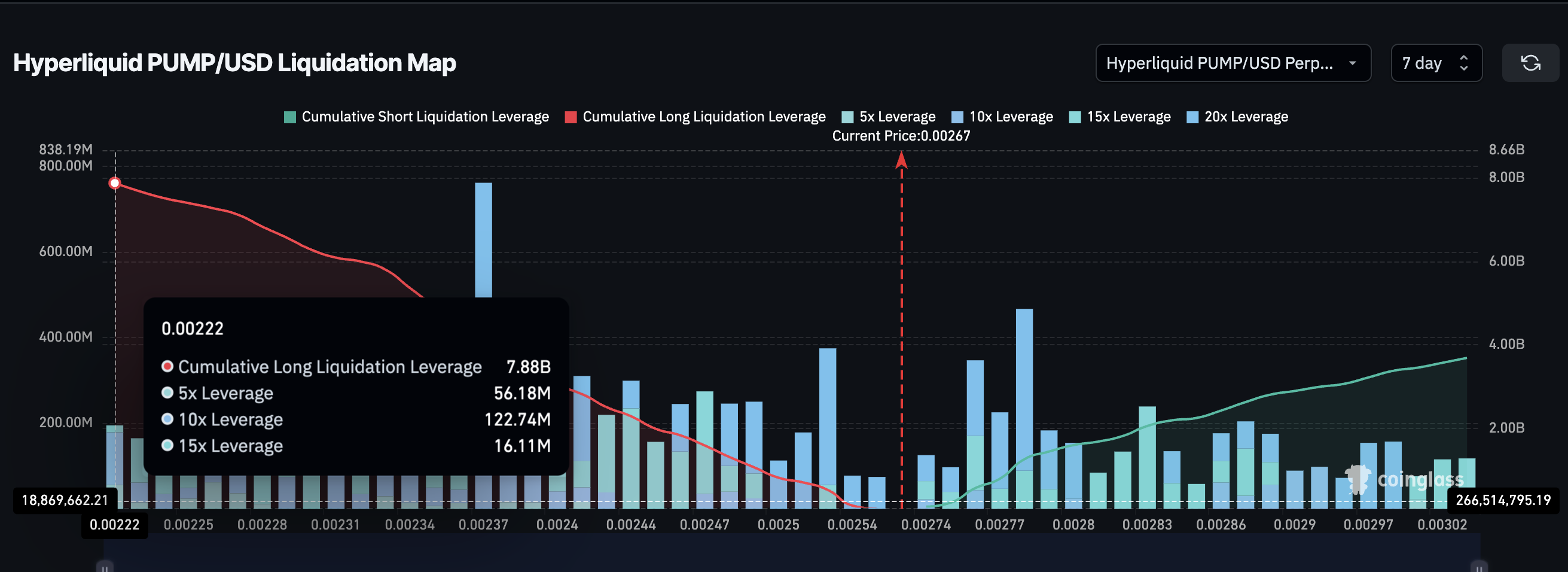

Liquidation Map Shows Long Bias Despite The Crash

Data from Hyperliquid reveals a market heavily skewed toward long positions, with $7.88 billion at risk of liquidation for longs, more than double the shorts. This imbalance shows traders are still betting on a PUMP price recovery despite the 18% correction.

Hyperliquid’s PUMP liquidation map:

Coinglass

Hyperliquid’s PUMP liquidation map:

Coinglass

However, this presents a price risk as well. If the correction continues, led by retail selling, longs might quickly get liquidated. That would cascade a deeper price drop.

On the flip side, if whale accumulation continues and the PUMP price starts to climb, the large build-up of long positions could trigger a cascade of short liquidations, adding fuel to any rebound rally. For now, the market bias remains bullish on leverage, but sentiment could flip if selling accelerates.

Key PUMP Price Support May Decide The Next Move

The 2-hour chart shows PUMP clinging to the $0.00259 Fibonacci support after the steep sell-off. PUMP price has formed an ascending channel structure over recent sessions, hinting at a broader bullish setup despite short-term weakness.

A breakdown below this level could open the way to $0.00241, invalidating the bullish scenario. While some might argue that breaking the lower trendline could also invalidate the bullish setup but we also need to account for false breakouts. A dip under $0.0024 confirms trend weakness.

Yet, holding support and the lower trendline of the channel may allow bulls to retest $0.00284 and $0.00294 in the near term. That happens only when the whale buying manages to outpace the retail sentiment. And in that case, PUMP remains very much inside the channel.

PUMP price analysis:

TradingView

PUMP price analysis:

TradingView

The divergence between retail selling and whale dip-buying paints a tug-of-war scenario. If whales keep stacking and netflows turn consistently negative on exchanges, a rebound could take shape, invalidating the latest correction and sparking a relief rally.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Systemic Risks of Celebrity-Backed Memecoins: How Retail Investors Are Exploited in the Crypto Speculation Era

- Celebrity-backed memecoins exploit retail investors through centralized allocations, pre-distributed tokens, and market manipulation tactics. - Projects like Kanye West’s YZY and TRUMP tokens see insiders extract millions via liquidity traps while 83% of retail wallets suffer losses. - Academic studies confirm 82.6% of high-return meme coins use wash trading and liquidity pool inflation to artificially inflate prices. - Regulatory gaps allow celebrities to evade accountability despite SEC investigations,

Why Tapzi (TAPZI) Is the Most Promising GameFi Altcoin for 5,000x Returns by 2030

- Tapzi (TAPZI) redefines GameFi with skill-based competition, blockchain scalability, and utility-driven tokenomics, contrasting speculative meme coins. - The platform's BNB Chain integration enables gasless transactions, while 5% token allocation to player rewards ensures organic growth without inflation. - Presale reached 35% of its hard cap in 48 hours, with early investors acquiring tokens at $0.0035, projecting 171% returns before 2030's 5,000x target. - By targeting the $180B gaming market through f

South Korea's Institutional Bitcoin Adoption: A Strategic Inflection Point for Asian Crypto Markets

- South Korea launches Bitplanet, its first institutional-grade Bitcoin treasury with $40M in debt-free capital, signaling a strategic shift toward digital asset management. - The move aligns with regional trends as Japan and Singapore advance crypto adoption, redefining Bitcoin’s role as a corporate reserve asset amid geopolitical and demographic risks. - Bitcoin’s 0.94 Sharpe Ratio (2023–2025) and $132.5B in ETF assets highlight its institutional legitimacy, outperforming traditional assets while mitigat

Tornado Cash Legal Defense and the Future of Decentralized Innovation: Navigating Regulatory Uncertainty and Market Resilience

- Tornado Cash case highlights legal challenges of applying traditional finance laws to decentralized blockchain protocols. - Roman Storm's conviction for unlicensed money transmission and Treasury's sanctions reversal reveal fragmented regulatory approaches. - Market response shows privacy tools' resilience, with TORN token surging 75% after sanctions lifted in March 2025. - DeFi adoption grows (312M users, $247B TVL) as privacy-focused protocols integrate compliance tools like AI-driven AML analytics. -