SOL, SUI Lead August’s $3 Billion Token Unlock—What Traders Need to Know

August's $3 billion token unlocks, led by Sui and Layer-2s, could drive volatility but may allow price recovery if demand holds.

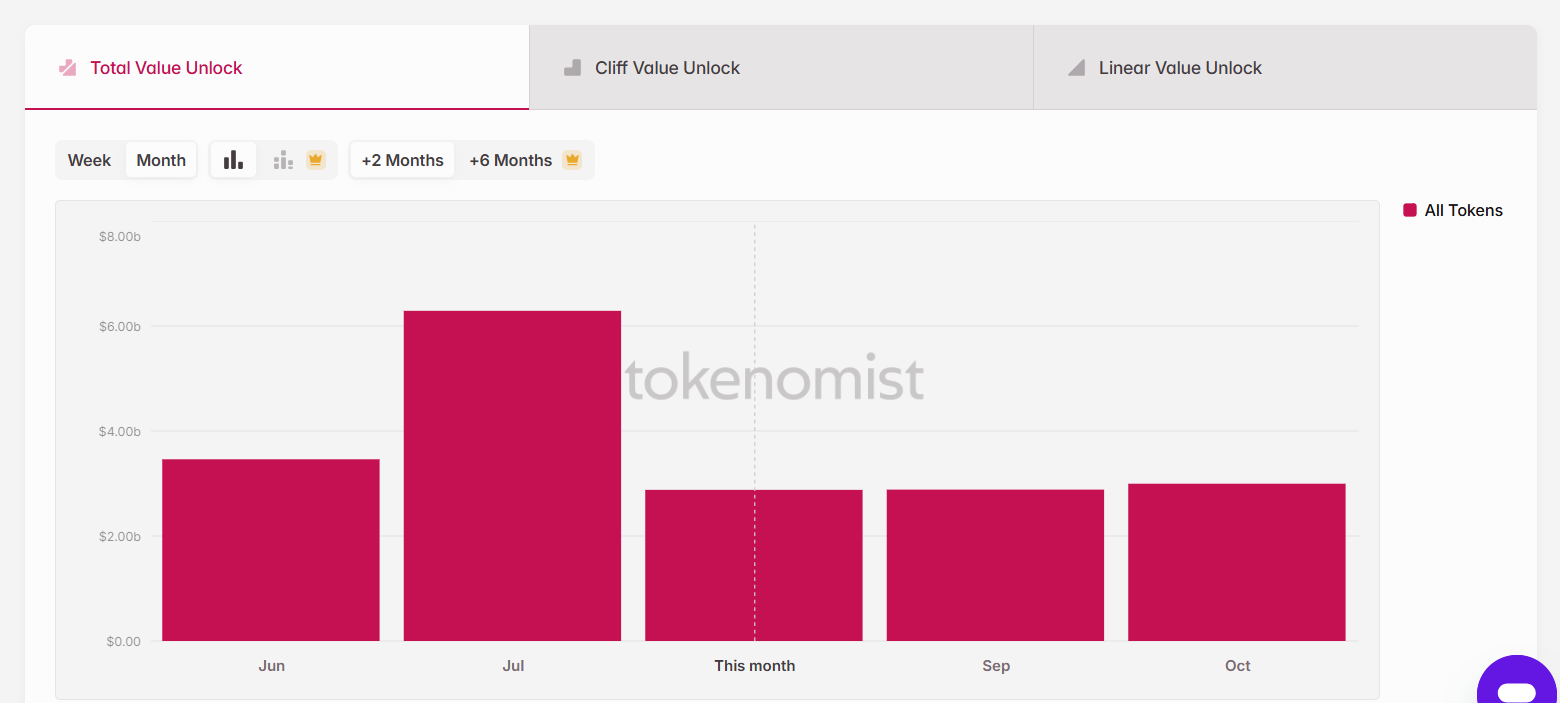

According to the latest data from Tokenomist, the total value of tokens expected to be unlocked in the crypto market in August is approximately $3 billion. This is sharply down from July’s $6.3 billion total.

Nevertheless, the August unlock is considered one of the year’s largest unlock events and could significantly impact investor sentiment and overall market volatility in the short term.

Top Token Unlocks in August: SOL & SUI

Token unlock is an integral part of the lifecycle of most blockchain projects. This process involves the release of previously “locked” tokens, typically allocated to development teams, early investors, or the community. The system actively distributes these tokens to the market over time.

Such events often create selling pressure if not balanced by genuine market demand. Therefore, the significant unlock value in August draws special attention from analysts and the crypto investor community.

August token unlock. Source:

Tokenomist

August token unlock. Source:

Tokenomist

According to Tokenomist, Solana (SOL) will have the largest unlock volume in August, with around $367 million. Solana also had a successful July, with a price spike to $206. The on-chain value of SOL locked in DeFi pools increased by 14%, with DEX trading volume increasing by 30%.

However, the large number of unlocks in August could cause SOL price to fall, which could push it toward $115,000 or lower.

After Solana, Sui (SUI) will be the second-largest unlocking project in August with $216 million. A large-scale unlock at a specific time like this could cause significant price volatility if there is insufficient liquidity or demand to absorb it.

However, both SUI and SOL have recently attracted institutional attention. Mill City Ventures, a Nasdaq-listed company, has allocated $450 million to SUI as a reserve asset. Additionally, Upexi is committing $500 million to Solana for its altcoin treasury.

“$SUI looks good here for reversal after making a higher low. The weakness past few days was mainly due to the fear of $200m worth tokens being unlocked. But markets are efficient & usually the token pumps on the unlock day, expecting the same here!” crypto investor Momin stated on X.

SUI price analysis. Source:

Momin on X

SUI price analysis. Source:

Momin on X

Worldcoin (WLD) and Trump Coin (TRUMP) actively hold an unlocked value of approximately $377 million. The rest is reserved for mid/low-cap tokens.

“With another heavy unlock cycle ahead, supply absorption continues to be the key metric to monitor.” Tokenomist shared on X.

However, with the total unlock value not being excessively large, supply pressure could be “eased.” If supported by macroeconomic factors or other positive news, this could help stabilize token prices or even see a slight recovery.

Nevertheless, this does not mean that selling pressure has completely disappeared. Investors closely monitor funds’ or developers’ unlock schedules and wallet behaviors to assess the risk of short-term price corrections.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PHB +576.67% in 24 Hours Amid Strategic Developments

- PHB surged 576.67% in 24 hours to $23.88 amid a major tech partnership for enterprise blockchain integration. - Technical upgrades added advanced smart contracts and cross-chain interoperability, boosting institutional interest. - Market volatility reflects 895.59% monthly gains but a 5,682.95% annual decline, with analysts noting consolidation ahead of product launches. - Governance reforms introduced decentralized voting and multi-signature controls to enhance transparency and community trust. - Analys

Nvidia's AI Boom Fueled by Cloud Giants, Hobbled by China's Clampdown

- Nvidia reported 56% YoY revenue growth in Q2 2025, driven by AI chip demand from cloud providers expanding generative AI infrastructure. - Q3 revenue forecast of $54B exceeded expectations despite zero H20 chip sales to China and geopolitical tensions impacting 13% of its revenue. - A 15% revenue-sharing deal with Trump eased U.S. restrictions on China sales, but Beijing's security warnings halted H20 production and pressured gross margins. - Chinese rivals like Cambricon gained traction, reporting 4,000

Stablecoins Go Mainstream as Circle, Mastercard, and Finastra Redefine Global Payments

- Circle partners with Mastercard and Finastra to expand USDC usage in global payments, targeting EEMEA and 50+ countries via stablecoin settlements. - Mastercard’s EEMEA initiative enables merchants to settle in USDC/EURC, reducing costs and volatility risks for SMEs. - Finastra integrates USDC into its Global PAYplus platform, processing $5T daily, enhancing cross-border efficiency. - Circle’s Asia expansion includes partnerships with Korean banks and Japan’s JPYC, aligning with U.S. regulatory progress

Solana News Today: Robinhood and Whales Fuel Solana’s $200 Rally as $1B Treasury Talks Emerge

- Solana (SOL) surged past $200 on August 26, 2025, driven by Robinhood’s micro futures and increased whale accumulation in the $190–$200 range. - Market cap hit $112.5B with 176% higher daily volume, while on-chain buybacks jumped 158% to $46.8M, reflecting ecosystem confidence. - Institutional interest intensified via VanEck’s JitoSOL ETF filing and a potential $1B Solana treasury fund, mirroring Bitcoin’s staking strategy. - Technical analysis highlights $210 resistance and $195 support, with bullish RS