The leading cryptocurrencies and the entire crypto market tumbled on Friday after investors reacted negatively to U.S. President Donald Trump’s newly imposed tariffs on multiple countries around the world.

The sell-off, which also affected stock markets, reflects a mix of broader macroeconomic uncertainty and profit-taking following recent all-time highs.

Bitcoin and Altcoins Decline

Bitcoin dropped to $114,250, its lowest point since June 11, breaking below its three-week trading range and now eyeing the next support level around $111,000.

Sponsored

Major altcoins, including Ethereum (ETH), XRP, Solana (SOL), Cardano (ADA) , and Dogecoin (DOGE), also saw sharp corrections of over 6% as of Friday morning.

The total crypto market capitalization fell more than 3.7%, wiping out nearly $300 billion and currently standing at approximately $3.75 trillion.

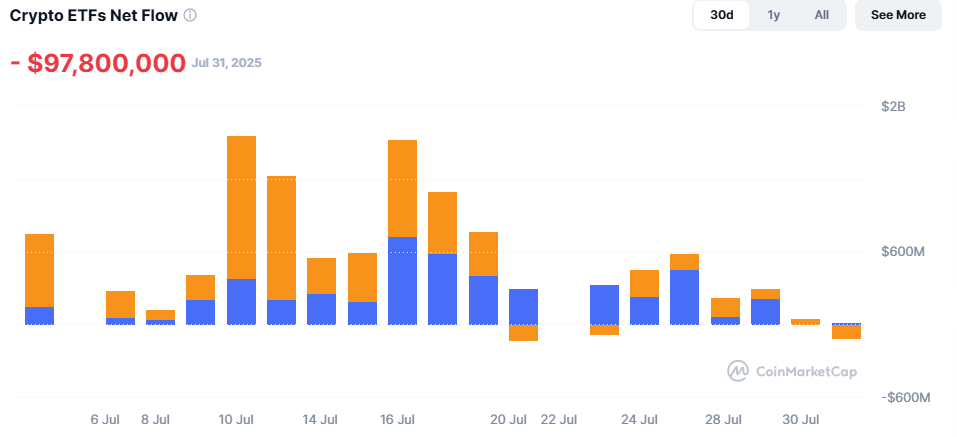

Meanwhile, net inflows into crypto ETFs turned negative, dropping by $98 million since Thursday.

Crypto ETFs’ net inflows turned negative on August 1.. Source: CoinMarketCap

Crypto ETFs’ net inflows turned negative on August 1.. Source: CoinMarketCap

The Bitcoin dominance index began climbing again, rising 0.3% to 61.2%, signaling cautious investor rotation back into BTC.

Trump Unveils New Tariffs

Late Thursday, President Trump finalized a sweeping package of tariff hikes and trade deals. These included raising tariffs on Canadian imports from 25% to 35%.

Countries that failed to secure agreements with the U.S., including Switzerland, South Africa, Turkey, Indonesia, Taiwan, and Thailand, will now face new tariffs ranging from 19% to 39%.

Trade agreements with key partners like the European Union, Japan, South Korea, and the United Kingdom were also formalized.

In addition to general import tariffs, the executive order imposes sector-specific levies targeting industries such as steel, aluminum, copper, automobiles, and auto parts.

All new tariff rates are set to take effect on August 7.

More Calm, Than Expected

The announcement triggered a broad wave of selling across financial markets, with Asian stock indexes dropping sharply on Friday.

Still, markets showed resilience, according to analysts at The Kobeissi Letter. “The trade war has lost its shock effect on markets,” they wrote on X.

S&P 500 futures were down just 0.37%, largely due to disappointing earnings from Amazon. The Kobeissi Letter noted that just a few months ago, such a tariff action might have sent the index down 3% or more.

Why This Matters

The crypto and stock market pulback signals heightened investor sensitivity to global trade tensions, compounded by lingering economic uncertainty.

Check out DailyCoin’s popular crypto stories:

Shiba Inu Fever Grips Coinbase Whales: Monster Rally Looming?

Hyperliquid Outage Sends HYPE Token Down 5% in 24 Hours

People Also Ask:

Geopolitical moves, such as tariffs or trade restrictions, increase uncertainty, prompting investors to reduce risk across both traditional and crypto markets.

Crypto ETFs are investment funds that track crypto assets. Positive inflows suggest investor confidence, while negative inflows can signal broader risk-off sentiment.

Yes. Any policy that affects investor sentiment or global financial markets can influence crypto prices, especially during uncertain economic or political periods.