Date: Fri, Aug 01, 2025 | 06:10 AM GMT

The broader cryptocurrency market is facing a notable pullback, triggered largely by Ethereum (ETH) failing to sustain its momentum after testing a key multi-year resistance around $3,940. ETH has since dropped to around $3,675, down 4% on the day, and this weakness has spilled over into altcoins — including Artificial Superintelligence Alliance (FET).

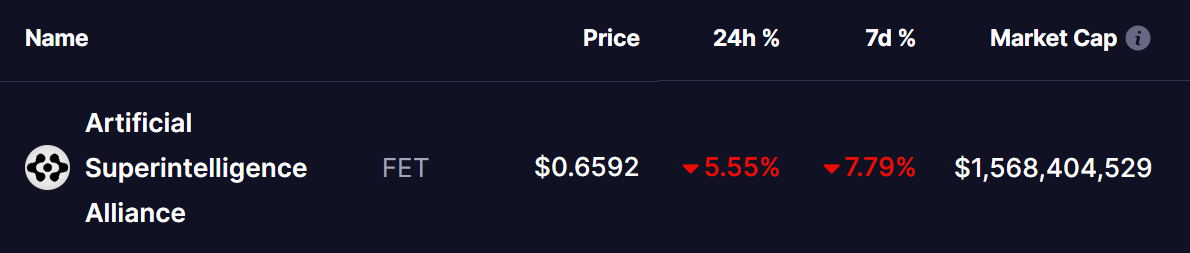

FET has taken a hit of over 5% in the last 24 hours, deepening its weekly loss to around 8%. But more importantly, the token has now arrived at a pivotal technical level — one that could decide whether this is just a temporary dip or the start of a larger correction.

Source: Coinmarketcap

Source: Coinmarketcap

Testing Support of Symmetrical Expanding Triangle Pattern

On the daily chart, FET is trading within a symmetrical triangle pattern, which is typically a neutral formation — meaning it can resolve either to the upside or downside depending on the breakout direction. The price has now reached the lower boundary of this triangle, around the $0.65 level.

FET Daily Chart/Coinsprobe (Source: Tradingview)

FET Daily Chart/Coinsprobe (Source: Tradingview)

This lower trendline has acted as dynamic support for several months, and its significance is amplified by the recent breakdown below the 200-day moving average, currently sitting at approximately $0.72.

What Next for FET?

If FET manages to hold the $0.65 support and initiates a bounce, it could reclaim the 200-day moving average — a key technical trigger that might attract bullish momentum. A successful move above this level could set the stage for a push toward the triangle’s upper resistance near $0.80, or even higher if broader market sentiment improves.

On the flip side, failure to hold this lower trendline support could result in a bearish breakdown. If that happens, FET could tumble toward the next support zone around $0.55 or even revisit earlier lows — a move that might trigger panic selling or stop-loss cascades from trader.

With the price sitting at a key inflection point, the next few daily candles will be crucial.