Stellar (XLM) Bull Flag Breakout Shows Cracks as Momentum Fades

XLM price remains above the bull flag breakout, but net flows are weakening, OBV and CMF are losing strength, and key support at $0.41 is at risk. Without fresh buying pressure, the breakout could fail.

Stellar (XLM) has had a strong July, rallying 77% this month. But in the last seven days, it’s given up nearly 10%, and the picture on the charts is looking less convincing.

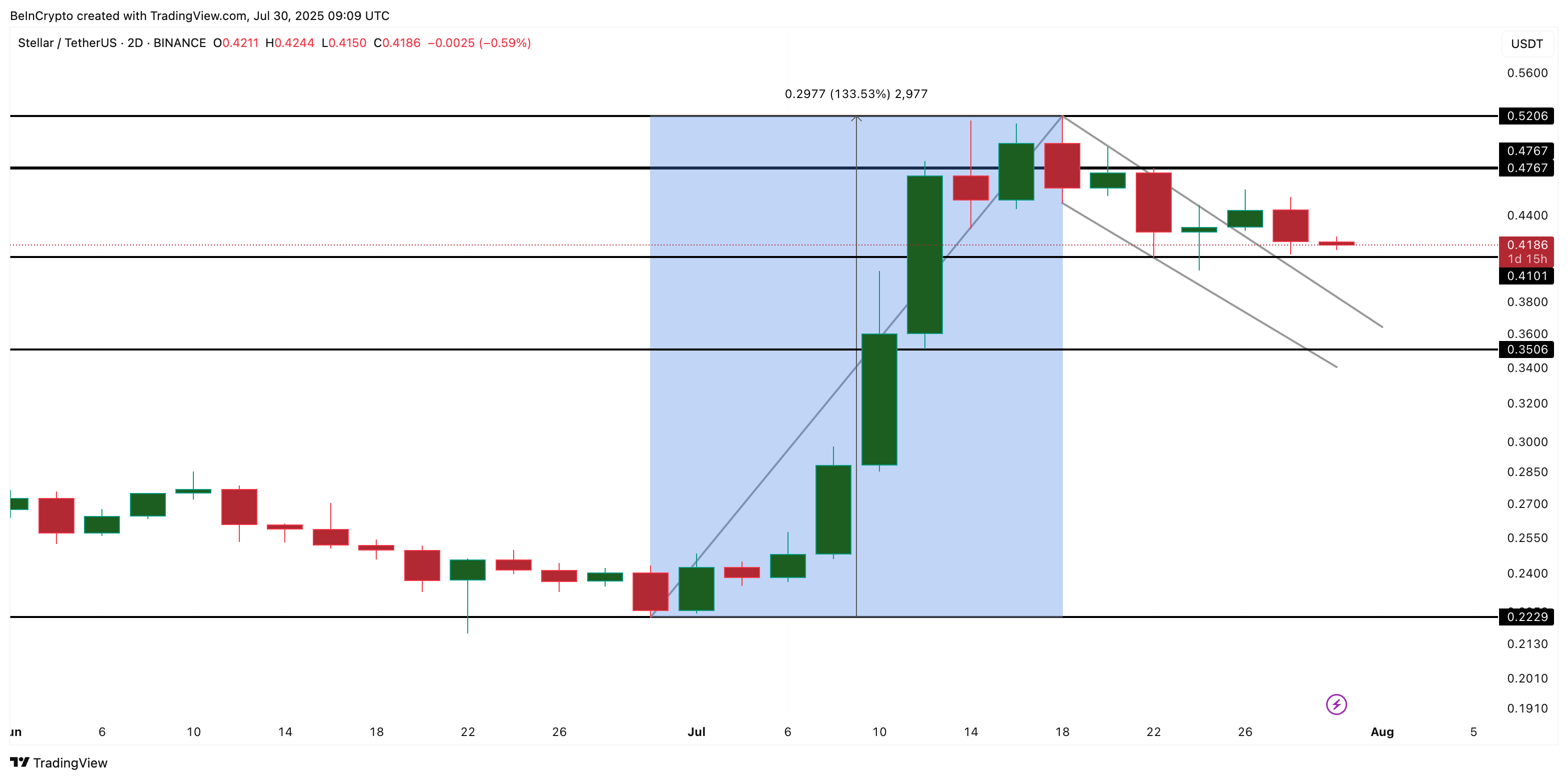

On the two-day chart, XLM price initially broke out of a bull flag, a continuation pattern that usually signals another upward leg, yet the candles that followed have mostly turned red. Without new buying pressure, the breakout could already be faltering.

Net Flows: The Only Tailwind is Losing Strength

Exchange net flows have played a big role in XLM’s recent rally. Earlier this month, more coins were leaving exchanges than entering, reducing available supply and fueling upward momentum.

Stellar price and netflows:

Coinglass

Stellar price and netflows:

Coinglass

Over the past week, that trend has weakened noticeably, with net outflows sliding closer to neutral levels. The lack of sustained withdrawals hints that long-term holders aren’t adding fresh buying pressure anymore, leaving the breakout without much support.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Weak Money Flow Adds to Concerns

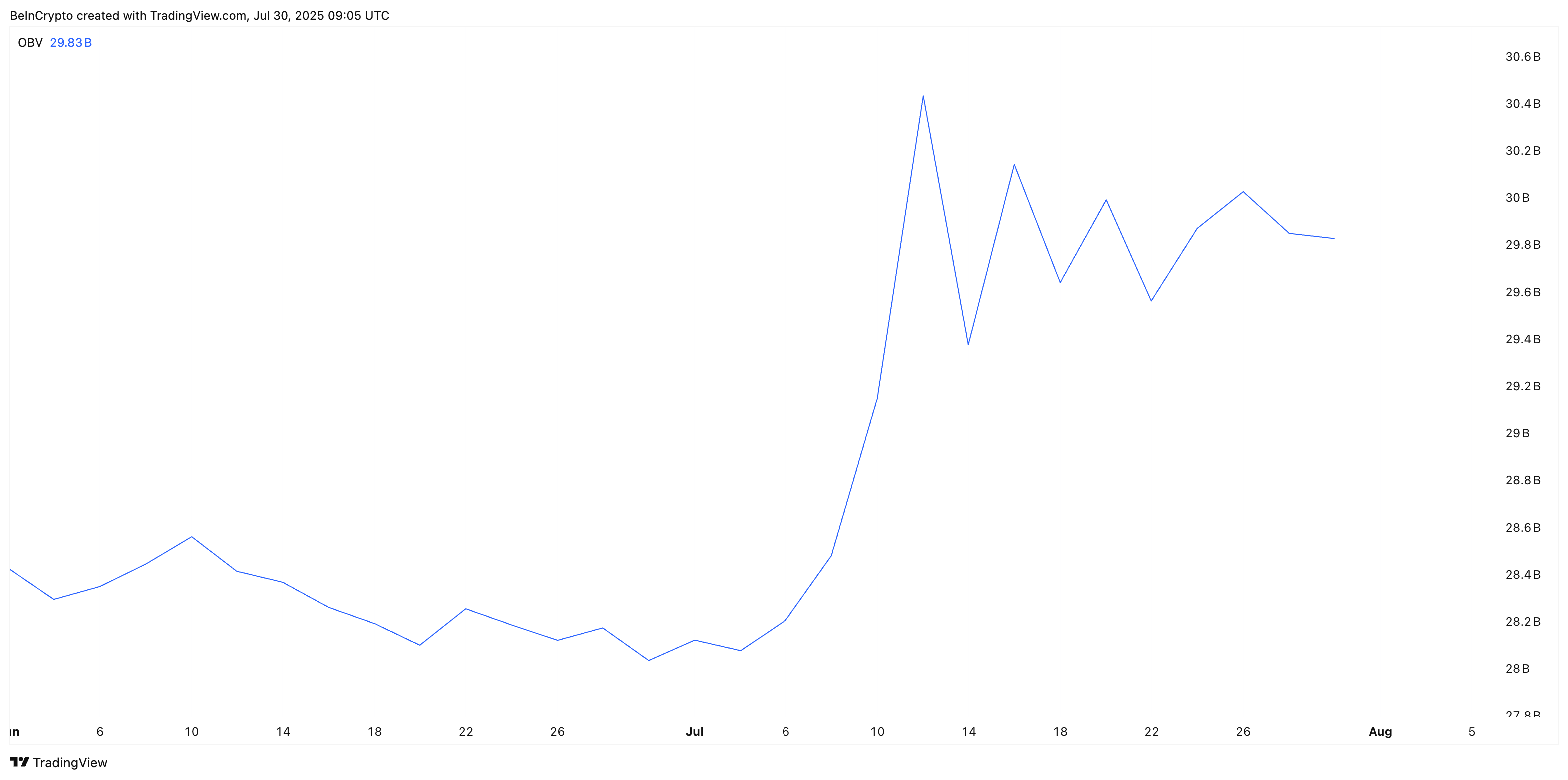

Volume data on the two-day timeframe reinforces this fading momentum. On-Balance Volume (OBV), which tracks cumulative buying and selling pressure, has been drifting lower despite the XLM price breakout, showing that large buyers aren’t stepping in with conviction.

XLM and the On Balance Volume metric:

TradingView

XLM and the On Balance Volume metric:

TradingView

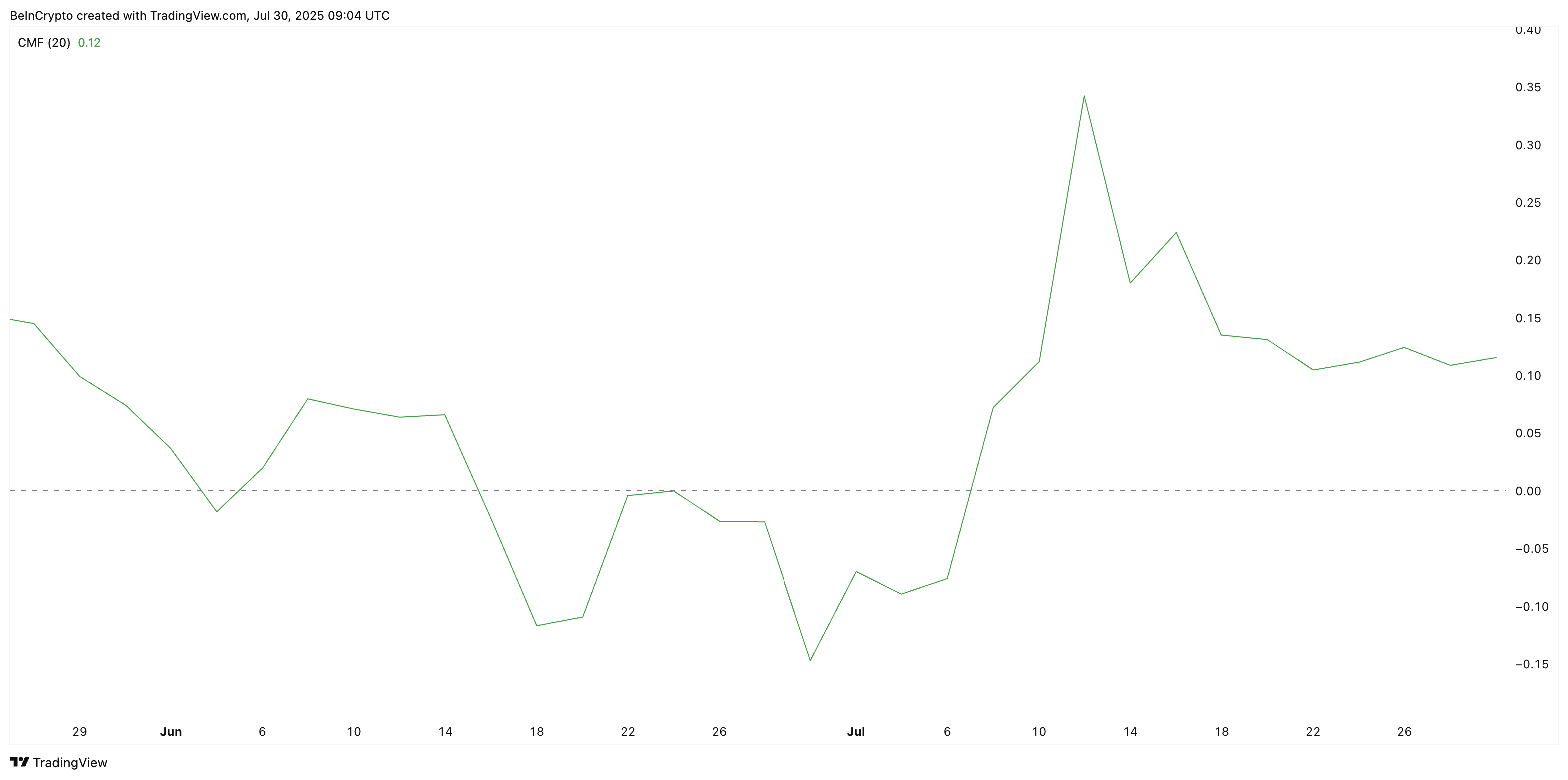

Similarly, the Chaikin Money Flow (CMF) has dropped sharply, falling from highs around 0.35 in early July to roughly 0.12 now. CMF gauges whether actual money is flowing in or out of an asset, and a slide like this indicates weakening demand.

Chaikin money flow indicator showing XLM price weakness:

TradingView

Chaikin money flow indicator showing XLM price weakness:

TradingView

Both metrics suggest that the bullish breakout may lack the capital backing needed to extend higher.

Stellar (XLM) Price Still Above Flag, but Invalidation Levels Are Clear

The XLM price is currently holding above the bull flag breakout line, trading near $0.41. However, momentum is fragile. A dip below $0.41 would put the Stellar (XLM) price back inside the pattern, and a break under $0.35 would erase almost half of the 133% rally that built the flagpole, effectively invalidating the breakout structure.

XLM price analysis:

TradingView

XLM price analysis:

TradingView

For bulls to regain control, the XLM price needs a decisive move back above $0.47, backed by stronger inflows and renewed volume. Without that, the recent breakout risks becoming just another failed attempt to push toward new highs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Weekly Hot Picks: Bank of Japan Sends Strongest Rate Hike Signal! Is the Copper Market Entering a Supercycle Rehearsal?

The leading candidate for Federal Reserve Chair is being questioned for potentially "accommodative rate cuts." Copper prices have reached a historic high, and a five-hour meeting between the United States and Russia ended without results. Expectations for a Japanese interest rate hike in December have surged, and Moore Threads' stock soared more than fivefold on its first day... What market moves did you miss this week?

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.