XRP Whale Outflows Reflect Price Concern | Weekly Whale Watch

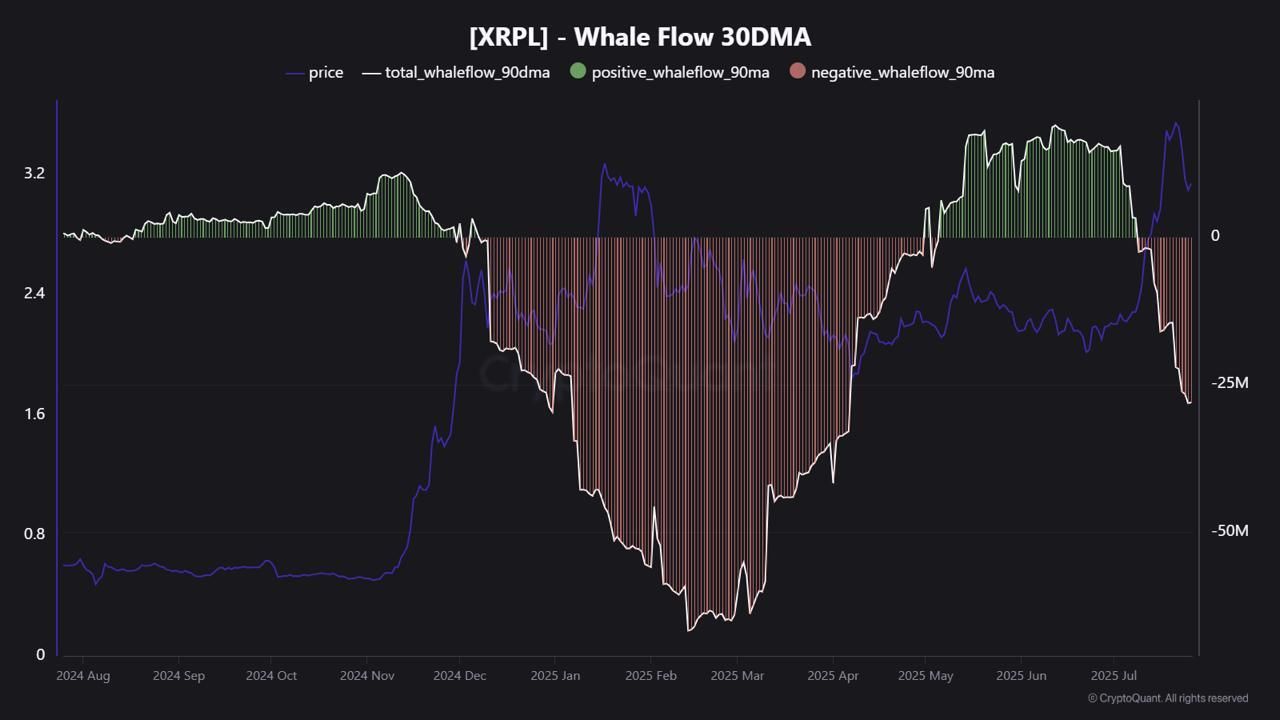

XRP whales are withdrawing $28 million daily, flipping net flows negative and signaling growing pressure on the $3 support zone.

Whales are once again offloading XRP at scale, triggering fresh concerns about market stability as prices hover above $3.

New data from CryptoQuant shows that large holders have been withdrawing an average of $28 million per day over the past 90 days. This trend suggests a sustained distribution phase, despite the asset’s recent rally.

XRP Whale Pattern Mirrors Early 2025 Cycle

CryptoQuant analyst JA Maartunn highlights the shifting whale behavior. After turning briefly positive in May and June, the 90-day average whale flow has now flipped negative again.

This whale selloff resembles the sharp outflow seen earlier this year. In February 2025, XRP whales offloaded tokens at a record pace, averaging $64 million per day.

XRP Whale Flow. Source:

CryptoQuant

XRP Whale Flow. Source:

CryptoQuant

That earlier distribution coincided with a price correction. A similar scenario may now be unfolding, with whales cashing out at local highs.

Despite rising prices, on-chain momentum is weakening. The disconnect between bullish price action and bearish whale flows raises questions about the sustainability of XRP’s current level

Last week, BeInCrypto reported that Ripple co-founder Chris Larsen transferred $140 million in XRP to exchanges after the altcoin touched a $3.65 all-time high.

On-chain data confirmed the outflows from Larsen-linked wallets. Over 2.81 billion XRP (~$8.4 billion) still remain under his control.

This sale intensified concerns about centralization and insider-driven market moves.

XRP Support Levels at Risk

XRP is trading between $3.10 and $3.15 at press time. However, the growing net outflows suggest that large holders are exiting rather than accumulating.

If this pressure continues, the $3.00 support zone may not hold. Historically, price weakness follows when smart money rotates out.

While previous analysis pointed to a possible breakout above $3.66, the outflow data paints a more cautious picture.

For upward momentum to continue, fresh demand must absorb the ongoing whale sales. Without it, XRP could face another period of consolidation or decline.

Bottom Line

XRP’s short-term trend appears fragile. Despite recent gains, whale activity suggests distribution is underway.

Traders should watch whale flows closely. Without renewed inflows or strong demand, XRP could struggle to maintain its current price.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto News: Trump’s Plan to Let Cryptos Back Mortgages & 401(k)s Sparks Debate

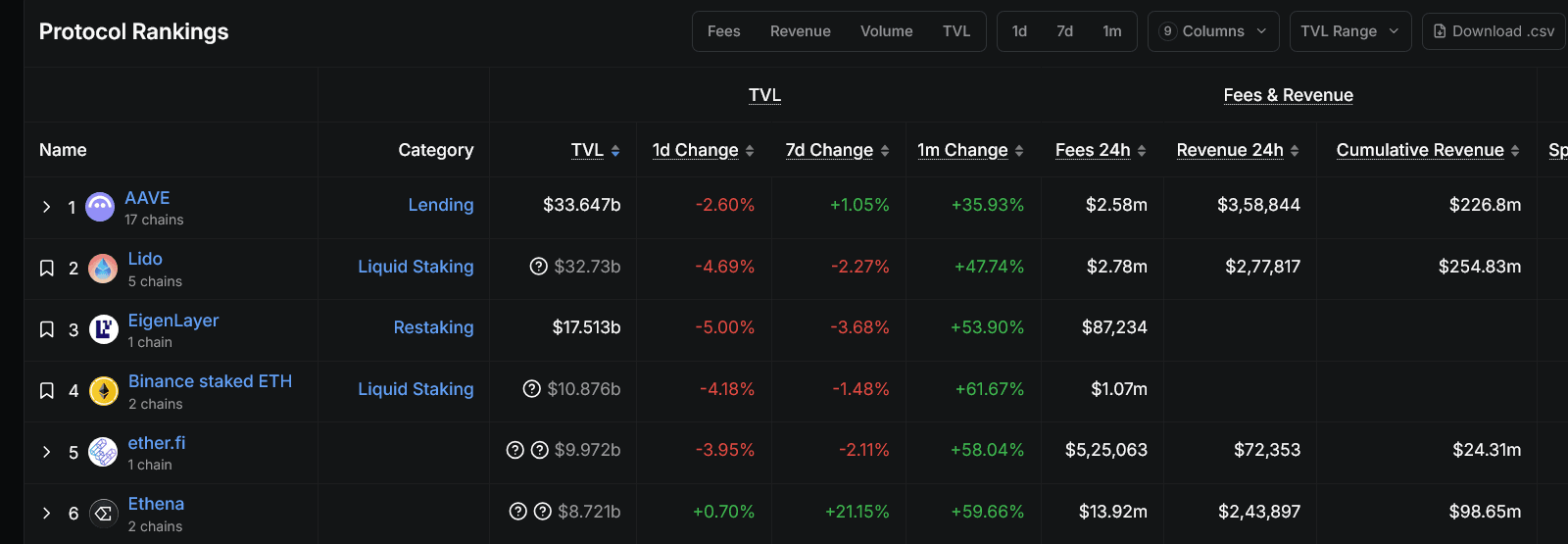

Why This DeFi Dip Might Be the Start of a Major Rotation?

Chinese video AI models gain global attention as the industry heats up

Share link:In this post: Chinese tech companies have increased their efforts in AI-generated video tools, positioning them as major players in the field, which is still in its early stages. Kling AI, developed by Kuaishou, a short video platform, converts text or still images into video content. Wei Xiong, an internet analyst at UBS Securities, believes AI video generation has the potential to reshape the content industry.

Big Tech’s ‘acquihires’ face new EU antitrust threat

Share link:In this post: The EU competition chief vows to close flat on talent-only “acquihires.” National regulators have been urged to flag below-threshold deals for EU review. Big Tech’s AI talent raids draw scrutiny amid fears of stifled innovation.