HBAR Leaves Bitcoin’s Orbit, Immediate Reaction Brings Price Down 11%

HBAR’s 11% decline reflects shifting sentiment and investor uncertainty, with the potential for further drops or a rebound if key support levels hold. The weakened Bitcoin correlation leaves HBAR more exposed to market forces.

The recent price action of Hedera (HBAR) shows a sharp decline of 11% over the last three days. The altcoin is moving away from Bitcoin’s (BTC) orbit, reflecting a shift in market sentiment and weakening investor confidence.

HBAR is now vulnerable to further decline, with worsening market conditions fueling outflows.

HBAR Investors Pull Back

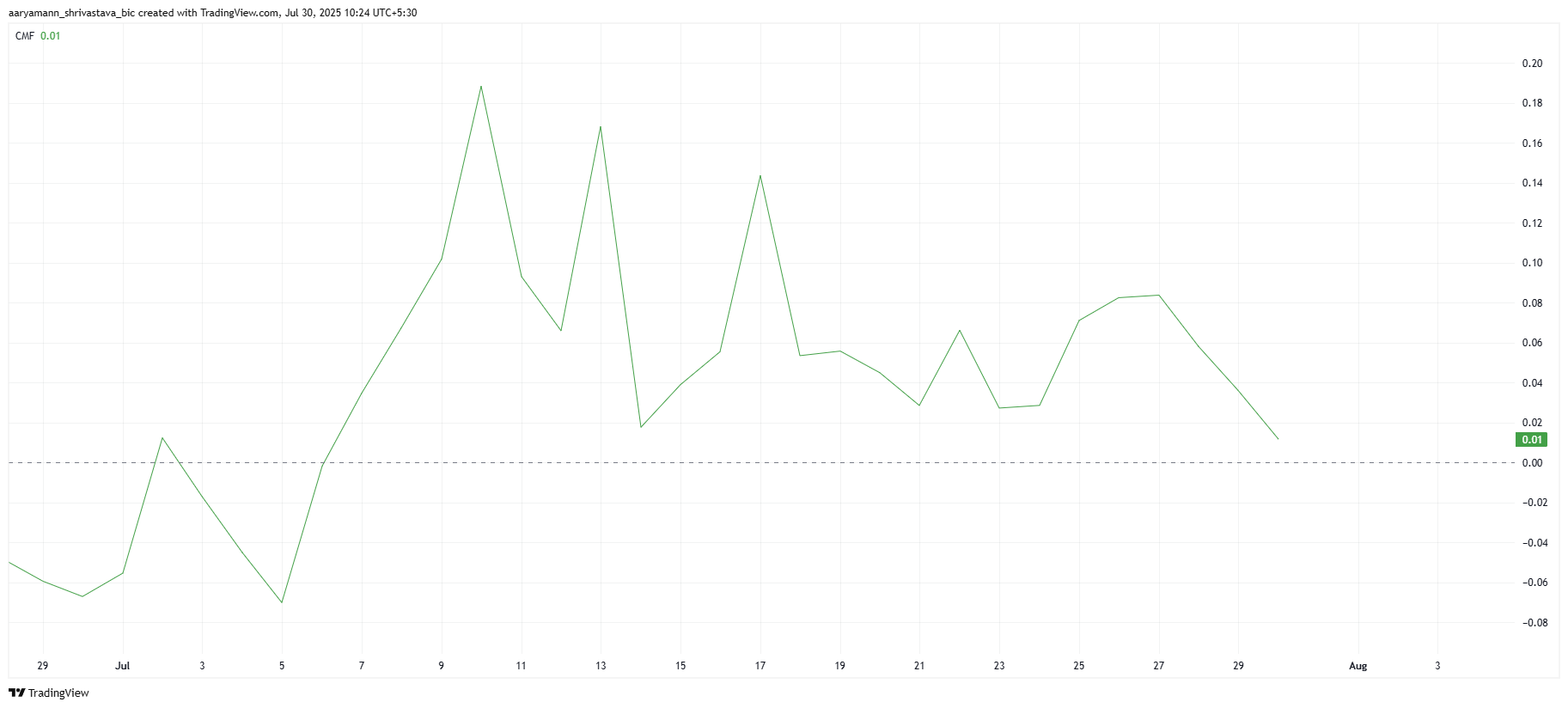

The Chaikin Money Flow (CMF) for HBAR is currently sitting at a near 4-week low, close to the zero line. This suggests that investor outflows are dominating, with a significant shift from accumulation to selling. A drop below the zero line on the CMF would confirm that selling pressure is overwhelming the buying interest.

The current market sentiment is characterized by investor uncertainty. The weakening CMF reading highlights the lack of confidence in HBAR’s price potential in the near term. As HBAR faces these outflows, the altcoin could face a steeper decline.

HBAR CMF. Source:

TradingView

HBAR CMF. Source:

TradingView

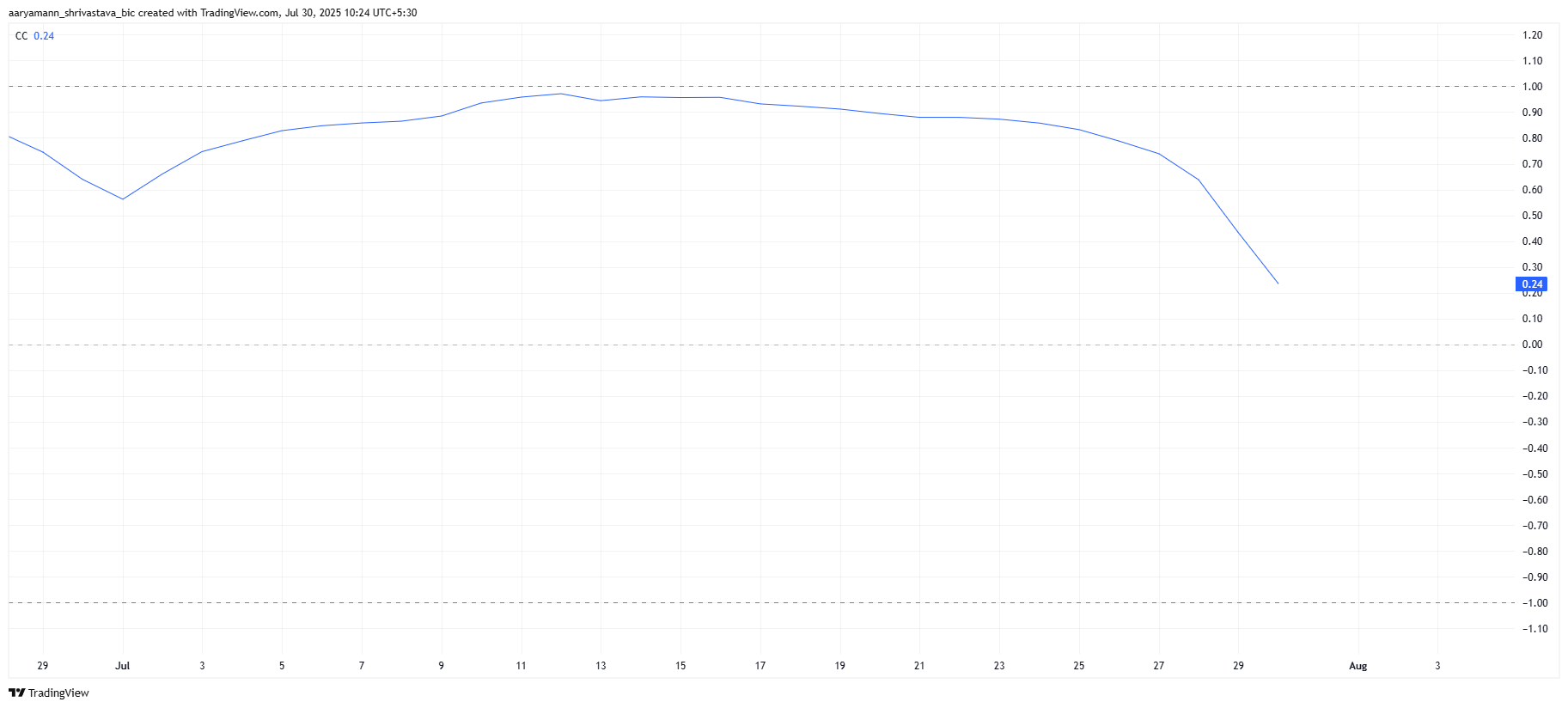

The broader market momentum for HBAR is heavily influenced by its correlation with Bitcoin. Currently, the correlation between HBAR and BTC is at a near 2-month low. This weakened correlation is a double-edged sword for HBAR as it could benefit from Bitcoin’s price drop, but any rally in BTC could negatively impact HBAR’s price.

The diminished connection to Bitcoin leaves HBAR more exposed to independent price action. With investor sentiment shifting and external market factors playing a larger role, HBAR’s price might experience more ups and downs, depending on the direction BTC takes.

HBAR Correlation To Bitcoin. Source:

TradingView

HBAR Correlation To Bitcoin. Source:

TradingView

Can HBAR Rise To $0.30?

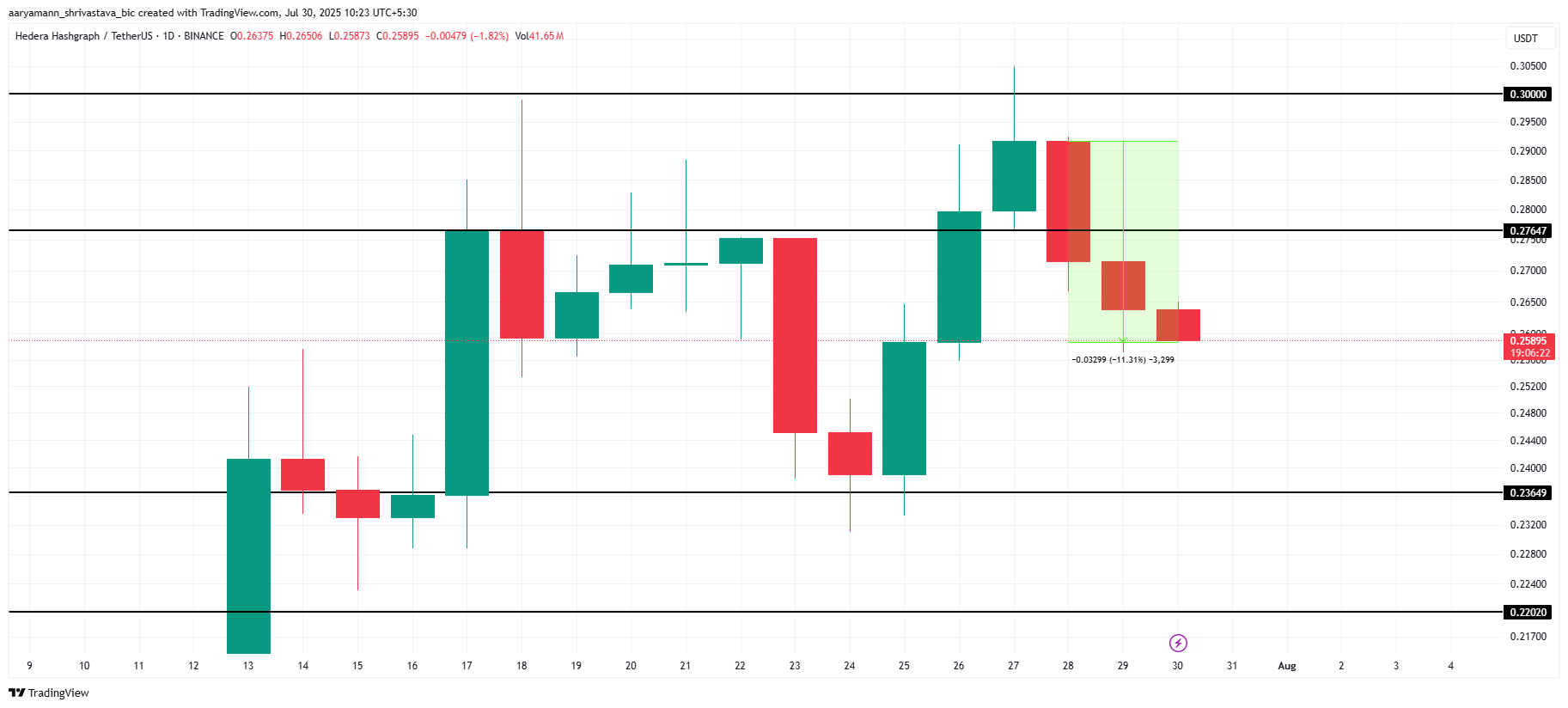

Currently trading at $0.258, HBAR is in a vulnerable position after the recent 11% drop. The altcoin is sitting just above key support levels, and further decline is possible. A drop to the $0.236 support level seems likely, especially with the current market conditions and investor sentiment.

If the downward trend persists, HBAR could continue to consolidate between $0.236 and $0.276. These price levels may provide some stability, but they also represent areas of significant resistance. A prolonged consolidation phase could trap HBAR within this range, with little upward movement in the short term.

HBAR Price Analysis. Source:

TradingView

HBAR Price Analysis. Source:

TradingView

However, if market conditions reverse, HBAR might manage to reclaim the $0.276 level as support. This would open the door for a potential price surge toward $0.300. Whether it breaches this resistance remains uncertain, but a shift in sentiment could drive HBAR toward higher levels.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Telegram, the world's largest social platform, launches major update: Your graphics card can now mine TON

Telegram’s ambition for privacy-focused AI

A well-known crypto KOL is embroiled in a "fraudulent donation scandal," accused of forging Hong Kong fire donation receipts, sparking a public outcry.

Using charity for false publicity is not unprecedented in the history of public figures.

An overview of two new projects in the Polkadot ecosystem and what they will bring to Polkadot Hub

HIC: Continue to bring truly valuable new projects to Polkadot in a sluggish market!