Altcoin Season 2025: When, How, And Which Tokens To Watch

The crypto market is shifting toward an altcoin season, with Ethereum leading the way. Ethereum's growth and capital flow from Bitcoin are setting the stage for a broader altcoin rally in 2025.

The crypto market is transforming and is looking to be on track to witness the first full-fledged Altcoin Season of 2025. The supply flowing into Ethereum and other altcoins from Bitcoin is painting a bullish picture at the moment.

The question remains: When should the market expect the altcoin season, and which tokens should investors watch? BeInCrypto has answered these questions.

The Altcoin Season Everyone Has Been Waiting For

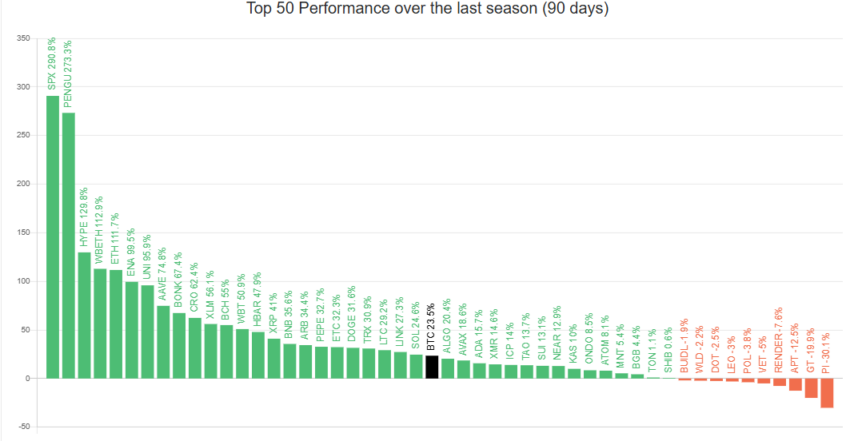

The crypto market is currently in a transitional phase, sitting halfway toward declaring an altcoin season. An altcoin season is officially recognized when over 75% of the top 50 cryptocurrencies outperform Bitcoin.

At the moment, this figure stands at 49%, signaling that the market is moving towards altcoin dominance but has not fully transitioned yet. As more altcoins gain traction against Bitcoin, investor sentiment is beginning to shift, which could lead to an altcoin season in the near future.

Top 50 Altcoins’ Performance Against Bitcoin. Source:

BlockchainCenter

Top 50 Altcoins’ Performance Against Bitcoin. Source:

BlockchainCenter

This halfway mark suggests that the altcoin market is still in a consolidation phase, with some tokens beginning to outperform Bitcoin; however, it could likely still arrive before the end of Q2 2025.

Talking to BeInCrypto, analyst Michaël van de Poppe stated that macroeconomic factors are crucial in dictating the movement of crypto assets.

“Macro-economic is super important for investors to shift away from risk-off towards risk-on. That’s why there’s a strong inverse correlation between Gold and Ethereum. When Gold consolidates, that’s the moment where riskier assets like Ethereum start to outperform. The other way around, if Gold rallies in a strong way, that’s usually a period where altcoins aren’t performing. On top of that, the crypto-specific hype has increased due to the MA’s and IPOs recently, but also due to the approval of the regulatory bills in the US,” said Michaël.

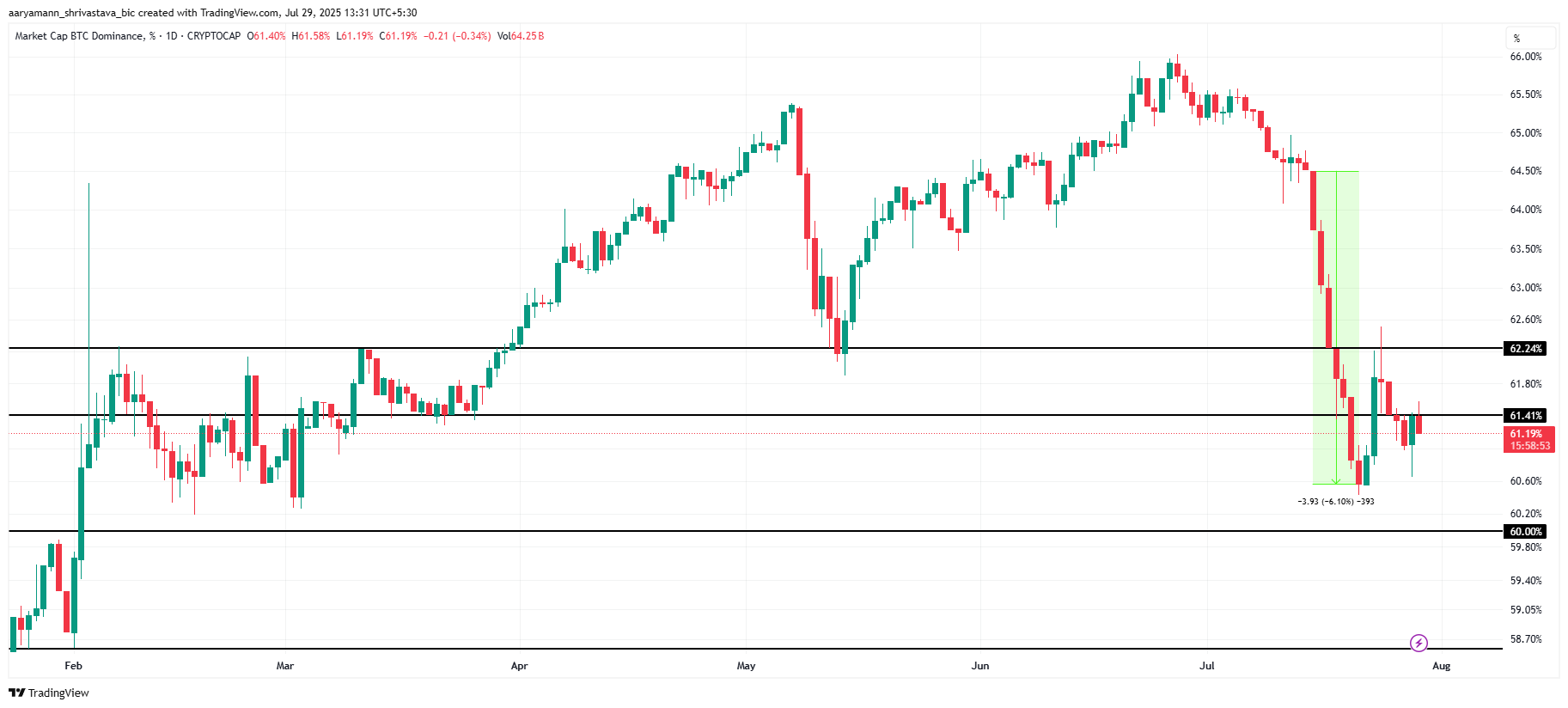

Bitcoin’s dominance has recently started to regain pace, following a 6.1% decline earlier this month. The drop in Bitcoin dominance was initially seen as a signal that an altcoin season might be approaching.

Historically, Bitcoin’s falling dominance indicates that altcoins are outperforming the crypto king, leading to broader market growth. However, if Bitcoin’s dominance picks up again, it could shift the market back toward Bitcoin’s influence. This would delay the arrival of an altcoin season. Michaël believes this would likely be due to macroeconomic factors.

“If the altcoin markets won’t be continuing their upwards momentum, it’s primarily due to reasons outside of the crypto markets, just like the previous six months have been yielding negative returns for anything in the crypto markets due to the fact that the macro has completely shifted. If that risk-off appetite comes back into the markets, perhaps due to trade wars, actual wars, or a potential recession, we could be seeing the altcoin markets fall again. However, the opposite of that case is that we’re likely going to be seeing a strong upward market,” Michaël stated.

Bitcoin Dominance Analysis. Source:

TradingView

Bitcoin Dominance Analysis. Source:

TradingView

Ethereum Is On Track Of Gains

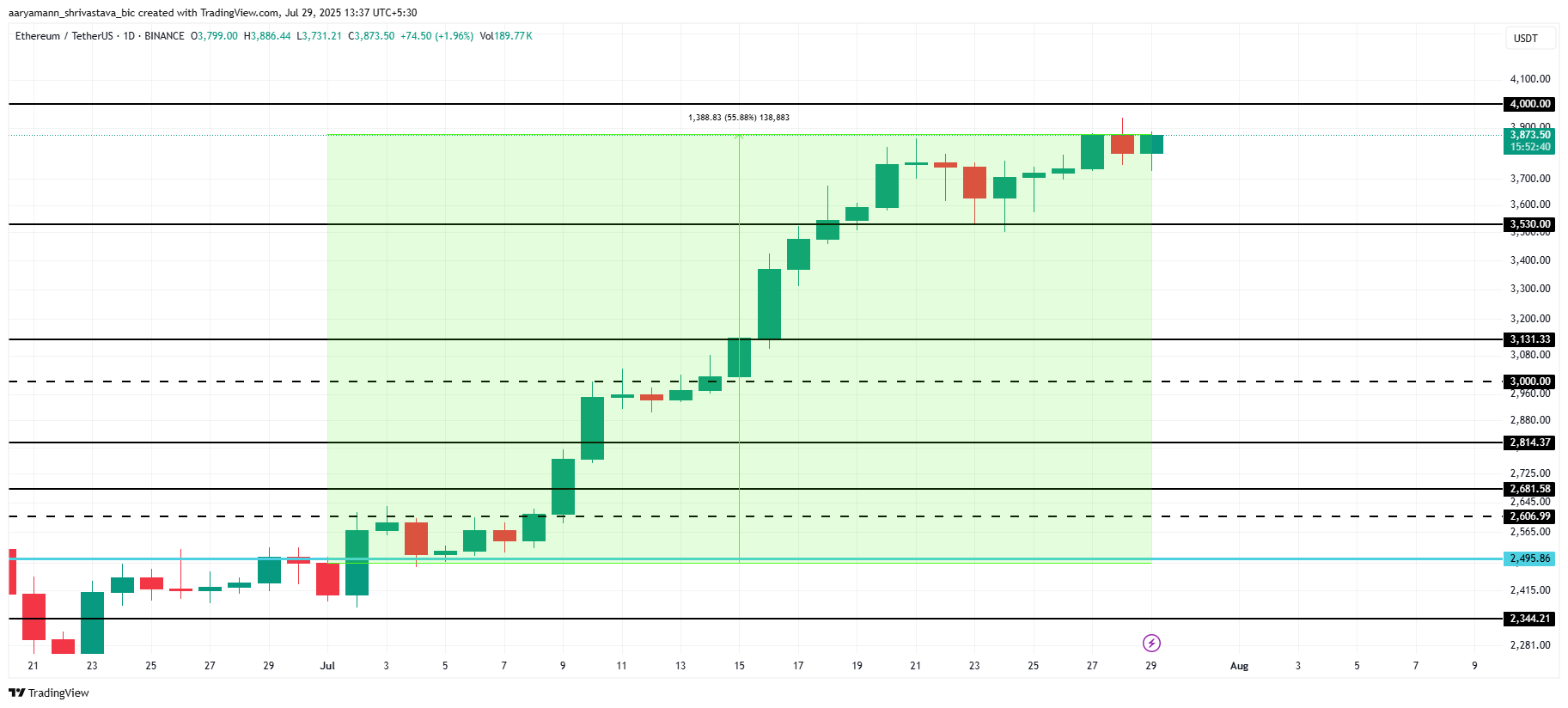

Ethereum’s price has surged 55% since the start of the month, inching closer to the $4,000 mark. This growth is primarily due to the capital shift from Bitcoin to Ethereum, attracting investors seeking higher returns.

“Ethereum has outperformed Bitcoin by more than 70%, signalling that we’re now in an Ethereum market. The reason behind this sudden shift is the regulatory shift in the United States. The GENIUS bill approval and the acceptance of the CLARITY act opened the doors for institutional liquidity to flow towards Ethereum, as the Ethereum ETF has seen more inflow than the Bitcoin ETF over the past weeks,” Michaël told BeInCrypto.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

The recent growth in Ethereum is likely to benefit altcoins built on its second-generation blockchain. These coins could be the standout performers during the altcoin season that investors should watch.

“It’s very likely that coins that are providing utility within the Ethereum ecosystem (Aave, Optimism, Celestia, Arbitrum) will thrive when Ethereum is doing well. Additionally, if there are any tokens that have links to the US would likely outperform others as there will be hype attached to them,” Michaël noted.

The positive momentum around Ethereum is expected to push its price toward the $4,000 mark and potentially beyond in the coming days. With continued capital flow from Bitcoin, Ethereum could reach new highs, influencing the broader crypto market. Investors are watching for signs of further bullish action as Ethereum leads the way.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Chinese video AI models gain global attention as the industry heats up

Share link:In this post: Chinese tech companies have increased their efforts in AI-generated video tools, positioning them as major players in the field, which is still in its early stages. Kling AI, developed by Kuaishou, a short video platform, converts text or still images into video content. Wei Xiong, an internet analyst at UBS Securities, believes AI video generation has the potential to reshape the content industry.

Big Tech’s ‘acquihires’ face new EU antitrust threat

Share link:In this post: The EU competition chief vows to close flat on talent-only “acquihires.” National regulators have been urged to flag below-threshold deals for EU review. Big Tech’s AI talent raids draw scrutiny amid fears of stifled innovation.

Wall Street calls Powell’s bluff after weak US jobs print, puts September rate cut back on the table

Share link:In this post: The U.S. added just 73,000 jobs in July, far below expectations. Unemployment rose to 4.2%, matching forecasts but signaling weakness. Traders now see a 75% chance of a September rate cut after the report

OpenAI raises $8.3B for $300B valuation ahead of schedule

Share link:In this post: OpenAI secured $8.3B ahead of schedule in a funding round that was five times oversubscribed. The company has increased its revenue and active users, but still has a higher than expected cash burn rate. OpenAI has grown its business customers, and the inclusion of Blackstone and TPG may increase business adoption of multiple AI models.