Ethereum captures 40% of futures market as Bitcoin loses speculative momentum

Ethereum’s recent rally against Bitcoin appears to be gaining further strength, with derivatives data signaling a notable change in market sentiment.

On July 29, blockchain analytics firm Glassnode revealed that Ethereum’s share of open interest in the perpetual market has climbed to nearly 40%.

This marks the highest level recorded since April 2023. Historically, only a small fraction of trading days, about 5%, have seen a higher figure.

Open interest measures the total number of unsettled futures contracts in the market. It is often used to assess investor conviction and the intensity behind a trend.

So, the rise in Ethereum’s open interest suggests that more traders are betting on ETH, shifting attention away from Bitcoin.

Meanwhile, this shift isn’t just visible in the open interest of both digital assets.

Glassnode also reported that Ethereum’s perpetual futures trading volume has overtaken Bitcoin’s for the first time since the bottom of the 2022 market cycle.

This marks the largest gap in ETH’s favor, further highlighting a dramatic change in speculative activity.

The data points to a decisive rotation from Bitcoin to Ethereum in the derivatives space. Crypto traders are positioning themselves for potential gains in ETH, amid renewed market optimism surrounding the second-largest digital asset by market capitalization.

The post Ethereum captures 40% of futures market as Bitcoin loses speculative momentum appeared first on CryptoSlate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

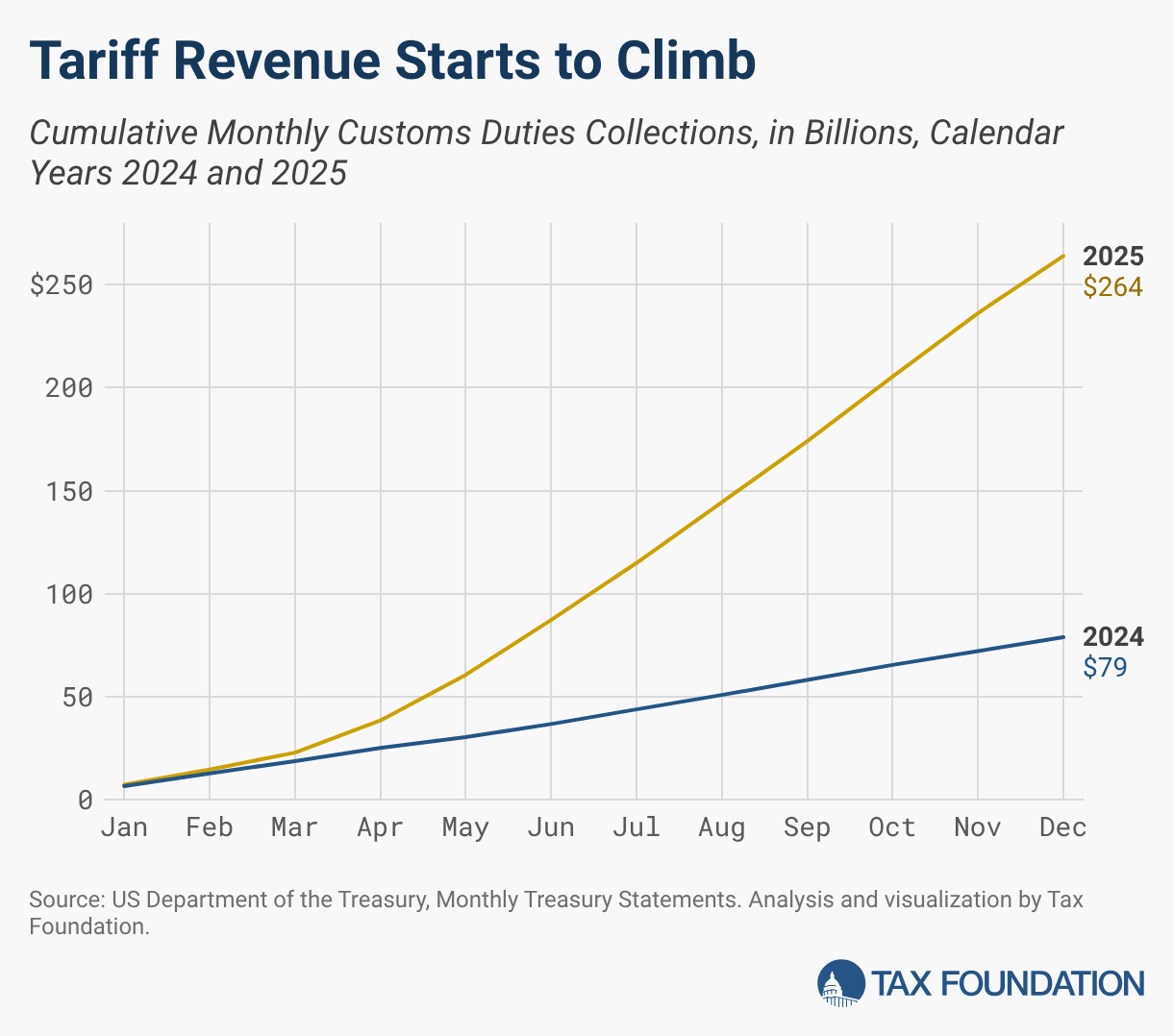

US collects $264 billion in tariffs after a 234% year‑over‑year surge thanks to Trump

Alibaba’s Qwen app wins praise as AI life assistant

Japanese Yen retreats from its highest level in a week against the USD; upward momentum appears to remain strong