ETH Bull Market through the Eyes of a 24-word Cryptography Expert: End-of-Year Target $4000, Is it the Starting Point or the Finishing Line?

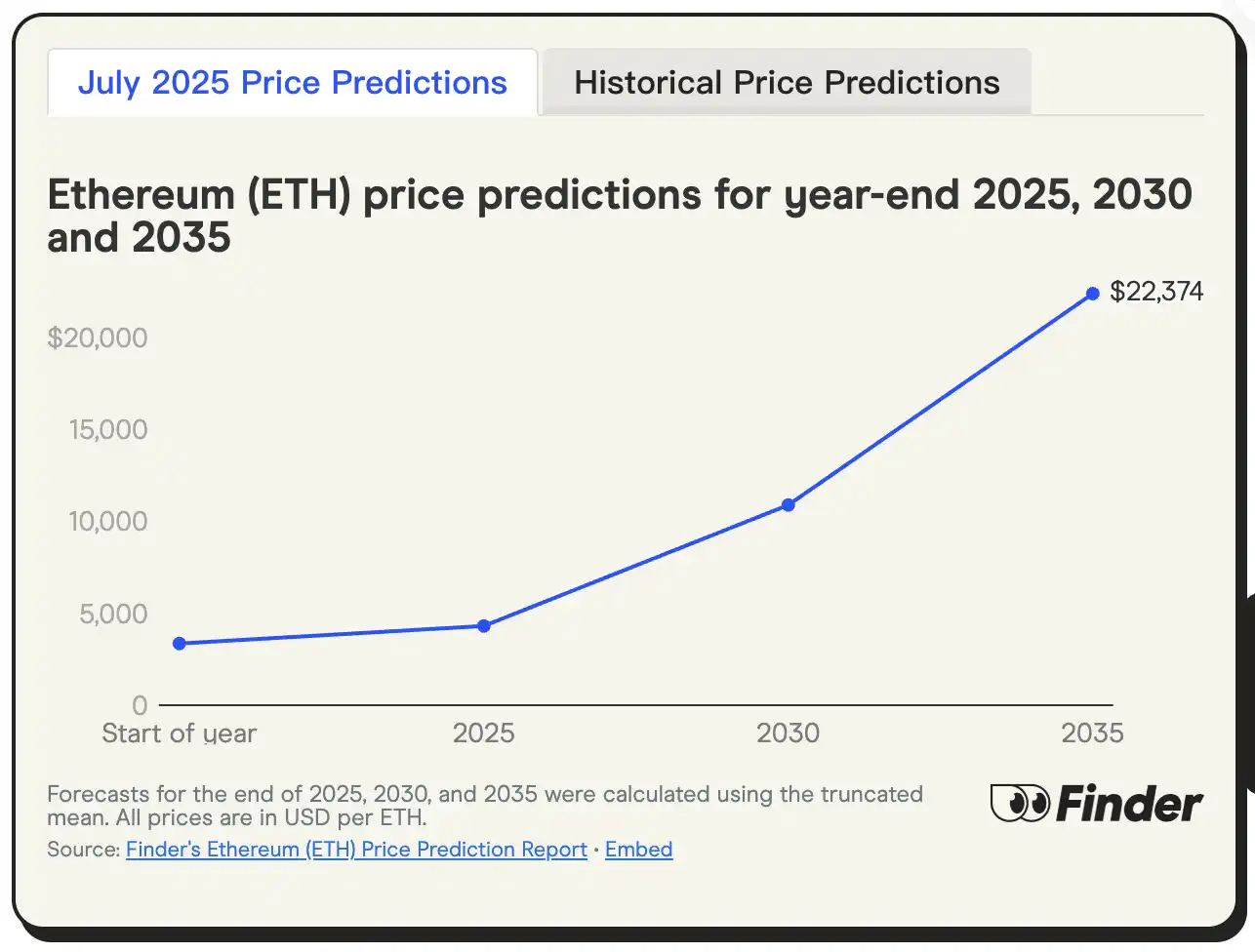

Experts predict that the price of Ethereum (ETH) will reach an average of $4,308 by the end of 2025, rise to $10,882 by the end of 2030, and further climb to $22,374 by the end of 2035.

Original Article Title: Ethereum (ETH) Price Prediction 2025, 2030 & 2035: July 2025 Report

Original Article Author: Richard Laycock, Finder

Original Article Translation: Deep Tide TechFlow

Key Takeaways

· 2025 Price Prediction: The average expert prediction for the end of 2025 is $4,308 for Ethereum.

· Peak and Trough Prediction: The remaining time in 2025 may see significant fluctuations, with an average high price prediction of $4,746 and a low point prediction of only $1,940.

· Long-Term Outlook: Experts believe Ethereum will continue to rise, with a price projected to be $10,882 by 2030 and further reaching $22,374 by 2035.

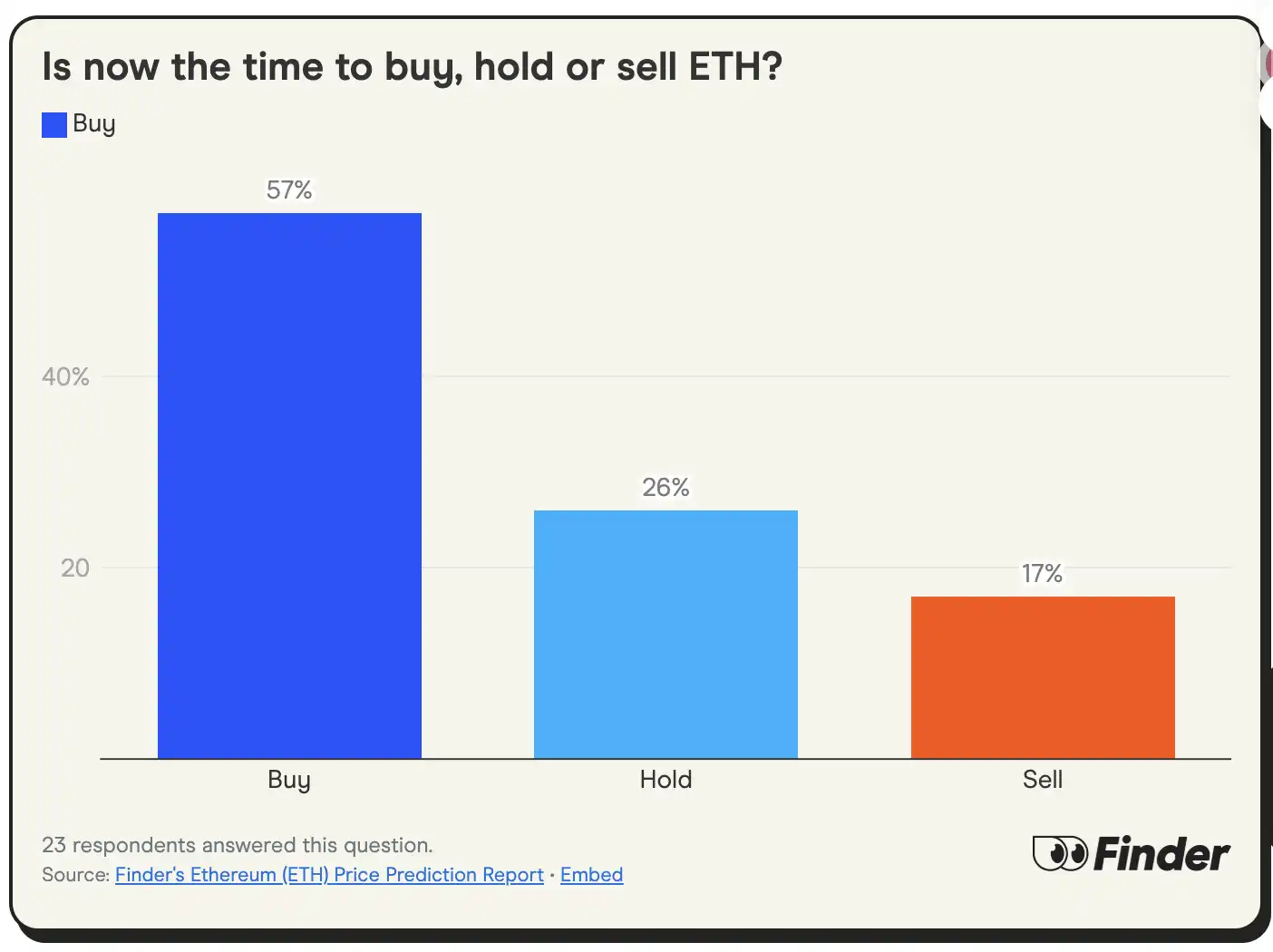

· Should You Buy ETH: A majority of experts (57%) believe now is a good time to buy Ethereum.

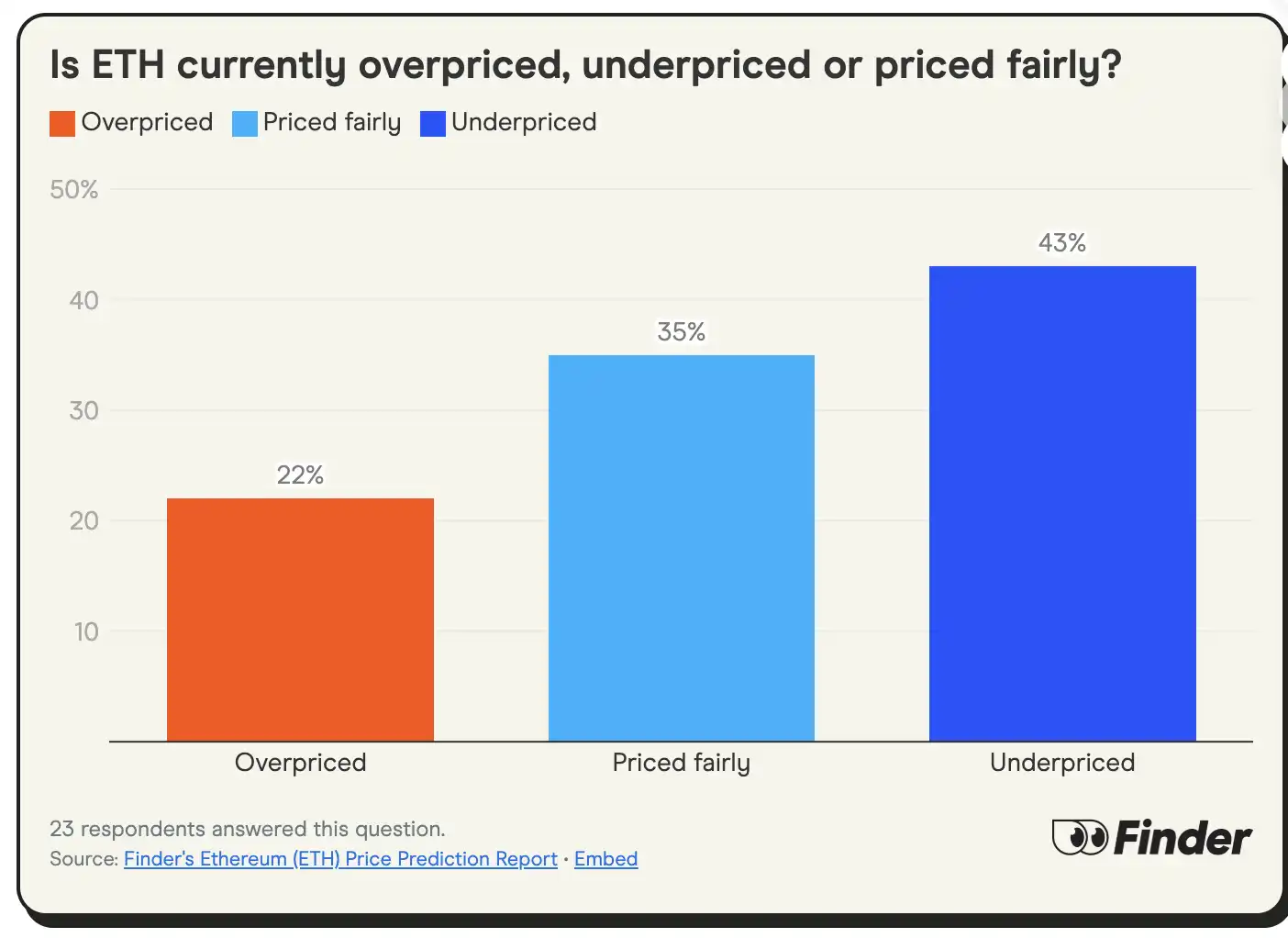

· Is Ethereum Undervalued: Nearly half of the experts (43%) think Ethereum is currently undervalued.

Finder analyzes experts' price predictions every quarter. At the end of June 2025, we surveyed 24 crypto industry experts to understand their views on Ethereum (ETH) performance up to 2035.

All prices mentioned in this report are in USD.

The expert panel's average prediction is that the Ethereum price will reach $4,308 by the end of 2025, then rise to $10,882 by the end of 2030, and further climb to $22,374 by 2035.

Ethereum (ETH) Price Prediction: Outlook for 2025, 2030, and 2035

According to expert predictions, the Ethereum price is expected to reach $4,308 by the end of 2025, rise to $10,882 by the end of 2030, and further climb to $22,374 by the end of 2035. This forecast is more optimistic than the $4,153 reported in the April 2025 report.

Experts predict that Ethereum (ETH) will reach $10,882 by 2030 and rise to $22,374 by 2035. Similar to the 2025 prediction, the expectations of this expert group are slightly more optimistic, surpassing the average forecast from our April 2025 survey, which projected an ETH price of $9,495 in 2030 and $17,042 in 2035.

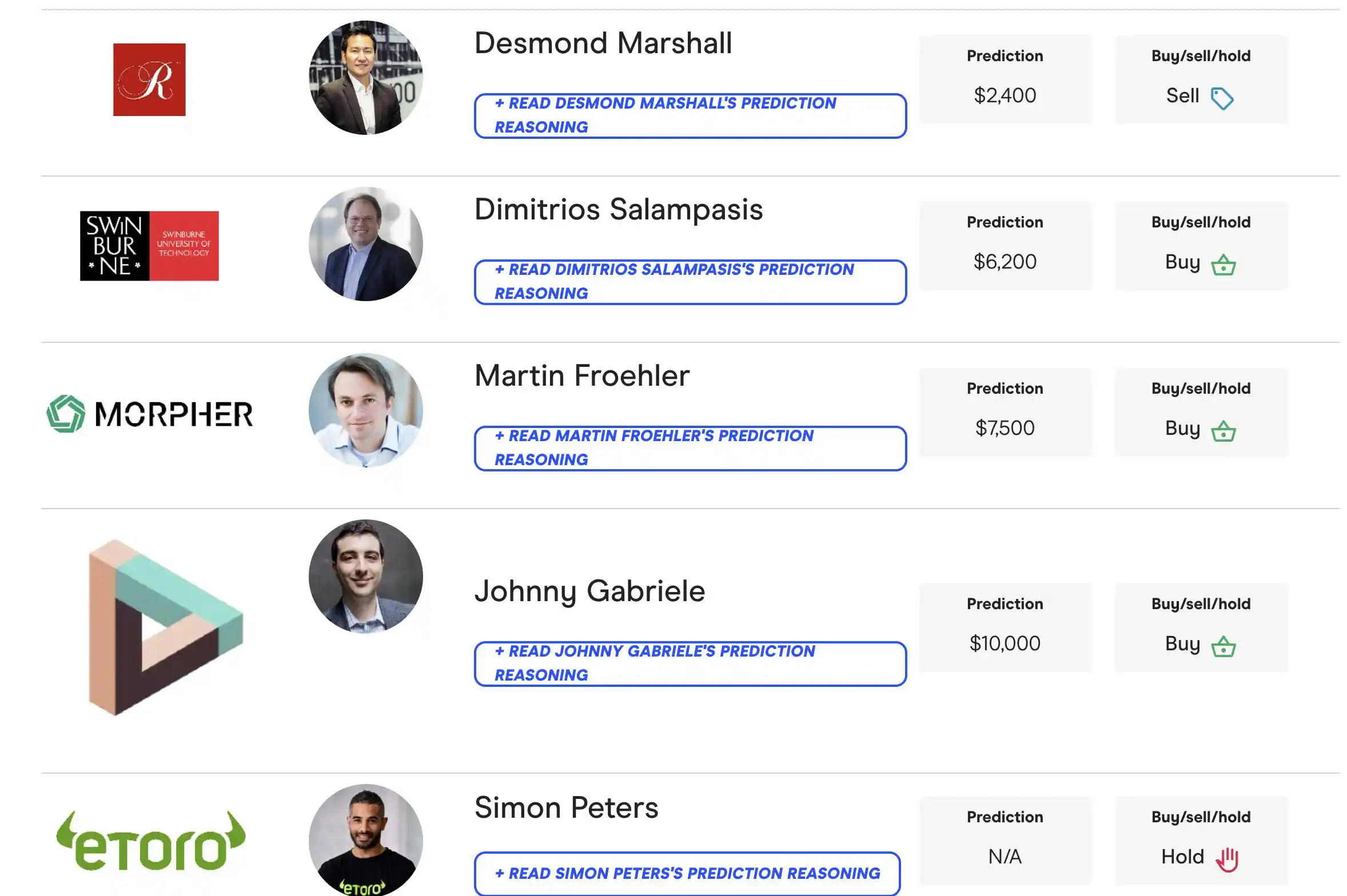

Johnny Gabriele, Chief Analyst of Lifted Initiative's Blockchain Economy and AI Integration, predicts that the Ethereum price will reach $10,000 in 2025 and compares Ethereum to "global assets like oil."

Gracy Chen, CEO of Bitget, stated that Ethereum is the core of Decentralized Finance (DeFi) and has a promising future due to its scalable Layer-2 solutions.

These price predictions stem from Ethereum's role as a core pillar of Decentralized Finance (DeFi), with its application in Real-World Asset (RWA) tokenization expected to reach $160 trillion by 2030. Furthermore, the speed increase post-Ethereum upgrade has facilitated Ethereum's widespread use in payment systems. Strong institutional interest and Ethereum's scalable Layer-2 solutions further enhance its future prospects.

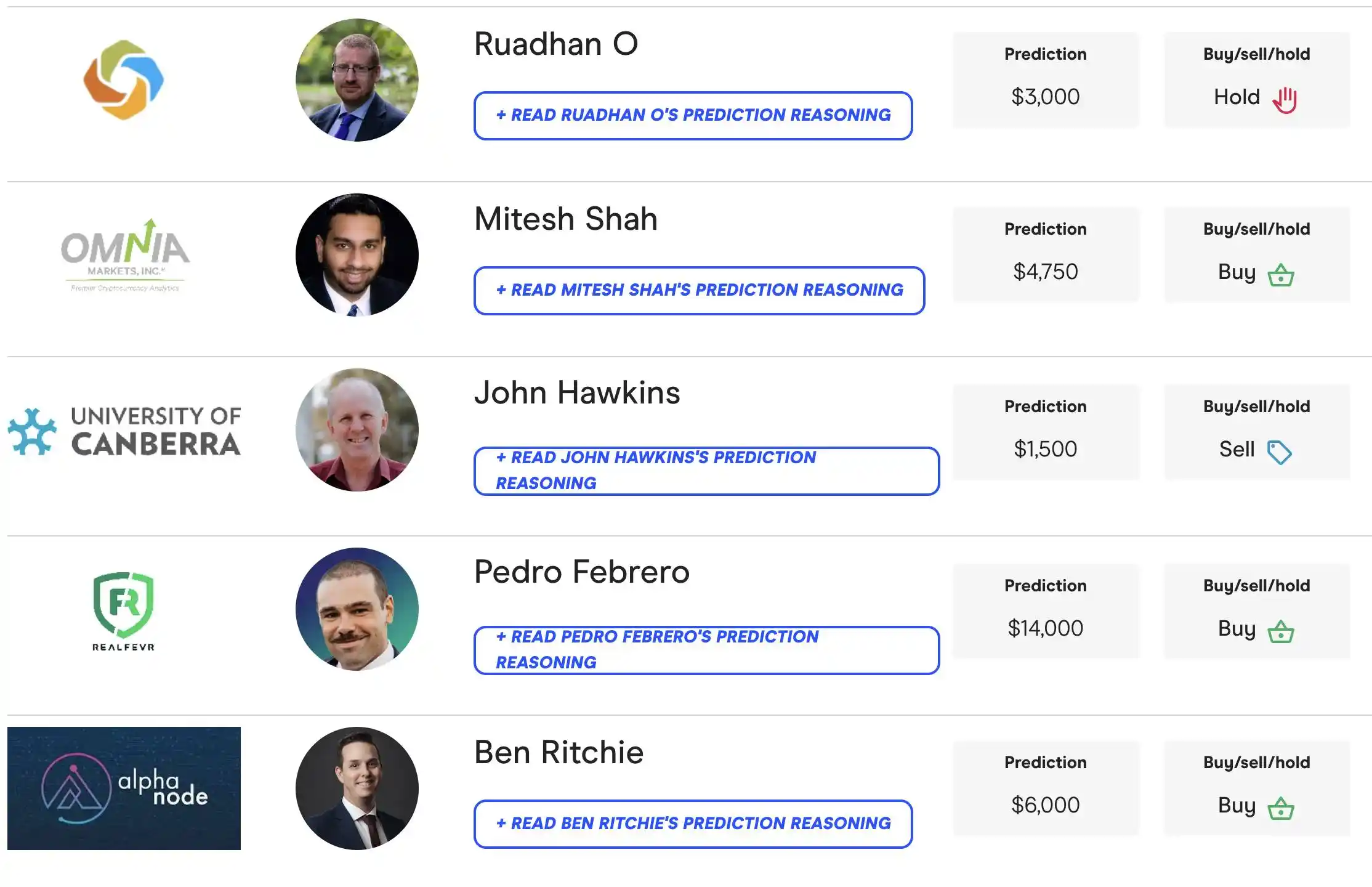

Ben Ritchie, Managing Director of Alpha Node Global, predicts that the Ethereum price will reach $6,000 in 2025 and highlights institutional investor interest.

Our view is based on the strong growth of institutional interest, particularly driven by the Ethereum spot ETF (Exchange-Traded Fund) and Ethereum's increasingly expanding role in Real-World Asset (RWA) custody. In essence, RWAs require a stable and reliable core infrastructure, and Ethereum and its Ethereum Virtual Machine (EVM) have already proven their industry-leading position through long-standing practice.

Origin Protocol co-founder Josh Fraser holds a fairly optimistic view of Ethereum (ETH) in 2025, predicting a price of $9,000 and suggesting that Ethereum could potentially surpass Bitcoin's market cap in the long term.

“Ethereum is the world's computer with nearly limitless use cases. Demand for Ethereum comes from ETFs, coupled with the amount of ETH locked for staking, expected to rise further by 2025.”

On the other hand, John Hawkins, Senior Lecturer at the University of Canberra, holds a more conservative view, predicting Ethereum's price to be only $1,500.

2025 Ethereum Price Range Predictions

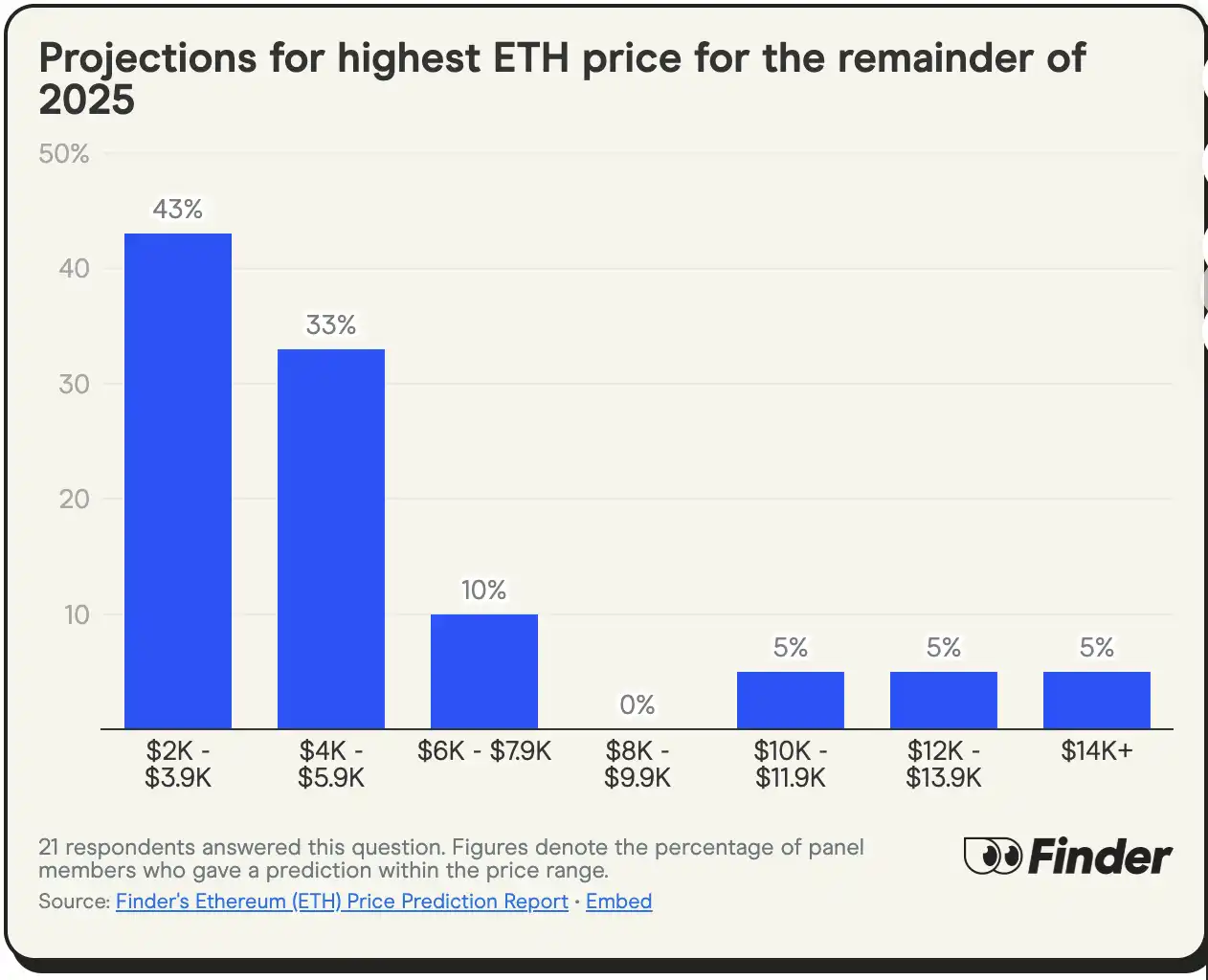

Experts predict that Ethereum (ETH) will reach an average peak price of $4,746 in 2025, with some forecasts suggesting prices could go as high as $14,260.

Over two-fifths (43%) of experts believe that the price of ETH will reach a high of $2,000 to $3,999 range by the end of 2025, while a third (33%) of experts expect the price to reach the $4,000 to $5,999 range during the same period.

Martin Froehler, CEO of Morpher, holds an extremely optimistic view of Ethereum (ETH) in 2025, predicting a price of $7,500 as Ethereum is seen as the preferred platform for real-world asset tokenization.

“Ethereum is currently the most decentralized blockchain and the preferred platform for real-world asset tokenization.”

The CEO of CryptoConsultz, Nicole DeCicco, gave the highest prediction of $5,200 and stated that due to institutional investor participation, Ethereum will maintain its strength in the long term.

“Ethereum remains one of the most reliable and widely used platforms in the crypto space, especially in real-world applications. The recent Pectra upgrade brought necessary improvements in transaction speed, wallet security, and validator performance. Its infrastructure is being utilized by major players such as BlackRock, PayPal, among others, who would not bet on a platform without long-term potential. With this widespread adoption and ongoing scalability developments, Ethereum still has significant room for growth.”

Low-End Prediction

· Average Low Price: The expert panel predicts the average lowest price of Ethereum in 2025 to be $1,940, with some forecasts going as low as $1,390.

· Bottom Range: Over half of the experts (52%) believe that the lowest price of Ethereum for the remainder of 2025 will be in the range of $2,000 to $2,249.

Seasonal Tokens founder Ruadhan O suggests that there are more adverse factors for Ethereum (ETH) in 2025, and the price is expected to drop to $2,000 by the end of the year.

During a recent market turmoil, Ethereum briefly dropped to $2,200, indicating its current price support is not as strong as Bitcoin (BTC). Since its peak after the December elections, the Ethereum price has fallen by 40%. Without any significant positive news in the coming months, the likelihood of the price surpassing $4,000 in 2025 is low.

Daniel Keller, CEO of InFlux Technologies, believes that the stagnation of Gas Fees could have a negative impact on the Ethereum price, predicting that its lowest price could fall to $1,500.

Currently, Ethereum (ETH) is oversold, and the price still has room to rise. However, the unchanged Gas Fee could have a negative effect on it, so I predict that by the end of 2025, the price will only experience a slight increase.

Is Now the Best Time to Buy, Hold, or Sell Ethereum (ETH)?

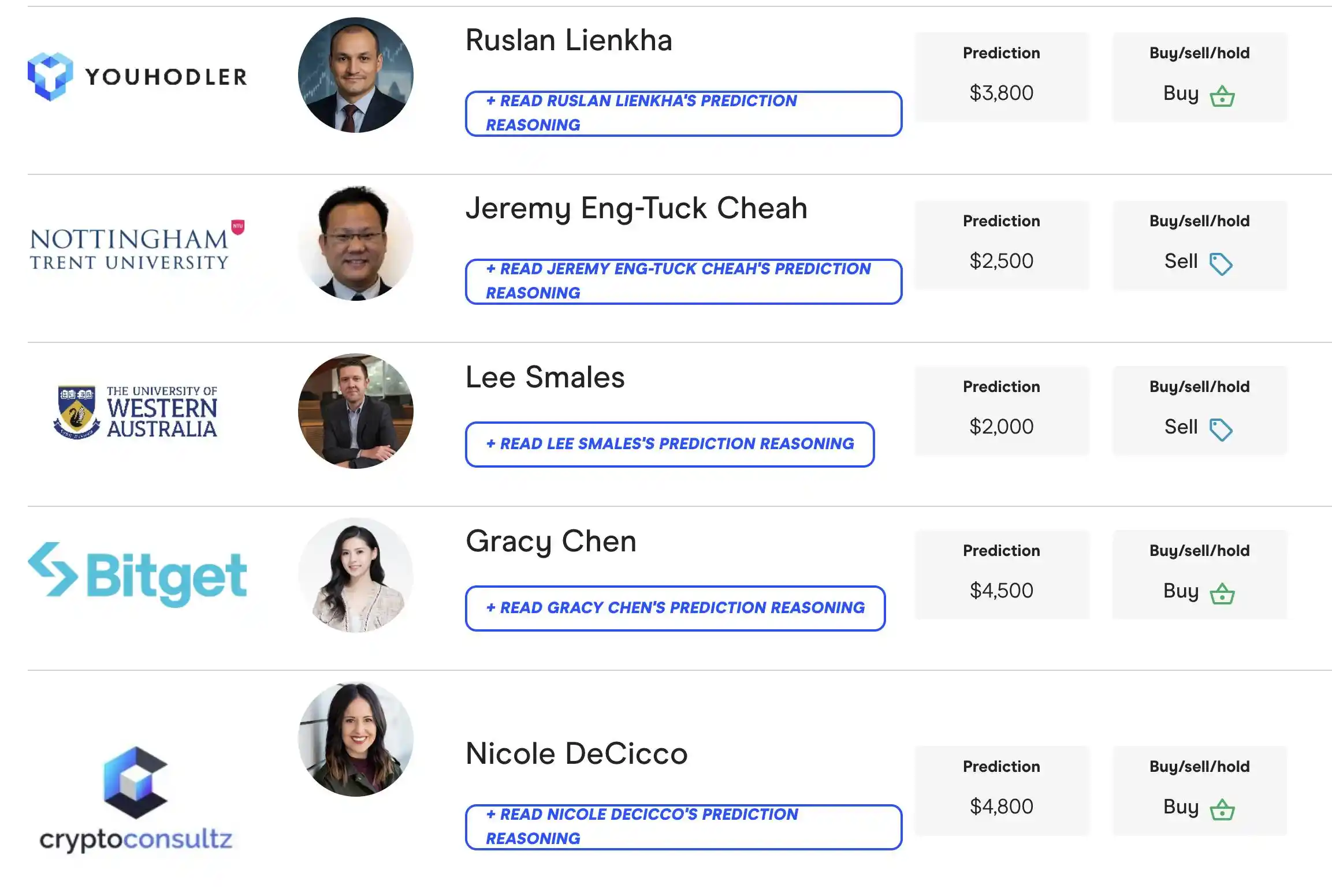

Ethereum is currently trading below its January 2025 high, prompting 57% of experts to believe now is a good time to buy Ethereum; 26% of experts suggest holding, while 17% of experts advocate selling.

YouHodler's Chief Marketing Officer Ruslan Lienkha believes Ethereum is a worthy asset to buy as it is a leading blockchain for stablecoin issuance.

Ethereum continues to lead in stablecoin issuance and non-financial applications in the broader economy. It remains the second-largest cryptocurrency by market capitalization and is generally considered more decentralized compared to its closest competitors.

FV Bank CEO Miles Paschini states that Ethereum (ETH) should be held as it "remains the dominant decentralized network and has strong utility across various realms and Layer 2 support."

Future technologist Joseph Raczynski from JT Consulting & Media also supports the hold view, stating:

70% of stablecoin transaction volume occurs within the Ethereum ecosystem, including the top two stablecoins: Circle's USDC and Tether's USDT. With the passage of the GENIUS Act, most U.S. companies will have new channels to attract more users. This is an underrated critical moment that will have a significant positive impact on Ethereum (ETH) in the future.

Desmond Marshall, Managing Director of Rouge International and Rouge Ventures, suggests selling ETH and has no positive remarks about the token.

"ETH has been disappointing. Regardless of the market sentiment, its price has always hovered around the highest $2600 mark. I have always been candid about pointing out that ETH is severely manipulated, and while it does have a function as a token... as a financial asset, it is worthless."

Is Ethereum (ETH) Currently Overvalued, Undervalued, or Fairly Valued?

Within the expert panel, about 43% believe Ethereum is currently undervalued, 35% think the price is fair, and 22% consider the price to be too high.

Komodo Platform's Chief Technology Officer, Kadan Stadelmann, believes that Ethereum's price to some extent depends on Bitcoin's performance, but institutional adoption and ETF news will drive its price up. He believes that the current Ethereum price is undervalued.

Despite significant progress and growth in the market over the past few years, Ethereum (ETH) still remains a major altcoin following Bitcoin's trend. As we enter the final stage of this bull market, ETF news and institutional interest in Ethereum will continue to drive market activity upwards.

John Murillo, Chief Business Officer of B2BROKER, on the other hand, believes that the current Ethereum price is fair.

Ethereum is facing intense competition from cheaper DeFi protocols such as Solana, Stellar, Uniswap, and other tokens. While Ethereum is undergoing several upgrades (including Spectra and Danksharding), the issue of high gas fees remains unresolved, casting doubt on its future performance. However, as a significant cryptocurrency, Ethereum will still follow the overall market trend and participate in market fluctuations.

Mitesh Shah, Founder and CEO of Omnia Markets, stated that the current price of Ethereum is reasonable, mainly benefiting from the introduction of ETFs and the growth of Real World Assets (RWA) markets:

The recent launch of spot ETFs has attracted over $42 billion in cumulative net inflows, creating a significant and sustained new source of demand for this asset. At the same time, the Real World Assets (RWA) tokenization market on Ethereum has grown to over $240 billion, solidifying its position as a key settlement layer for this multi-trillion-dollar opportunity. This growing utility, along with the network's deflationary token burn mechanism and a clear technical roadmap, provide a strong foundation for Ethereum's long-term positive valuation.

Institutional Adoption Drivers

Ethereum remains the preferred blockchain for institutional players, despite facing competition from ecosystems like Solana. There are now over 50 non-crypto sector companies, including global financial giants such as BlackRock, PayPal, and Deutsche Bank, operating on Ethereum and its Layer 2 networks.

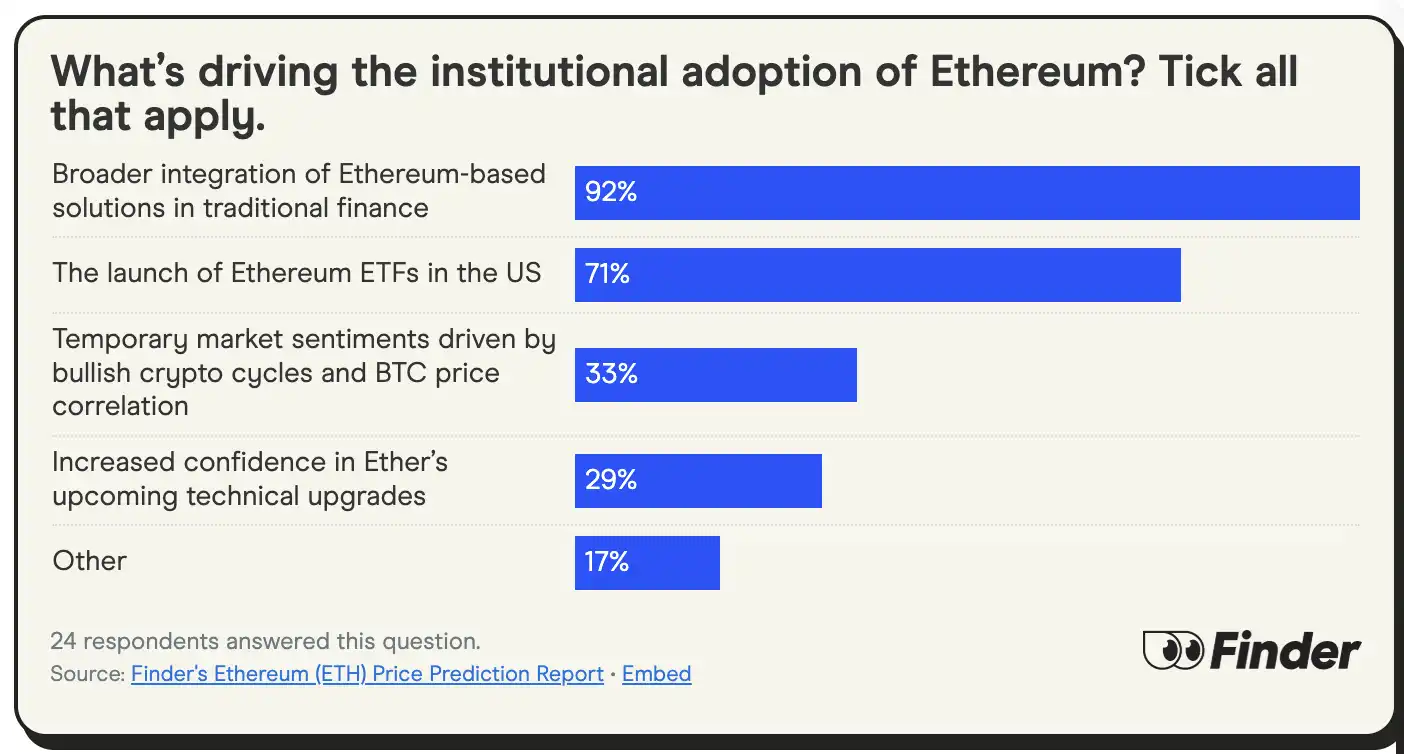

So, what is driving institutional adoption of Ethereum?

· Extensive Financial Integration: 92% of experts believe that Ethereum solutions' application in the traditional financial sector (such as asset tokenization, stablecoins, and real-world assets) is the main reason for its widespread institutional adoption.

Launch of ETFs: 71% of experts point out that the launch of Ethereum ETFs is a key factor driving institutional adoption.

What is your view on the future of decentralized AI on Ethereum?

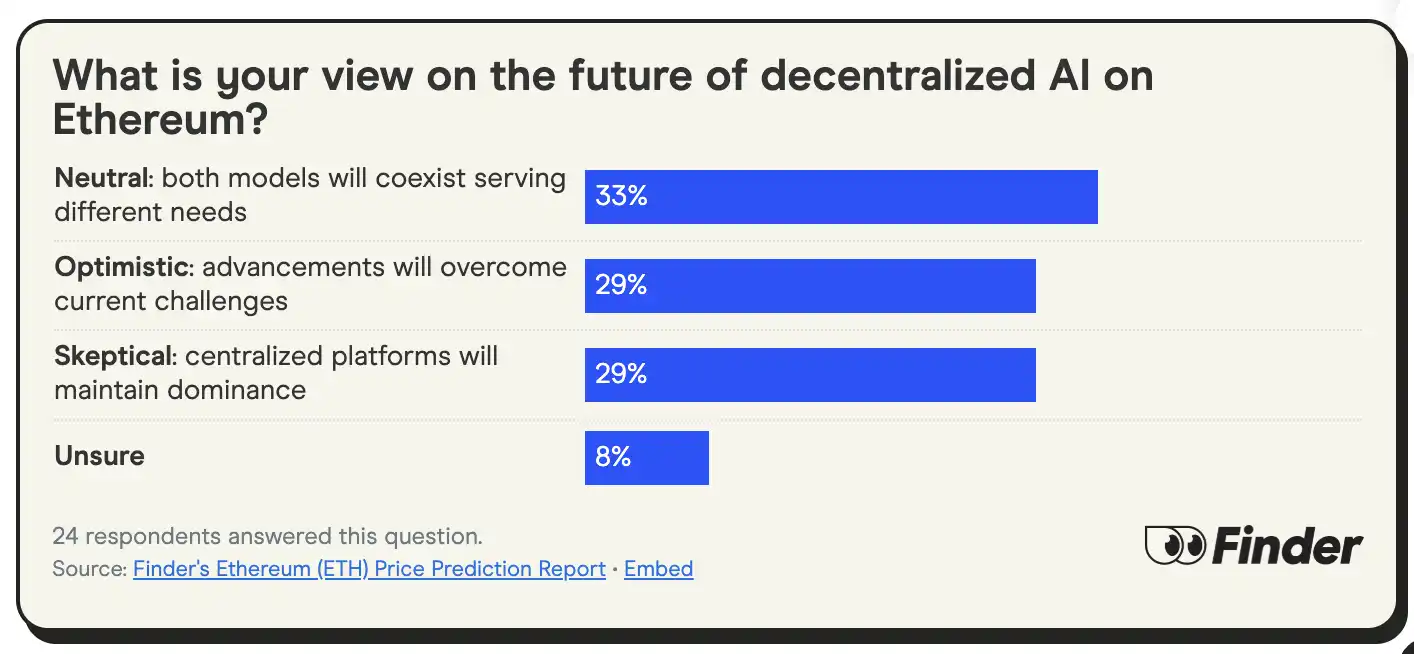

Decentralized AI platforms on Ethereum are starting to emerge, but reportedly face challenges in technology and economics, making it difficult to compete with centralized services. The expert views on the future of this field are mixed:

Regarding the future of decentralized AI on Ethereum, the expert group's opinions are relatively balanced. One-third (33%) hold a neutral stance, believing that decentralized and centralized models will coexist to meet different needs.

A slightly smaller number (29%) of experts are optimistic, believing that technological advancements will overcome current challenges; meanwhile, another 29% of experts express skepticism, suggesting that centralized platforms will continue to dominate.

Expert Team

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Uniswap Votes on 100M UNI Burn and New Fee Switch Proposal

XRP Poised for Massive Breakout. Here’s The Signal

Investors parse delayed data as us inflation cools but remains above Fed target

SUI ETF Filing: Bitwise’s Bold Move for Mainstream Crypto Adoption