Bitget Daily Digest (7.21)|WLFI Trading Approved, Public Companies Building LTC Treasuries, ETH Staking Ratio Rises to 29.15%

远山洞见2025/07/21 02:58

By:远山洞见

Today’s Preview

-

US June Conference Board Leading Index MoM to be released today (previous: -0.10%)

-

Malaysia Blockchain Week takes place July 21–22

-

July 21 is the deadline for the Thailand SEC’s public consultation on crypto listing standards. The proposed rules would allow exchanges to list self-issued tokens, but require disclosure of issuer identities and warning labels in their reporting systems to aid SEC monitoring and insider trading prevention.

-

Berachain voting proposal: Redistribute 33% of PoL rewards allocated to BGT to the BERA Yield module.

Macro & Hot Topics

1. Over 20% of Senior Trump Administration Officials Hold Crypto

According to the Washington Post, nearly 70 Trump administration officials and nominees (over one-fifth of senior appointees) held crypto or had investments tied to blockchain companies at the time of their appointments. Trump himself currently holds at least $51 million in crypto. VP JD Vance and seven cabinet members or nominees together hold at least $2 million in crypto assets. In total, reported crypto holdings and investments by Trump officials exceed $193 million.

2. VanEck, Others Urge SEC to Approve ETH Staking ETFs on a FIFO Basis

BlackRock’s move to add staking to its iShares ETH Trust brought new debate on batch approvals. VanEck, 21Shares, and Canary Capital are urging the SEC to approve applications on a “first-in, first-out” basis, preferring not to be lumped together with BlackRock, who filed much later. Bloomberg analyst James Seyffart notes ETF approvals may take time: the earliest applications reach deadline Oct. 2025, while BlackRock's isn’t due until April 2026. The first possible approval may come as soon as Q4 2025.

3. MEI Pharma (NASDAQ: MEIP) to Establish $100M+ LTC Treasury

US-listed MEI Pharma has established a dedicated LTC treasury with over $100 million pledged. Litecoin founder Charlie Lee will join MEI Pharma’s board, while the LTC Foundation has also invested, aligning this with their mission to drive global adoption of Litecoin.

4. WLFI

Token

Trading Approved, Launch to Go Live in 6–8 Weeks

WLFI announced its token trading has been approved by the community and is expected to officially launch in 6–8 weeks. None of the founding team, advisors, or co-founders’ tokens will unlock at launch; there will be no further private rounds. WLFI will collaborate with major exchanges to offer token rewards so users can earn tokens directly on trusted platforms.

Market Updates

1. BTC consolidates at highs, ETH rallies strongly, alts broadly up: $371M in liquidations over 24H, mostly shorts.

2. Friday’s S&P 500 closed flat; Fed’s Waller backs rate cuts, boosting Treasuries; oil slightly down, gold and base metals up.

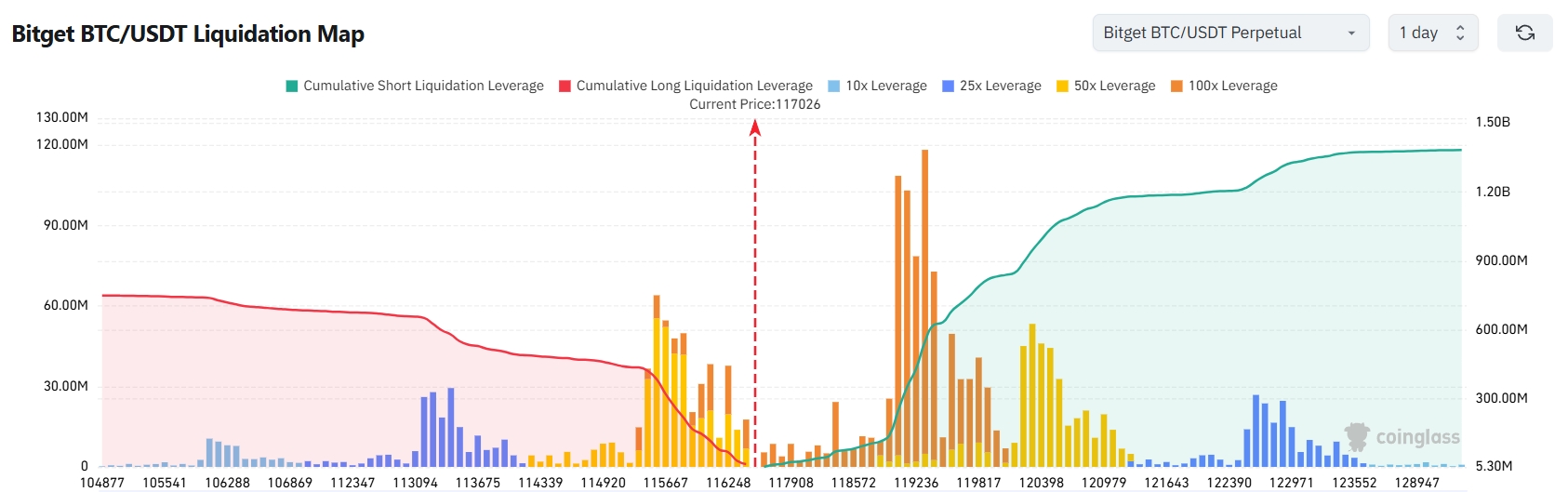

3. Bitget BTC/USDT liquidation map: With BTC at $117,077—if down 2,000 points to $115,077, total long liquidations exceed $452M. If up to $119,077, shorts face $248M in liquidations. Long risk dominates; use leverage sparingly to avoid forced liquidations.

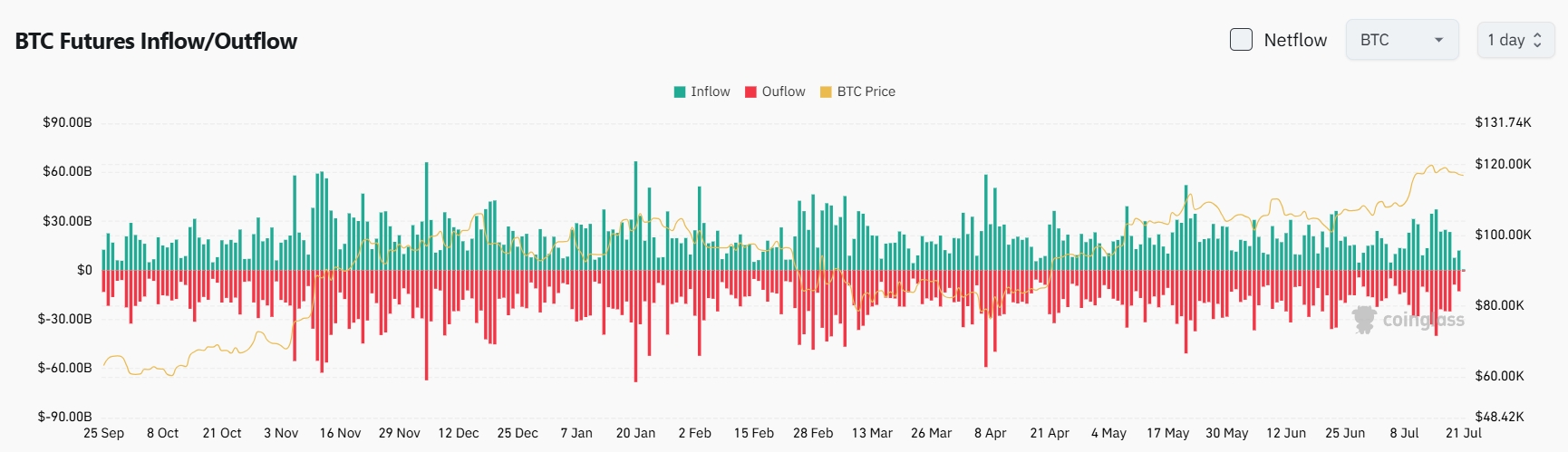

4. BTC spot flows: $1.52B in, $1.57B out, for

net outflows of $43M in 24h.

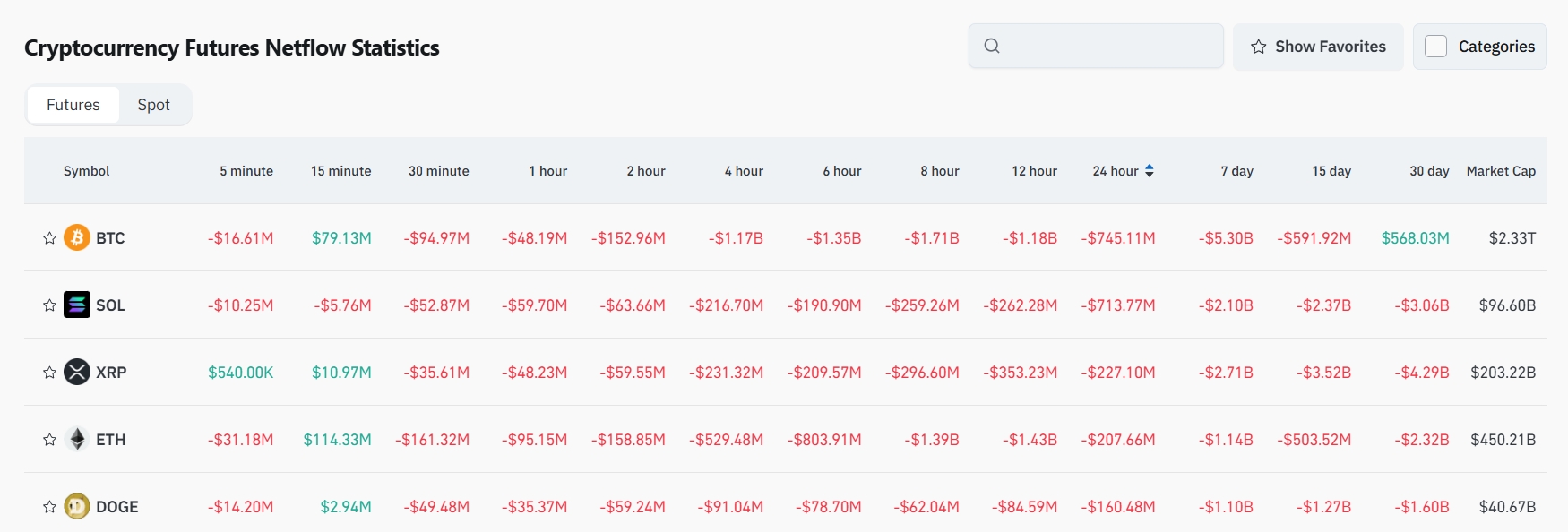

5. Contracts with highest outflows: $BTC, $SOL, $XRP, $ETH, $DOGE—may present trading opportunities.

Institutional Views

-

Circle: The GENIUS Act blocks Big Tech and banks from dominating stablecoin markets. Read more

-

Cooper Research: Every additional 10,000 BTC acquired by ETFs raises bitcoin’s average price by 1.8%. Predicts BTC could reach $150K by October. Read more

News Updates

-

US Commerce Secretary: Small nations must pay a 10% baseline tariff.

-

US FHFA explores including crypto assets in risk assessments for residential mortgages.

-

Hong Kong Financial Secretary Paul Chan: Stablecoins should not be speculative, but a long-term project.

Project Developments

-

Ethereum staking tops 36 million ETH, now 29.15% of total supply.

-

Aptos on-chain USDT supply surpasses $1B, up 20.4% this month.

-

Sign project announces 10% yield and Orange Hand honor badge for $SIGN stakers.

-

TAO Synergies (US stock) acquires **$10M in TAO at an average price of $**334.

-

MEI Pharma (NASDAQ:MEIP) to build $100M Litecoin treasury (see news above).

-

21Shares teams with Teucrium ETFs, files for two new crypto index ETFs with the SEC.

-

World Liberty Financial strategically buys ~**$40K in $**BANK to support Lorenzo Protocol.

-

FTX creditor representative: Bahamas may fall under UK/EU rules, additional approvals required.

-

Michael Saylor’s latest Bitcoin holdings tracking report expected this week—possible new buy data.

-

Last week’s NFT volume topped $140M, highest since mid-January.

X Highlights

1. Crypto_Painter: ETH Weekly Chart Points to Long-Term Washout End

ETH’s weekly chip distribution shows the market is now wrapping up the final shakeout of the 2022 bounce. After years of downtrend and washouts since that failed run three years ago, recent repeated tests of prior highs have left little weak-handed supply. Since March 2024, the chart’s descending broadening pattern hints that a capitulation and handoff is almost complete, setting the stage for a major reversal.

Link

2. allincrypto (AoYing Capital): PUMP Showing Bottoming Signals, Binance Spot Listing Anticipation Spurs Short-Term Trades

This weekend, PUMP stabilized after three straight days of declines; yesterday clearly marked a low, with stabilization today. Big inflows into Binance and spot listing anticipation have revived sentiment; major sellers seem cleared out. In a bull market, hot projects still have rebound windows. I’ve added some positions; if two consecutive green days appear, I’ll consider taking short-term profits and watching for new trends Monday.

Link

3. Phyrex: Market Calm Returns—BTC Range-Bound, Market Eyes Next Catalyst

A typical weekend: BTC drifted in a narrow range, with volume and turnover plunging—under 40,000 coins moved today. The $103,500–$108,500 support zone is holding; next big support: $93,500–$98,500. ETH is up, but no sign of broader fund spillover; altcoin season is on hold. Next week lacks major macro data; attention pivots to Powell and the Fed chair appointment, with August’s tariff drama likely to be a main theme. For now, a steady market suits range or grid trading—wait for the next catalyst.

Link

4. Lu Yao: Funding Rates Reveal Truth—Retail Missing Out as ETFs and “MicroStrategy-Style” Institutions Take Over

Don’t assume most people are riding the bull market. Funding rates show most retail traders are either on the sidelines or shorting. The big push comes from ETFs and institutions accumulating like MicroStrategy, with ample liquidity flowing in. The market’s true power has shifted from retail to institutional buyers, and capital keeps coming in, with strong links between stocks and crypto.

Link

3

1

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Crypto Markets Face a Rollercoaster: What Happened in the Past 24 Hours?

In Brief Bitcoin price dropped by 2.4%, influencing overall crypto market sentiment. The top 10 cryptocurrencies saw a general decline over the past 24 hours. Market seeks stability amid cautious investor behavior and potential short-term volatility.

Cointurk•2025/12/06 09:15

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$89,927.77

-1.12%

Ethereum

ETH

$3,049.5

-2.35%

Tether USDt

USDT

$1

-0.00%

BNB

BNB

$893.65

+0.05%

XRP

XRP

$2.03

-2.64%

USDC

USDC

$1

+0.03%

Solana

SOL

$132.79

-2.44%

TRON

TRX

$0.2902

+1.24%

Dogecoin

DOGE

$0.1398

-2.38%

Cardano

ADA

$0.4146

-3.46%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now