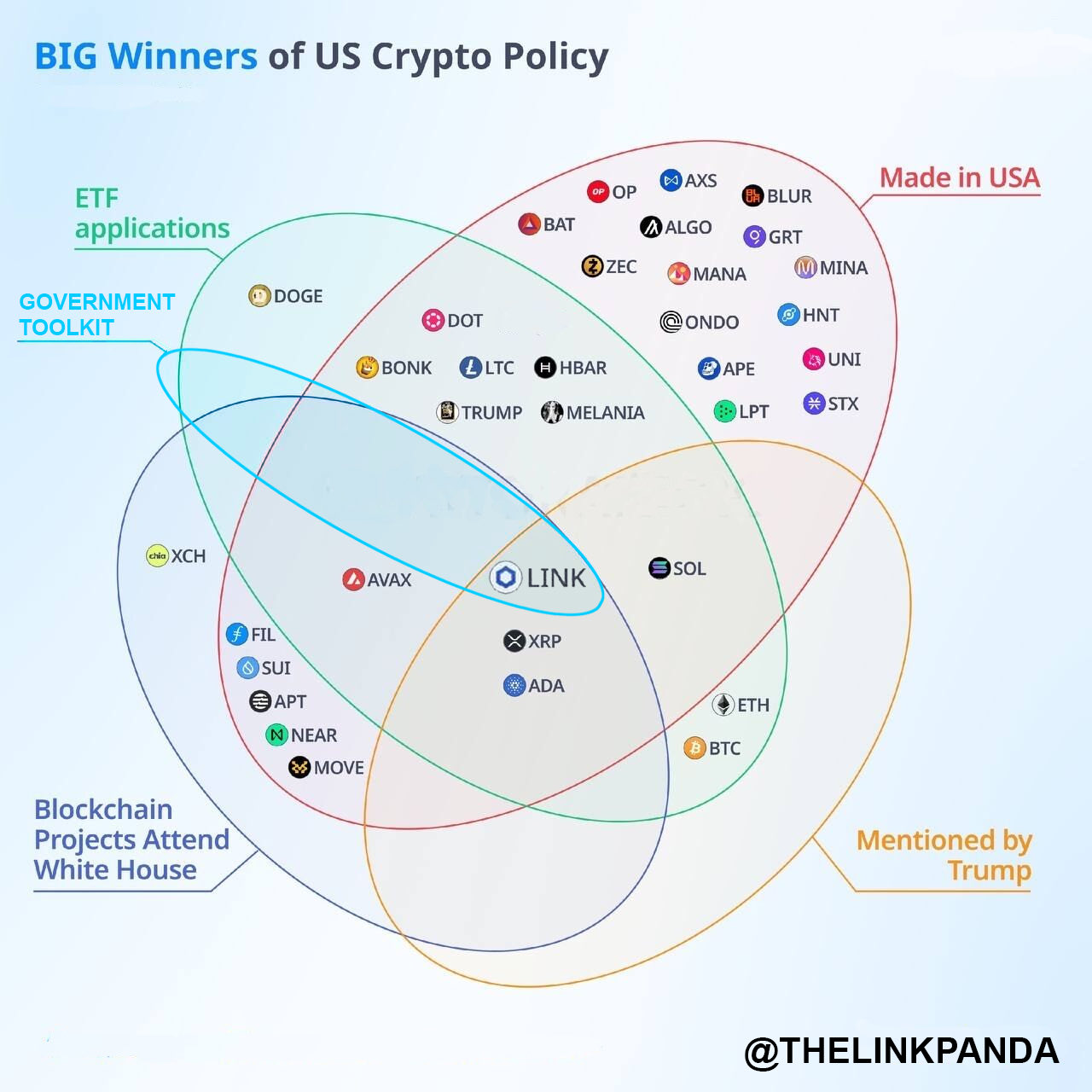

As Donald Trump took office, he announced his vision to establish the United States as the global capital for cryptocurrencies and is actively pursuing the necessary steps to fulfill this promise. One of the key actions in this plan is the completion of regulations concerning stablecoins, with the signing of GENIUS scheduled to happen at 21:30. This move has caught the attention of major asset managers, many of whom are either already invested in cryptocurrencies or are poised to do so. Given its geographic advantage, the question arises: which 36 U.S.-based cryptocurrencies are positioned to benefit from these developments?

U.S.-Based Cryptocurrencies

The United States is transforming into a secure haven for cryptocurrencies, a status that echoes El Salvador’s approach in 2021. Trump’s strategy, however, extends beyond offering mere support to altcoins. The forthcoming GENIUS signing at 21:00 marks a pivotal moment, enabling major financial institutions to issue their stablecoins across cryptocurrency networks swiftly.

Trillion-dollar conglomerates have already ventured into the world of cryptocurrency. The market is witnessing a surge, with daily ETF inflows in BTC and ETH nearing the billion-dollar mark. Over 200 companies are in the process of building cryptocurrency reserves, many of which are publicly traded.

In a bid to establish America as the cryptocurrency capital, Trump aims to simplify operations for U.S.-based crypto projects. Which cryptocurrencies stand to gain from this environment? The list includes 36 different cryptocurrencies, featuring some directly linked to Trump, others simply U.S.-based, like DOGE awaiting ETF approval, and others yet.

Chainlink (LINK) and ETH Price Analysis

Chainlink $18 ( LINK ) is instrumental in assisting financial institutions with crypto integration through initiatives like CCIP. The details of these moves have been previously discussed and can be found in search archives. Analyst Ali Martinez recently shared an analysis along with his target predictions for LINK.

“Chainlink (LINK) appears poised to reach $22 and potentially climb to $28!”

Meanwhile, analyst Noach is currently focusing on Ethereum $3,582 , noting the benefits of its dual accumulation phase. The recent trends suggest a potential rally.

“This structural break indicates further upward potential. If the trend continues, ETH could aim above $4,000.”

BTC is trading above $118,000, while ETH is attracting buyers at $3,573.