Cardano Price Eyes $1 Breakout As Top Wallets Keep Accumulating

Cardano is surging again. With ADA up over 26% in a week and large holders accumulating, the stage is set for a breakout toward $1; if key hurdles are cleared.

Cardano price is gaining serious momentum, climbing over 26% this week alone.

With large wallets quietly increasing their holdings and no signs of heavy selling, the recent rally seems more than just a bounce.

Whale Wallets Keep Accumulating Steadily

The 1 million –10 million ADA wallet group, often categorized as whales, has steadily increased its holdings from ~33% in January to 36.15% in mid-July. Despite ADA’s sharp rally in March, this cohort hasn’t trimmed exposure. This signals that top holders expect further upside.

Cardano price and whale wallets:

Santiment

Cardano price and whale wallets:

Santiment

Whale wallets are large ADA holders who typically hold between 1 million and 10 million coins. Their behavior often influences market direction.

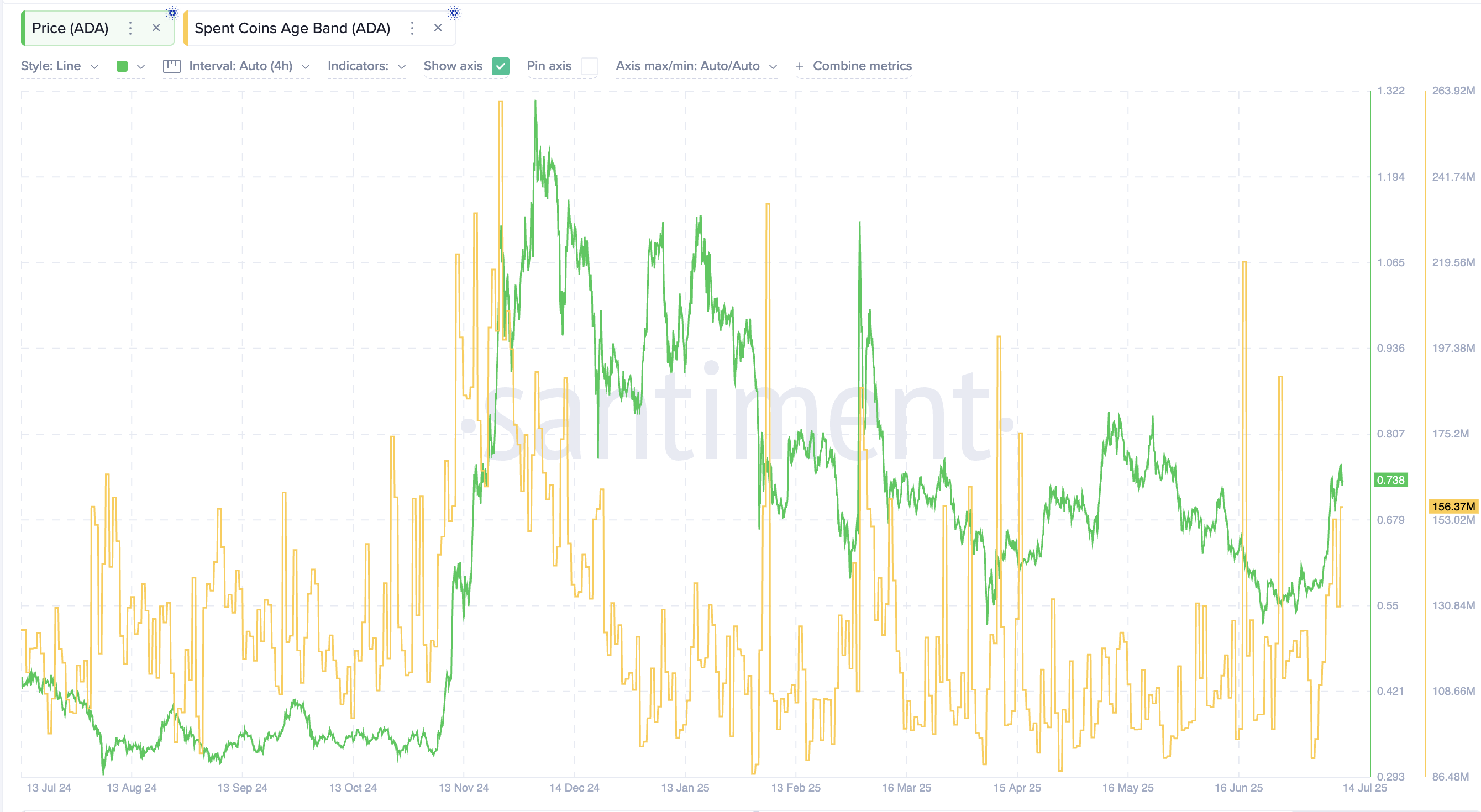

No Major Exits Yet as Spend Coins Age Remains Low

The Spent Coins Age metric spiked briefly in mid-June but has dropped back to lower levels. That means older ADA coins aren’t being sold. And most long-term holders appear to be sitting tight; a classic bullish signal during uptrends.

Also, the major spike in Spent Coins Age metric, around mid-June and also early-April, didn’t align with major price spikes. This shows that the selling trends associated with older wallets are not exactly profit-inspired. This might be a good sign in an uptrending market, meaning there aren’t many rally-restricting elements in play.

Cardano price and Spent Coins Age metric:

Santiment

Cardano price and Spent Coins Age metric:

Santiment

Spent Coins Age measures how long coins sit before being moved. A lower value suggests reduced selling pressure from older wallets.

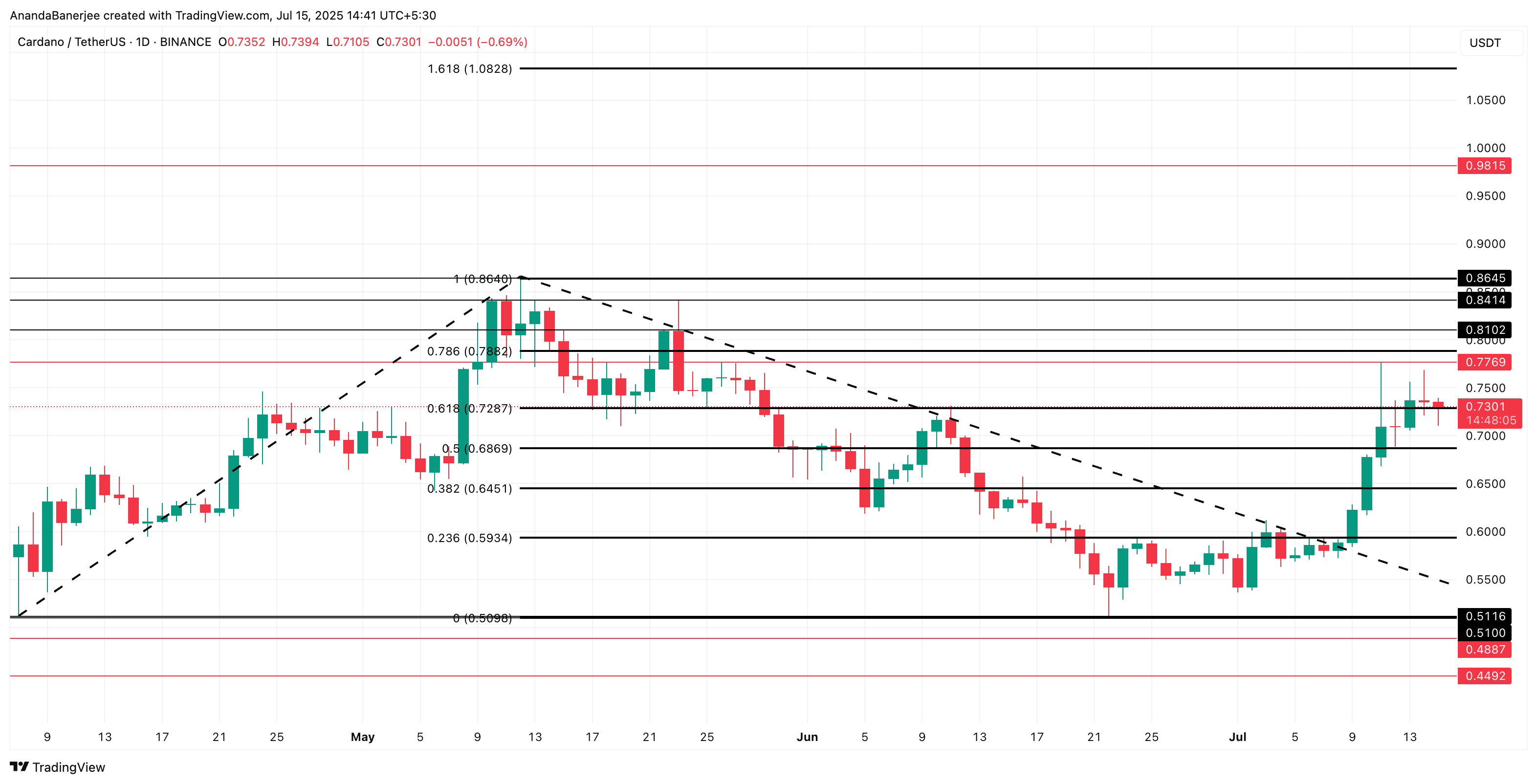

Cardano Price Approaches Critical Resistance

The Cardano price is currently trading at $0.73, marginally above the 0.618 Fibonacci level ($0.7287) and heading toward the dual resistance zone:

- Strong horizontal level at $0.77

- 0.786 Fibonacci at $0.78

Cardano price analysis:

TradingView

Cardano price analysis:

TradingView

If ADA price breaks both, there’s little friction until $0.86, and from there, the 1.618 Fibonacci extension targets $1.08, representing a ~46% potential upside from current levels.

The Fibonacci extension is drawn from the $0.51 swing low to $0.86 high, with retracement confirming support near $0.50, a textbook impulse wave.

With whales accumulating, no signs of mass exits, and a clean price structure, Cardano’s rally toward $1.08 looks increasingly probable. However, a dip under $0.72 followed by the retest of the key support level ($0.68 or .5 Fib level) could invalidate the bullish take.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Staking Weekly Report December 1, 2025

🌟🌟Core Data on ETH Staking🌟🌟 1️⃣ Ebunker ETH staking yield: 3.27% 2️⃣ stETH...

The Blood and Tears Files of Crypto Veterans: Collapses, Hacks, and Insider Schemes—No One Can Escape

The article describes the loss experiences of several cryptocurrency investors, including exchange exits, failed insider information, hacker attacks, contract liquidations, and scams by acquaintances. It shares their lessons learned and investment strategies. Summary generated by Mars AI This summary was produced by the Mars AI model, and the accuracy and completeness of its generated content are still in the process of iterative improvement.

Mars Morning News | Federal Reserve officials to advance stablecoin regulatory framework; US SEC Chairman to deliver a speech at the New York Stock Exchange tonight

Federal Reserve officials plan to advance the formulation of stablecoin regulatory rules. The SEC Chair will deliver a speech on the future vision of capital markets. Grayscale will launch the first Chainlink spot ETF. A Coinbase executive has been sued by shareholders for alleged insider trading. The cryptocurrency market fear index has dropped to 23. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

OECD's latest forecast: The global interest rate cut cycle will end in 2026!

According to the latest forecast from the OECD, major central banks such as the Federal Reserve and the European Central Bank may have few "bullets" left under the dual pressures of high debt and inflation.