Will Ethereum Price Sustain the $3,000 Support or Face Corrections?

Ethereum's price surge faces resistance from profit-taking, but strong support at $2,500 may stabilize ETH, pushing it toward higher targets. Ask ChatGPT Ethereum's price surge faces resistance from profit-taking, but strong support at $2,500 may stabilize ETH, pushing it toward higher targets.

Ethereum (ETH) has experienced a notable 19% surge over the past week, bringing its price close to $3,000.

The rally has been impressive, driven by broader market optimism. However, Ethereum faces a potential challenge from profit-taking, which could hinder its ability to maintain the $3,000 level.

Ethereum Holders Move To Sell

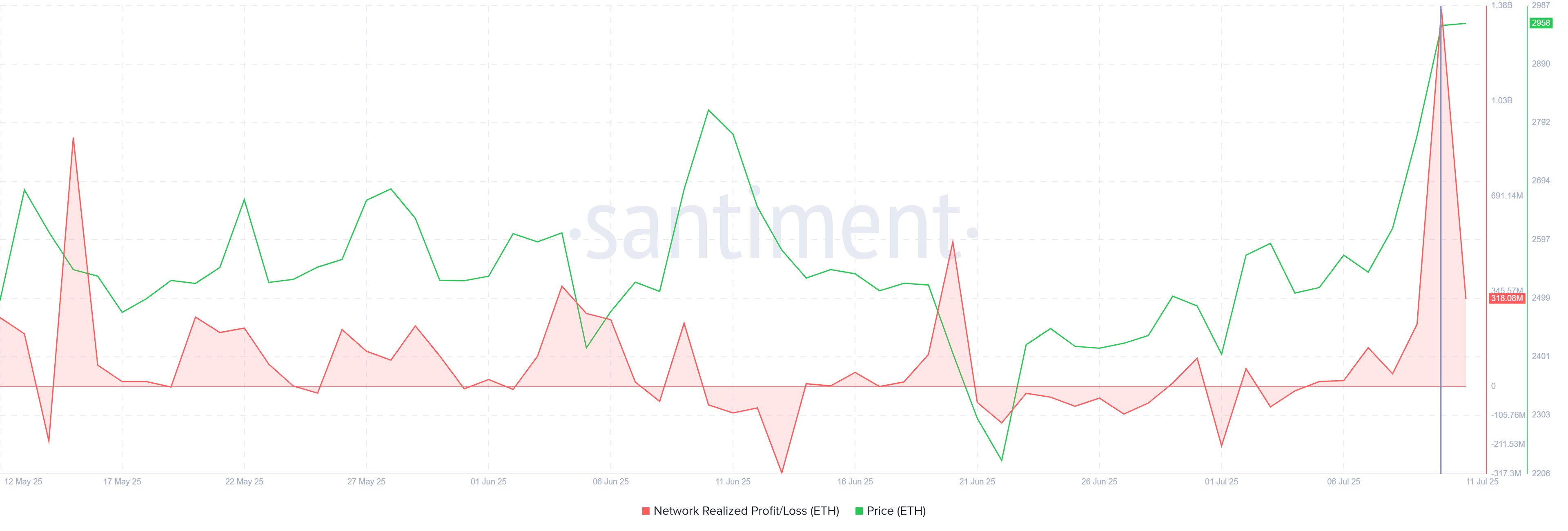

Ethereum’s Network Realized Profit/Loss metric has spiked to $1.36 billion, marking the largest increase since December 2022. This sharp uptick in realized profits indicates a significant amount of selling pressure.

The selling observed in the last 24 hours is the highest in 31 months, suggesting that many investors are capitalizing on recent price gains.

Historically, such large sell-offs have been followed by price corrections. Given the magnitude of the current selling activity, investors should be cautious, as it may signal a near-term pullback in Ethereum’s price.

Ethereum Network Realized Profit/Loss. Source:

Santiment

Ethereum Network Realized Profit/Loss. Source:

Santiment

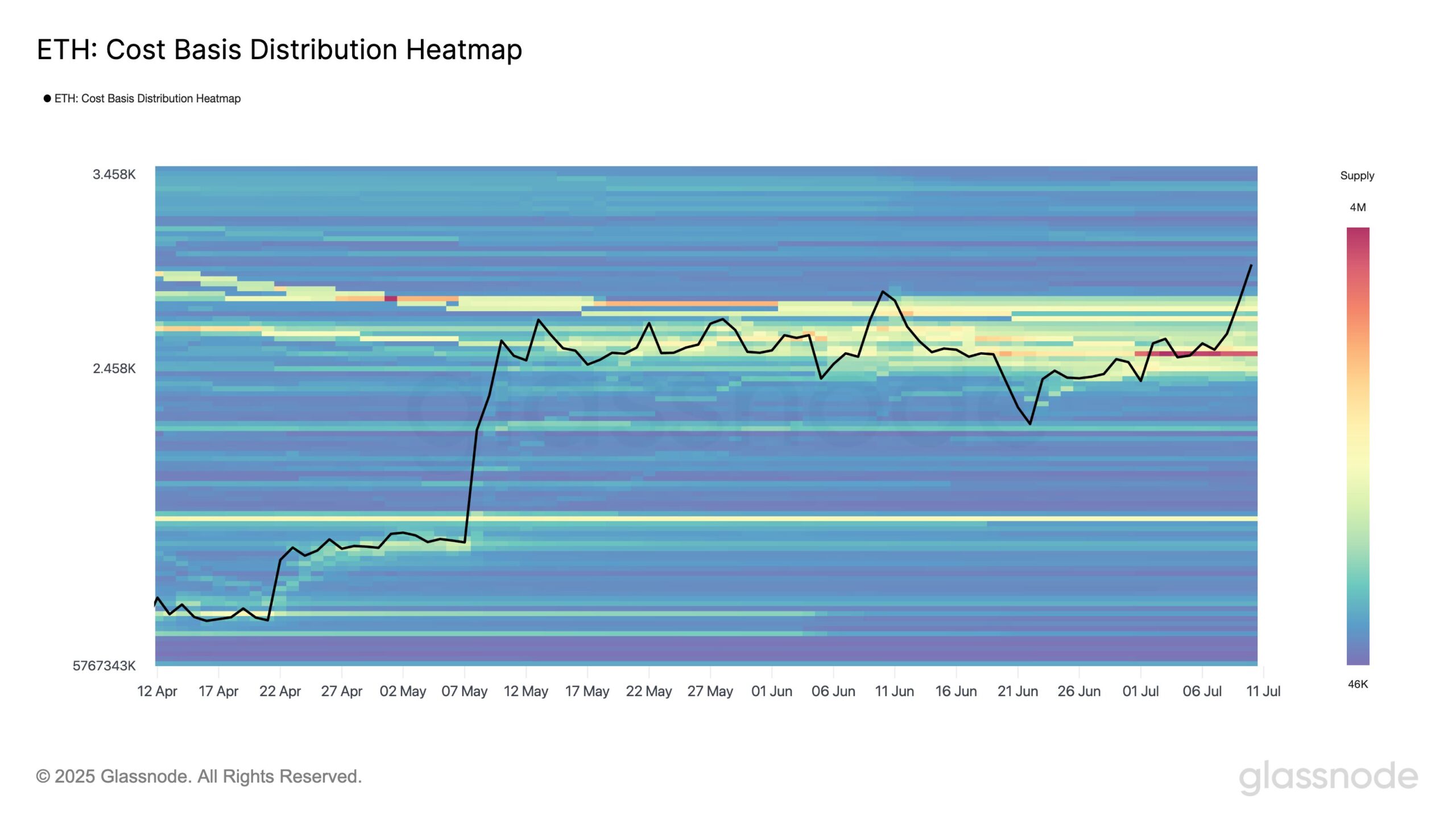

A key indicator of Ethereum’s potential support lies in its cost basis distribution, which shows that $2,500 has become a strong accumulation zone.

Over 3.45 million ETH had a cost basis near this level, providing significant support for the altcoin. As Ethereum recently bounced off $2,533, this level has become an important launchpad for its current rally.

This $2,500 support level is crucial if Ethereum faces a price decline due to profit-taking. Should ETH’s price retrace, the strong accumulation around $2,500 will likely act as a cushion, preventing a deeper pullback and supporting a potential rebound.

Ethereum Cost Basis Distribution. Source:

Glassnode

Ethereum Cost Basis Distribution. Source:

Glassnode

ETH Price Needs To Find Support

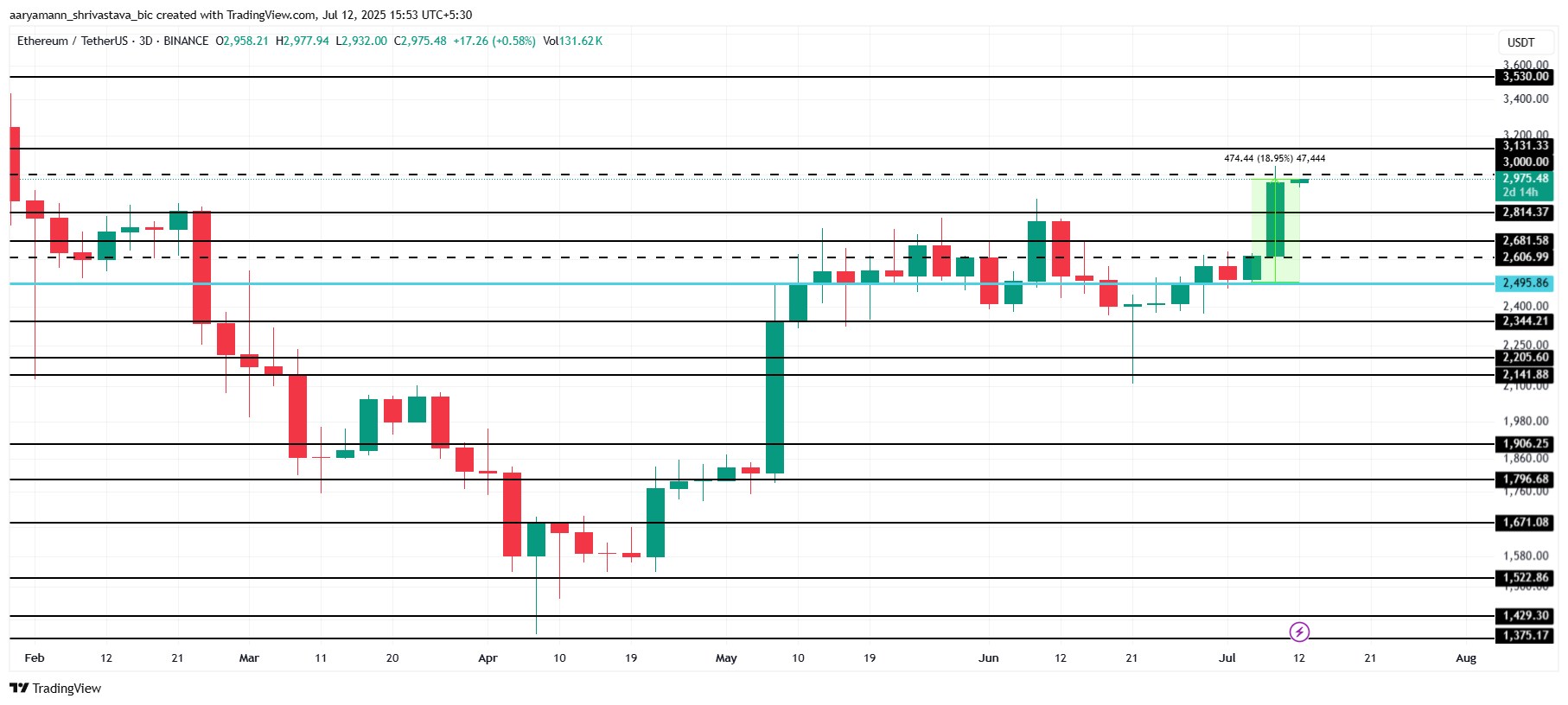

Ethereum is currently trading at $2,975, just below the crucial $3,000 resistance. After waiting five months to breach this level, Ethereum has finally crossed it.

However, the challenge remains in securing $3,000 as support. If ETH fails to hold this level, the rise could face significant resistance, limiting further gains.

Profit-taking could continue to weigh on Ethereum’s price in the short term. Yet, if Bitcoin’s uptrend continues and broader market conditions remain bullish, flipping $3,000 into support will likely push Ethereum towards the next resistance at $3,530. This move would indicate that the current bullish momentum is still intact.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

Should profit-taking surge, Ethereum’s price could fall back below $3,000. The 19% gain seen this week could be undone, but ETH is expected to hold above $2,495, thanks to the strong support established at the $2,500 level.

However, this would extend the wait for seeing Ethereum above $3,000 further into Q3.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bond investors expect Powell to tee up September rate cut in Friday speech

Share link:In this post: Powell is expected to hint at a September rate cut during his Friday speech in Jackson Hole. Traders are pricing in a 70% chance of a 0.25% cut and 50bps total easing in 2025. Trump is pressuring the Fed, but Powell may avoid firm commitments before new data.

UK business activity reached its fastest pace in a year

Share link:In this post: UK business activity reached its fastest pace in a year in August, led by growth in services. Government borrowing in July was £1.1bn, lower than the OBR’s £2.1bn forecast, helped by higher tax receipts. Hiring stayed weak despite stronger activity, with employment falling for the eleventh straight month.

UK consumers grow more optimistic following BoE rate cut

Share link:In this post: UK consumers increase their confidence in household budgets after the Bank of England rate cuts. Consumer confidence hit its highest level in months, surprising experts. Rich families spend more, but poor families still struggle with high prices.

Crypto handheld buyers hit with sudden import charges

Share link:In this post: Crypto handheld buyers in the U.S. are being hit with unexpected import duties, sometimes as high as $348. The manufacturer has paused shipments of its $599 gaming device while it investigates varying fees and complaints from early customers. Buyers are frustrated over the lack of upfront cost clarity, with some calling the extra charges misleading and asking for refunds.