BlockFi Administrator and DOJ Reach Settlement to Dismiss Disputed Asset Transfer Lawsuit

BlockFi's bankruptcy administrator and the U.S. Department of Justice have reached a settlement to dismiss a $35 million crypto asset transfer lawsuit. reports Judge Michael B. Kaplan of the U.S. Bankruptcy Court for the District of New Jersey approved the agreement on Friday. The case was dismissed with prejudice, meaning it cannot be refiled.

The original lawsuit, filed in May 2023, sought to transfer over $35 million in crypto assets from BlockFi to the U.S. government. The DOJ claimed it held valid warrants to seize funds from BlockFi accounts belonging to two Estonian citizens charged in a criminal fraud case unrelated to BlockFi's bankruptcy. The dispute arose when DOJ attorneys argued the bankruptcy court lacked jurisdiction to prevent the asset transfer during BlockFi's Chapter 11 proceedings.

Under the settlement terms, each party will bear its own legal fees and costs. Mohsin Meghji, Plan Administrator for BlockFi's wind-down estates, represented the crypto lender. The DOJ was represented by senior trial counsel Seth B. Shapiro and his team from the Civil Division's Commercial Litigation Branch.

Federal Settlement Clears Path for Creditor Repayments

The resolution removes a major legal obstacle in BlockFi's ongoing bankruptcy wind-down process. notes this settlement allows BlockFi to focus on distributing funds to over 10,000 creditors without further legal complications from asset seizure disputes. The crypto lender owes approximately $10 billion to more than 100,000 creditors, including major debts to Three Arrows Capital and other institutional entities.

BlockFi has made progress resolving other claims tied to its bankruptcy. In March 2024, the company reached an $875 million settlement with FTX and Alameda Research estates, resolving about $1 billion in claims. CEO Zac Prince testified that FTX founder Sam Bankman-Fried's actions directly caused BlockFi's downfall. The bankruptcy court approved BlockFi's Chapter 11 plan in September 2023, enabling the firm to begin repaying creditors.

The case highlights jurisdictional complexities when federal criminal investigations intersect with bankruptcy proceedings. As we reported, Connecticut recently passed comprehensive legislation banning state government cryptocurrency operations, demonstrating continued regulatory uncertainty at various levels of government. BlockFi partnered with Coinbase in May 2024 to facilitate customer withdrawals, with an April 28, 2024 deadline for eligible users to reclaim their crypto holdings.

Regulatory Enforcement Shifts Create New Framework for Crypto Cases

The settlement occurs amid broader changes in federal crypto enforcement priorities. confirms the agreement follows recent DOJ policy shifts that narrow crypto prosecutions to cases involving fraud or terrorism rather than regulatory violations. The department disbanded its National Cryptocurrency Enforcement Team in April 2025, moving toward a more targeted approach.

Industry observers note the settlement may establish precedents for future asset seizure disputes involving crypto platforms in bankruptcy. The case demonstrates how criminal investigations unrelated to bankruptcy can complicate Chapter 11 proceedings when digital assets are involved. Legal experts suggest clear jurisdictional frameworks are needed to balance federal enforcement priorities with orderly bankruptcy wind-downs.

The BlockFi resolution reflects evolving regulatory approaches toward crypto bankruptcies following high-profile collapses in 2022. Traditional financial institutions increasingly view crypto integration as inevitable, while regulators seek balanced oversight that protects consumers without stifling innovation. The settlement enables BlockFi to complete its wind-down while providing clarity for similar future disputes between federal agencies and bankruptcy estates involving digital assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

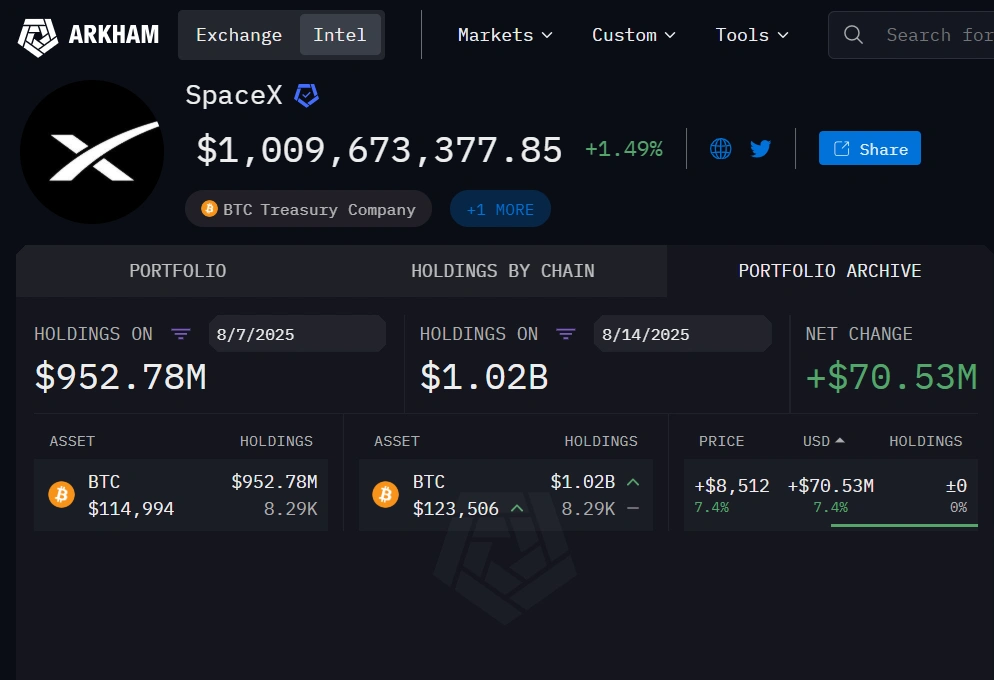

Norway hands Musk Tesla boost as SpaceX BTC holdings expand past $1B

Share link:In this post: Tesla’s sales in Norway have surged despite growing discontent among Norwegians regarding Elon Musk’s political stance. SpaceX’s BTC holdings have crossed the $1 billion mark again. Tesla’s deep ties in Norway influence its consistent sales numbers, but it is slowly losing its dominance as more rivals make headway.

Musk tips Google to dominate AI as it commits extra $9B to Oklahoma AI, cloud infrastructure

Share link:In this post: Elon Musk says Google currently has the highest probability of leading AI due to its compute and data advantage. Google will invest $9 billion in Oklahoma to expand AI and cloud infrastructure over the next two years. The plan includes a new Stillwater data center campus and expansion of its Pryor facility.

Nvidia partner Foxconn reports strong surge in AI server sales

Share link:In this post: Hon Hai Precision Industry (Foxconn) reported a 27% increase in Q2 profits, driven by sales in its AI server business. The company reported a net income of NT$44.36 billion for the period, surpassing an average analyst projection of NT$36.14 billion. It also expects significant growth in Q3 and the rest of the year.

US PPI beats estimates with 3.3% annual gain in July

Share link:In this post: US PPI jumped 3.3% in July, the highest annual gain since February. Monthly PPI rose 0.9%, blowing past the 0.2% forecast. Service costs surged, led by machinery wholesaling and portfolio fees.