FTX/Alameda Unstakes Significant SOL Worth $726 Million

- FTX controls significant Solana holdings amid bankruptcy estate management.

- Significant SOL tokens have been unstaked recently.

- Market impact from these moves appears muted for now.

FTX and Alameda’s staking address , as of June 2025, holds over 5 million Solana tokens, equating to around $726 million. Following earlier unstaking of 188,000 SOL, these tokens were distributed to multiple new addresses for potential liquidity moves.

The significant unstaking action by FTX/Alameda affects the Solana market, managing creditor obligations. Despite asset movements, Solana’s value remains stable with no drastic price changes reported.

“Each major unstaking event is closely tracked by on-chain analysts and typically prefaces possible market sell-offs.” — On-chain Analyst, Arkham Intelligence

The FTX and Alameda Research bankruptcy estate currently manages approximately 5 million SOL.

On-chain analysis indicates ongoing unstaking and asset distribution activities. These include over 188,000 unstaked tokens, distributed to more than 30 intermediary wallets.

Administrators and court-appointed trustees oversee the liquidation process. Unstaked assets moving through decentralized exchanges signal preparations for future sales. Despite apprehensions,

Solana’s value remains largely unaffected by these transactions.

Previous large-scale liquidations, particularly involving Ethereum and MATIC, prompted price fluctuations. However, ongoing

Solana unstaking shows market resilience. No direct statements are available from

key figures like Sam Bankman-Fried or current FTX leaders about these activities.

Analysis indicates these actions follow historical liquidation trends since FTX’s collapse in 2022. The persistent upkeep of Solana’s price suggests market absorption capacity for large-scale asset restructuring without significant downturns.

Official commentary lacks on these movements, yet on-chain monitoring continues to provide updates. The Solana community shows cautious engagement, with discussions prevalent on potential risks of broad-scale sell-offs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

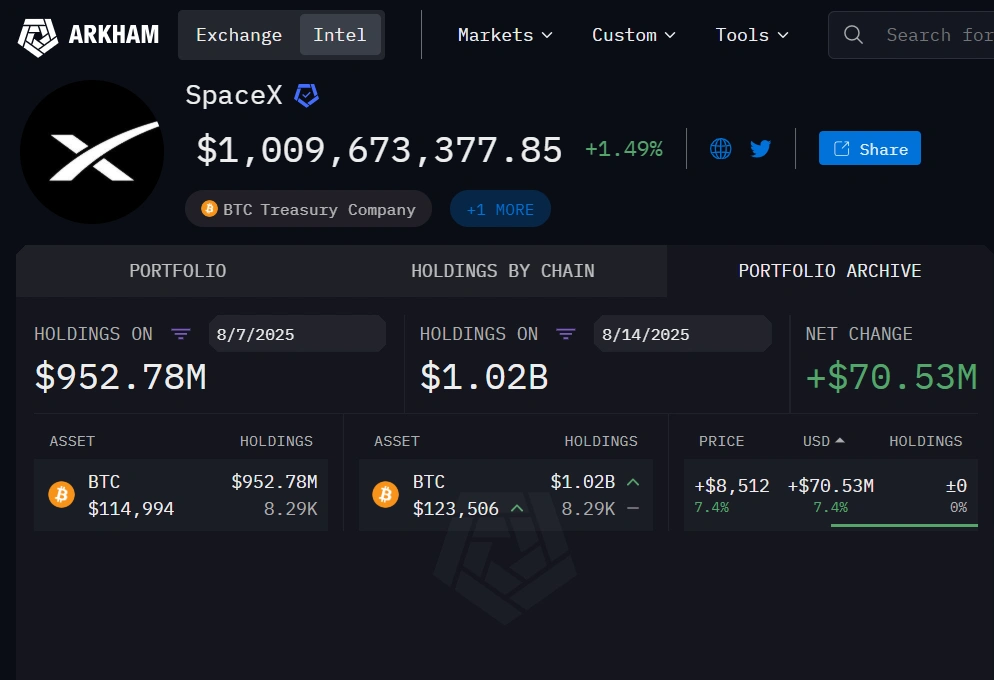

Norway hands Musk Tesla boost as SpaceX BTC holdings expand past $1B

Share link:In this post: Tesla’s sales in Norway have surged despite growing discontent among Norwegians regarding Elon Musk’s political stance. SpaceX’s BTC holdings have crossed the $1 billion mark again. Tesla’s deep ties in Norway influence its consistent sales numbers, but it is slowly losing its dominance as more rivals make headway.

Musk tips Google to dominate AI as it commits extra $9B to Oklahoma AI, cloud infrastructure

Share link:In this post: Elon Musk says Google currently has the highest probability of leading AI due to its compute and data advantage. Google will invest $9 billion in Oklahoma to expand AI and cloud infrastructure over the next two years. The plan includes a new Stillwater data center campus and expansion of its Pryor facility.

Nvidia partner Foxconn reports strong surge in AI server sales

Share link:In this post: Hon Hai Precision Industry (Foxconn) reported a 27% increase in Q2 profits, driven by sales in its AI server business. The company reported a net income of NT$44.36 billion for the period, surpassing an average analyst projection of NT$36.14 billion. It also expects significant growth in Q3 and the rest of the year.

US PPI beats estimates with 3.3% annual gain in July

Share link:In this post: US PPI jumped 3.3% in July, the highest annual gain since February. Monthly PPI rose 0.9%, blowing past the 0.2% forecast. Service costs surged, led by machinery wholesaling and portfolio fees.