Ethereum Foundation Moves 1,000 ETH in Treasury Management

- Routine fund management, no major market shifts observed.

- No immediate impact on ETH liquidity.

- No official comments from foundation leaders.

The Ethereum Foundation’s routine transfer highlights proactive treasury management practices, underscoring stability compared to speculative market activities.

The Ethereum Foundation

A key steward in Ethereum’s ecosystem, carried out a routine 1,000 ETH transfer, valuing approximately $2.55 million. Foundation leadership like Vitalik Buterin and Aya Miyaguchi refrained from commenting on this routine management action.

Vitalik Buterin, Co-founder, Ethereum Foundation, – “No statements or confirmations regarding the ETH transfer have been made.”

The action did not cause significant market changes as it mirrors the foundation’s established internal treasury patterns. The Ethereum Foundation has previously engaged in similar transfers without impacting the broader asset market.

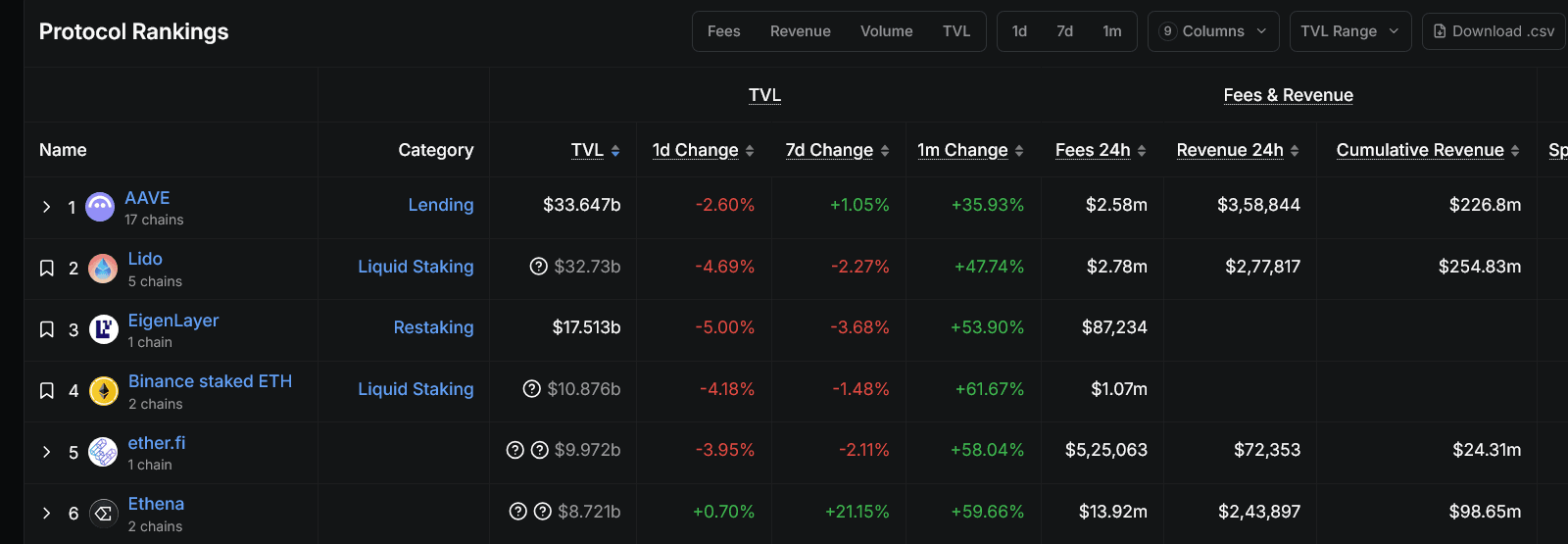

This internal activity did not influence financial markets, with no immediate liquidity shifts detected following the transaction. Regulatory bodies like the SEC have taken no action due to the routine nature of this activity. Although the Foundation controls significant funds allocated to DeFi protocols like Aave, Spark, and Compound, this movement was merely a minor internal fund adjustment. Historically, these treasury activities are aligned with transparency and stability, not triggering price volatility. As on-chain data confirms, this transaction aligns with Ethereum’s diligent management practices. The absence of regulatory intervention suggests confidence in the foundation’s procedural transparency.

The Ethereum Foundation’s continuous asset management within its treasury suggests ongoing prudence. The transfer occurred without significant influence on the Ethereum market or ecosystem, maintaining consistent internal fund allocation practices. These actions indicate a stable financial strategy, benefiting long-term adoption and stability in the Ethereum ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto News: Trump’s Plan to Let Cryptos Back Mortgages & 401(k)s Sparks Debate

Why This DeFi Dip Might Be the Start of a Major Rotation?

Chinese video AI models gain global attention as the industry heats up

Share link:In this post: Chinese tech companies have increased their efforts in AI-generated video tools, positioning them as major players in the field, which is still in its early stages. Kling AI, developed by Kuaishou, a short video platform, converts text or still images into video content. Wei Xiong, an internet analyst at UBS Securities, believes AI video generation has the potential to reshape the content industry.

Big Tech’s ‘acquihires’ face new EU antitrust threat

Share link:In this post: The EU competition chief vows to close flat on talent-only “acquihires.” National regulators have been urged to flag below-threshold deals for EU review. Big Tech’s AI talent raids draw scrutiny amid fears of stifled innovation.