Dormant Bitcoin Whales Activate, Moving $8.6 Billion BTC

- Historic activation of eight dormant Bitcoin wallets.

- $8.6 billion in BTC moved.

- Potential market and liquidity impacts noted.

Lede: Eight long-dormant Bitcoin addresses became active in July 2025, moving approximately $8.6 billion in BTC, sparking market speculation globally.

Nut Graph: This incident draws attention due to its potential impact on Bitcoin liquidity and investor sentiment, though the immediate price effect was limited.

Body:

A group of eight dormant Bitcoin whale wallets became active in early July 2025, each transferring 10,000 BTC. These accounts held a combined value of $8.6 billion, a sign of major latent market activity. On-chain analysis tools identified these transfers, yet no clear owner or intent was publicly described. Despite the vast sum involved, BTC prices remained mostly stable, reflecting possible over-the-counter transfers or self-custody moves rather than immediate sales.

The financial sector saw brief periods of volatility, with trades fluctuating as market participants speculated on potential sales. This development occurred amid historical high Bitcoin prices, suggesting potential diversification or security planning by the wallets’ holders. While no direct regulatory comments have been reported, the transfers contribute to ongoing discussions on the broader implications for digital asset governance.

Moreover, industry experts and forums continue to analyze the situation, lacking official statements validating a direct cause behind the BTC transfers. Historically, dormant wallet activations lead to keen market interest, though broader institutional or regulatory reactions remain unconfirmed. The ongoing evolution in crypto and securities highlights a cautious investor landscape amid heightened surveillance and global financial trends .

“These movements may suggest preparations for estate planning rather than immediate sell pressure.” – Unknown Source, Crypto Analyst

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SoftBank shares drop 5%, snapping 9-day rally after $2 billion Intel deal

Share link:In this post: SoftBank shares fell over 5% after it announced a $2 billion deal to buy Intel stock at $23 per share. Asian markets dropped across the board as investors waited for the U.S. Fed’s Jackson Hole meeting. Jerome Powell is expected to signal a possible rate cut, with futures showing an 83% chance for September.

Texas judge sides with Logan Paul’s effort to dismiss CryptoZoo lawsuit

Share link:In this post: Judge Ronald Griffing said Logan Paul’s bid to remove a lawsuit over the collapse of CryptoZoo should be allowed. Griffin also urged the class-action plaintiff to update all but one of its 27 claims against Paul, the one linking him to commodity pool fraud. The judge dismissed Paul’s bid to accuse CryptoZoo co-founders of the project’s failure.

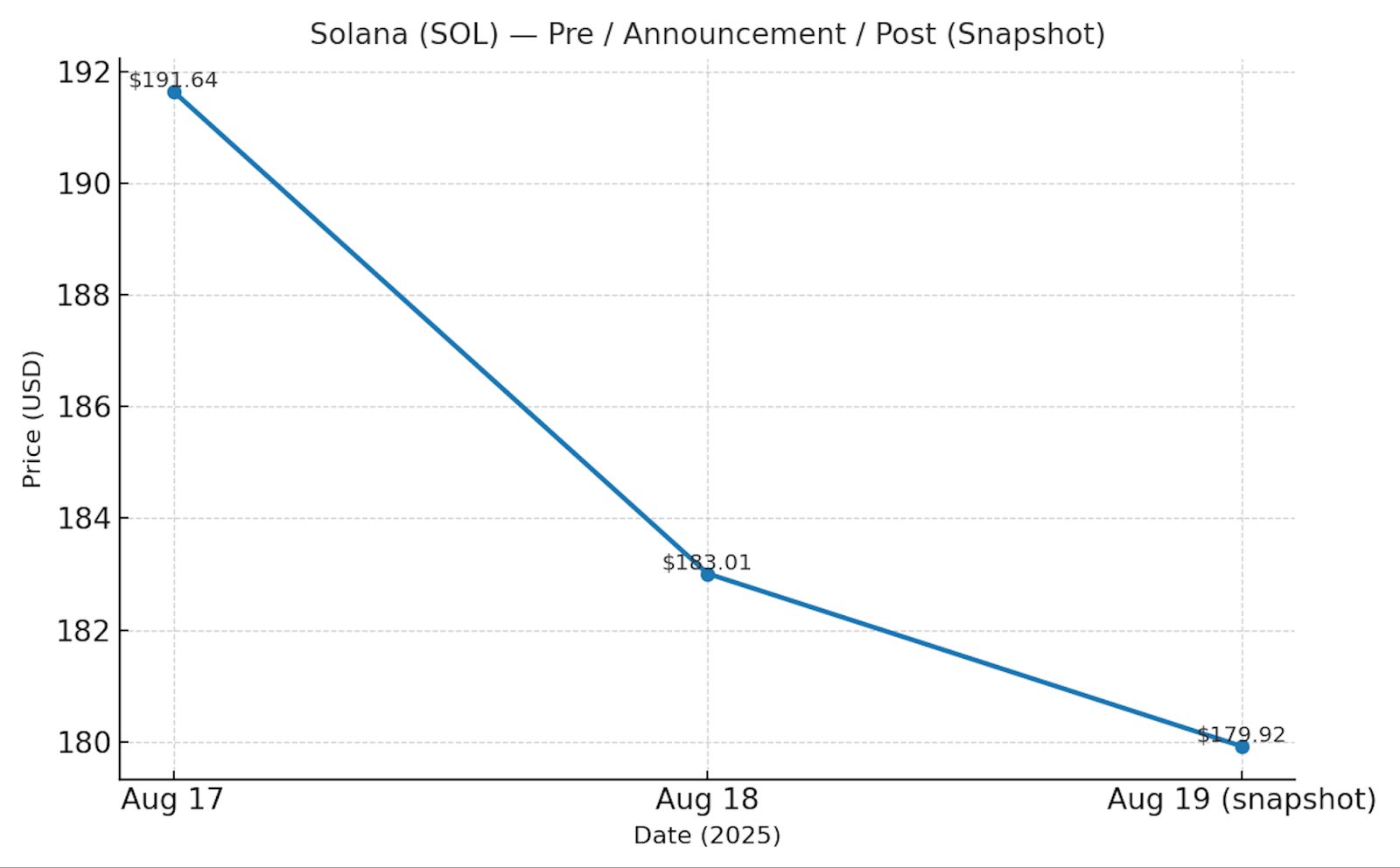

XRP & Solana ETF delays spark volatility – Stay or exit before October?

Share link:

Ethereum ETFs supply holdings to exceed BTC ETF’s holdings by September

Share link:In this post: Ethereum ETFs now hold over 6.5M ETH, with projections showing a September flip as they close in on Bitcoin ETFs’ share of the circulating supply. US spot ETH ETFs saw $59M in outflows on August 15 after record weekly inflows of 649,000 ETH pushed totals above $3.7B. Institutional investors dominate Ethereum with 19.2M ETH, while retail holdings fall sharply, highlighting shifting market influence amid price swings near $4,450.