Fragbite Secures Funding for Bitcoin Treasury Initiative

- Fragbite Group secures funding for Bitcoin holdings, led by CFO investment.

- CFO Patrik von Bahr takes on Treasury Director role.

- Initiative aims to elevate shareholder value through BTC.

Fragbite Group has secured a 5 million SEK funding agreement to create a Bitcoin treasury. CFO Patrik von Bahr personally invested 1 million SEK, emphasizing the move’s significance for the Sweden-based gaming and Web3 firm’s financial strategy.

Fragbite’s Strategic Financial Move

Fragbite Group, a Swedish-listed company , has secured a 5 million SEK agreement primarily to develop a Bitcoin treasury. CFO Patrik von Bahr contributed significantly, enhancing leadership within the firm’s new Bitcoin-focused division. This initiative enables Fragbite to strategically adopt Bitcoin holdings and report a new Bitcoin/stock metric in future reports.

CFO and Treasury Director Patrik von Bahr emphasized the growing importance of Bitcoin metrics in corporate strategies. The interest-free convertible loan matures by November 2028, reflecting an innovative financing model. According to von Bahr, “The ability to measure Bitcoin per share metrics and elevate value from BTC holdings will become increasingly important for companies in the future… Fragbite Group’s early adoption of this strategy will create substantial shareholder value in both the short and long term.” This funding impacts the cryptocurrency market by expanding corporate BTC holdings. Fragbite’s stock previously surged 64% amid positive investor sentiment, drawn by the pro-Bitcoin signal. Other firms like MicroStrategy have shown similar moves bolster company profiles.

Financially, Fragbite anticipates stronger treasury holdings with Bitcoin as a hedge against inflation, aligning with successful precedents set by global tech firms. The initiative aligns with investor interests and sets a notable trend among listed companies focusing on cryptocurrency reserves.

Immediate reactions suggest potential for increased BTC market activity with Fragbite’s inclusion. Historically, positive market sentiment follows such announcements, though it remains unclear if it will significantly impact current BTC prices.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SoftBank shares drop 5%, snapping 9-day rally after $2 billion Intel deal

Share link:In this post: SoftBank shares fell over 5% after it announced a $2 billion deal to buy Intel stock at $23 per share. Asian markets dropped across the board as investors waited for the U.S. Fed’s Jackson Hole meeting. Jerome Powell is expected to signal a possible rate cut, with futures showing an 83% chance for September.

Texas judge sides with Logan Paul’s effort to dismiss CryptoZoo lawsuit

Share link:In this post: Judge Ronald Griffing said Logan Paul’s bid to remove a lawsuit over the collapse of CryptoZoo should be allowed. Griffin also urged the class-action plaintiff to update all but one of its 27 claims against Paul, the one linking him to commodity pool fraud. The judge dismissed Paul’s bid to accuse CryptoZoo co-founders of the project’s failure.

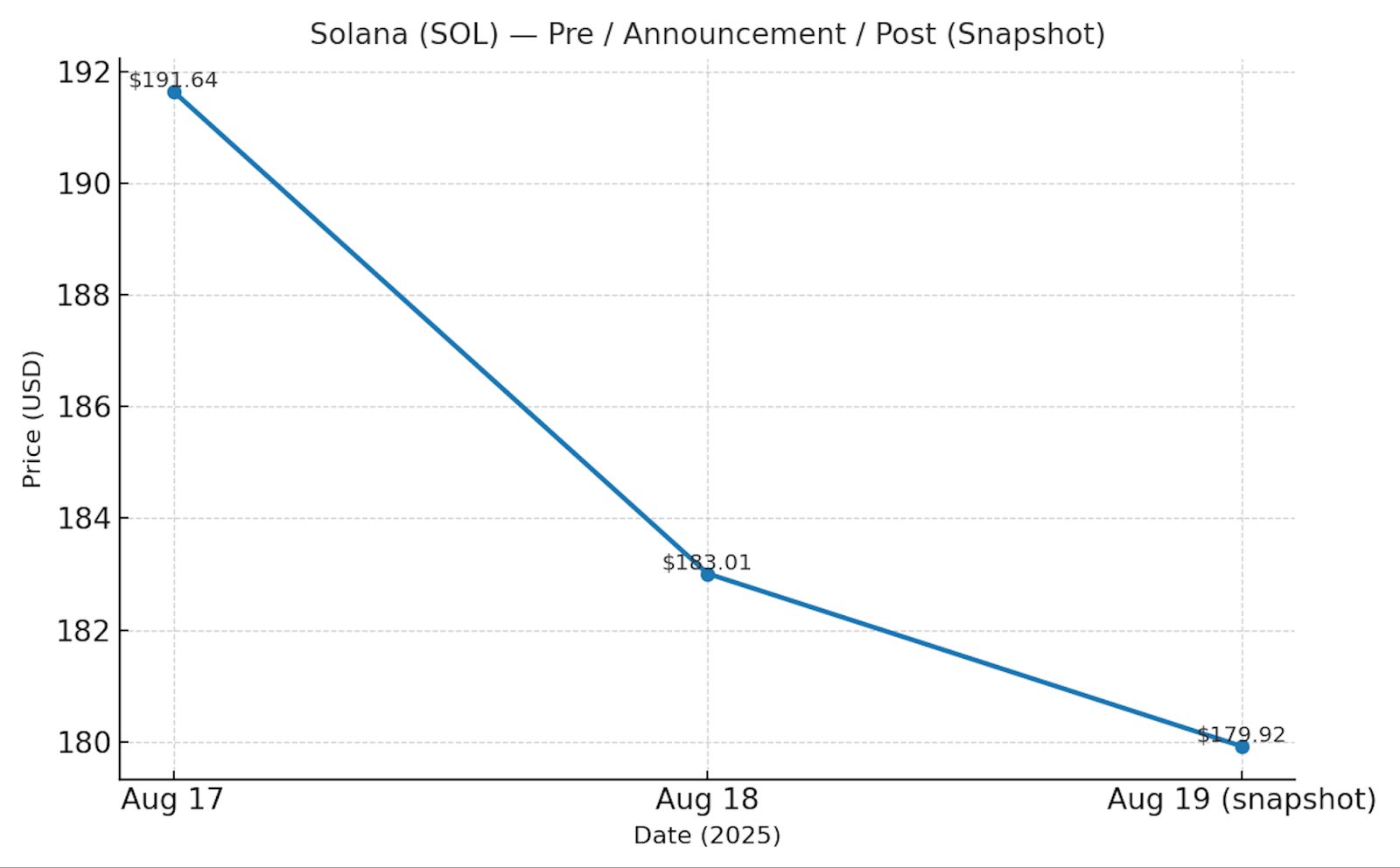

XRP & Solana ETF delays spark volatility – Stay or exit before October?

Share link:

Ethereum ETFs supply holdings to exceed BTC ETF’s holdings by September

Share link:In this post: Ethereum ETFs now hold over 6.5M ETH, with projections showing a September flip as they close in on Bitcoin ETFs’ share of the circulating supply. US spot ETH ETFs saw $59M in outflows on August 15 after record weekly inflows of 649,000 ETH pushed totals above $3.7B. Institutional investors dominate Ethereum with 19.2M ETH, while retail holdings fall sharply, highlighting shifting market influence amid price swings near $4,450.