Trump’s Tariff Notifications Set to Shake Global Trade and Finance

- Trump initiates new tariffs, affecting global trade dynamics.

- Immediate mixed market reactions observed.

- Potential shifts in U.S.-Canada trade relations.

The U.S. tariff notifications may heighten global trade uncertainty , impacting markets and economic relations.

Donald Trump, President of the United States, plans to send tariff notifications as of Friday, reflecting a consistent theme of trade renegotiation. Tariff rates will apply to numerous countries, continuing his previous strategies. President Trump stated that:

“We’re probably going to be sending some letters out, starting probably tomorrow, maybe 10 a day to various countries saying what they’re going to pay to do business with the US.”

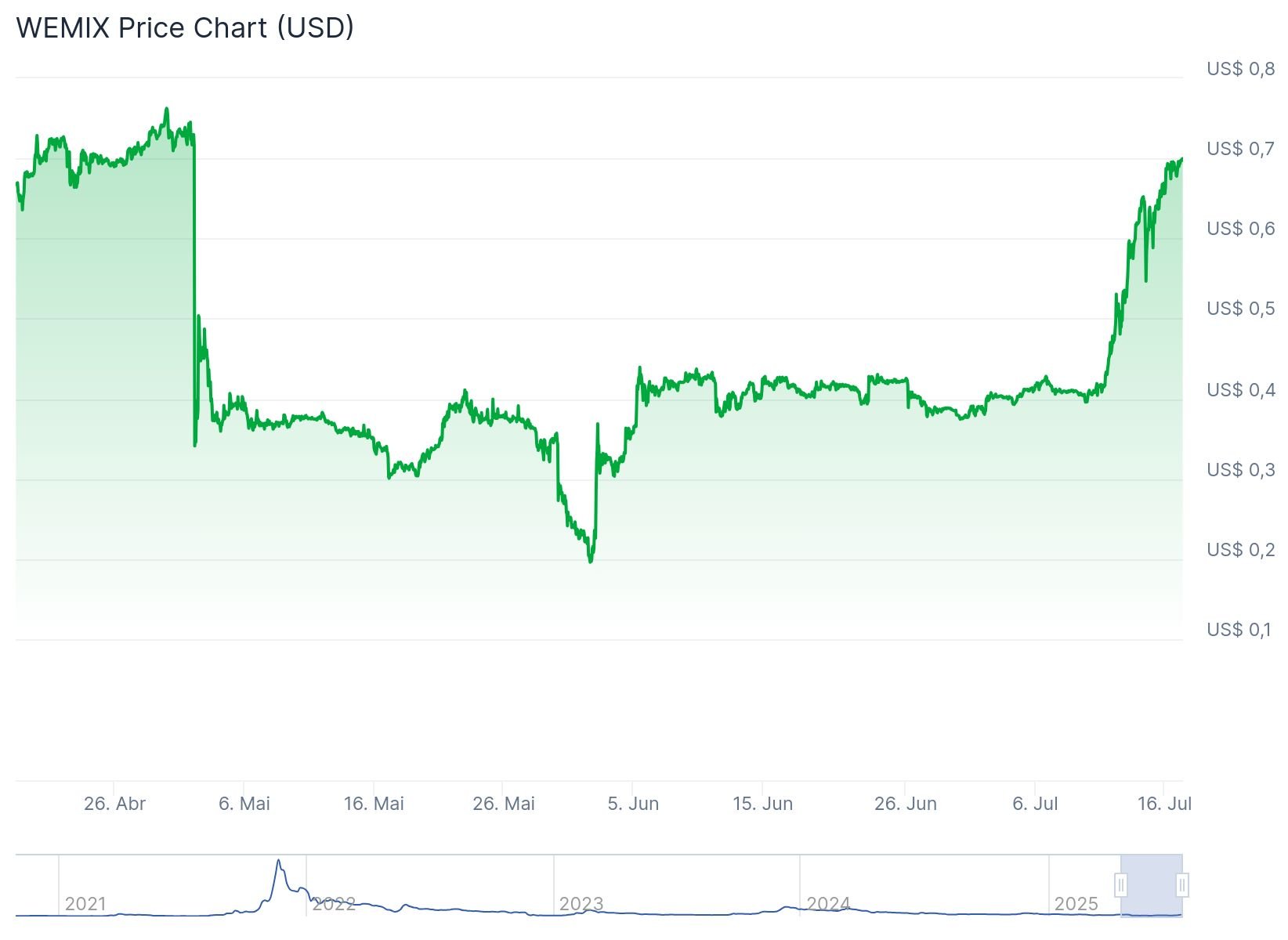

The initial market response exhibited caution. The U.S. Dollar saw mixed trading, and North American stock exchanges experienced both declines and recoveries. Trade talks with Canada ended sharply, affecting the USD/CAD rate. Financial markets are monitoring potential spillovers into other fiscal sectors.

Past actions under similar tariff regimes have caused market volatility and risk-off moves. Historical impacts like these suggest potential inflows into safe-haven assets like BTC. Institutional responses remain to be clarified by major economic authorities.

No explicit reactions from cryptocurrencies like BTC or ETH have been officially recorded at the time of this announcement. Regulatory bodies have yet to release statements regarding potential market implications or regulatory adjustments. Historical trends suggest possible increases in crypto trading volumes.

The regulatory and market outlook will develop as governments and market participants respond to these tariff measures. The potential effect on financial, regulatory, or technological aspects remains under evaluation, with a keen eye on broader macroeconomic indicators.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Gains Ground as Safe Haven Like Gold

Bitcoin decouples from stocks and real yields, mimicking gold’s role as a macro hedge.Institutional Adoption Driving the TrendWhat This Means for the Market

Huang Renxun: 30 Years After Financial Freedom, I Have No Dreams

From a conversation with Lei Jun to Huawei's chip and then to the recent super intense AI talent war in Silicon Valley, Huang Renxun has provided his own insights.

Top 5 criptomoedas promissoras da semana: altcoins disparam mais de 50% com Bitcoin acima de US$ 118 mil

Bitcoin Spot ETF Inflows in 2025 May Surpass Last Year’s Levels Amid Renewed Investor Interest