Smarter Web Raises $56M Days After Buying 196 Bitcoin

2025/06/27 07:15

2025/06/27 07:15

- The company raised $56 million using a fast equity method with no public marketing.

- Smarter Web now holds over 543 bitcoins after adding 196 bitcoins in late June.

- Its shares dropped nearly 15 percent after the Bitcoin buy and funding news came out.

UK-based firm The Smarter Web Company raised $56.59 million just two days after buying 196.8 Bitcoins worth over $20 million. The company confirmed on Thursday that the capital came from institutional investors using an accelerated bookbuild method. This funding round significantly boosts its market position while aligning with its recent crypto-focused treasury strategy.

The raise included £41.2 million ($56.96M) through the bookbuild and £4.97 million ($6.82 million) via direct subscription. The offer price was set at £2.90 ($3.98) per share, with the new shares expected to take effect from July 1. The company now holds 543.52 Bitcoin, all acquired at an average price of $104,450, bringing the current value to roughly $58.19 million.

Shares of The Smarter Web Company (OTCMKTS: TSWCF) responded with a sharp fall following the news, closing at $3.56 as of press time. This marks a 14.95% drop from the previous close of $4.18. The stock fluctuated between $3.19 and $3.99 throughout the day and experienced a further pre-market decline of 22.64%, resulting in a price of $2.75. The stock’s year range stands at $0.95 to $9.00, reflecting high market volatility.

Source:

Google Finance

Source:

Google Finance

Aggressive Accumulation Strategy Sparks Investor Reaction

The firm has added 460.28 Bitcoin in under 30 days, growing from 83.24 BTC at the end of May to 543.52 BTC by June 25. This marks the fifth Bitcoin purchase in June alone, continuing a treasury strategy launched in April.

Despite the bullish move, the company stated it is neither authorized nor regulated by the UK’s Financial Conduct Authority. The June 24 notice warned that cryptocurrencies like Bitcoin remain unregulated across the UK. As such, Bitcoin’s price can fluctuate heavily, potentially causing the firm’s holdings to lose value rapidly.

The company also disclosed that investors will not be protected under the Financial Ombudsman Service or the Financial Services Compensation Scheme. This means the company may not recover the value paid for its Bitcoin or the estimated value of those positions due to market movements. In a market update, the company reminded stakeholders that these risks remain significant as digital assets remain outside formal regulatory structures in the UK.

Related: Citi UK CEO Warns Crypto Rules May Fuel Shadow Banking

Other UK Firms Join the Crypto Treasury Trend

The Smarter Web Company is not alone in pivoting toward Bitcoin. Other UK firms are making similar moves despite regulatory gaps. On Tuesday, London-listed Vinanz confirmed the acquisition of 37.72 BTC, bringing its total stash to 58.68 BTC. On the other hand, Abraxas Capital, which is a London-based investment firm, reportedly acquired over $250 million worth of Bitcoin in April.

This pattern indicates growing interest among UK businesses in effectively utilizing digital assets within their treasury models. Still, the approach remains speculative given the absence of clear legal guidance. As more firms increase their Bitcoin exposure, the question arises: Will this strategy sustain investor trust in volatile times?

The post Smarter Web Raises $56M Days After Buying 196 Bitcoin appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

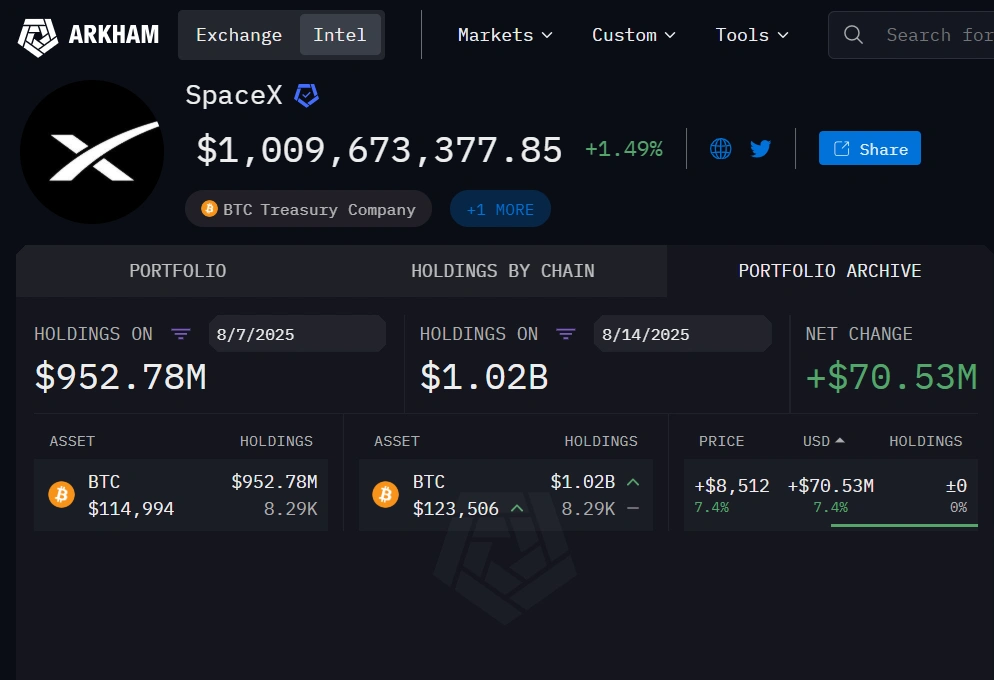

Norway hands Musk Tesla boost as SpaceX BTC holdings expand past $1B

Share link:In this post: Tesla’s sales in Norway have surged despite growing discontent among Norwegians regarding Elon Musk’s political stance. SpaceX’s BTC holdings have crossed the $1 billion mark again. Tesla’s deep ties in Norway influence its consistent sales numbers, but it is slowly losing its dominance as more rivals make headway.

Musk tips Google to dominate AI as it commits extra $9B to Oklahoma AI, cloud infrastructure

Share link:In this post: Elon Musk says Google currently has the highest probability of leading AI due to its compute and data advantage. Google will invest $9 billion in Oklahoma to expand AI and cloud infrastructure over the next two years. The plan includes a new Stillwater data center campus and expansion of its Pryor facility.

Nvidia partner Foxconn reports strong surge in AI server sales

Share link:In this post: Hon Hai Precision Industry (Foxconn) reported a 27% increase in Q2 profits, driven by sales in its AI server business. The company reported a net income of NT$44.36 billion for the period, surpassing an average analyst projection of NT$36.14 billion. It also expects significant growth in Q3 and the rest of the year.

US PPI beats estimates with 3.3% annual gain in July

Share link:In this post: US PPI jumped 3.3% in July, the highest annual gain since February. Monthly PPI rose 0.9%, blowing past the 0.2% forecast. Service costs surged, led by machinery wholesaling and portfolio fees.

BREAKING:

BREAKING: