Bitcoin near all-time high as dollar slides to three-year low

2025/06/27 04:57

2025/06/27 04:57Bitcoin is holding firm near historic highs as the U.S. dollar tumbles to its weakest level in more than three years, spotlighting the fragile dance between crypto prices and the world’s dominant reserve currency.

As of Friday morning in London, Bitcoin traded at $107,639, up around 9.8% since the start of the year and 6% over the last week. The world’s largest cryptocurrency remains just shy of its all-time high of $111,900 set on May 21. Meanwhile, the U.S. Dollar Index (DXY) has slipped to 97.10, marking a 10% decline year-to-date and fueling speculation about how much further the dollar could fall.

The dollar’s slide comes amid a swirl of macroeconomic forces: expectations of looser Federal Reserve policy, signs of easing trade tensions between the U.S. and China, and growing worries that political pressures could undermine the Fed’s independence.

Analysts say those dynamics are reviving Bitcoin’s appeal as a hedge against dollar debasement and traditional financial volatility.

Vasileios Gkionakis, senior economist and strategist at Aviva Investors, in comments to Reuters, said,

“I don’t think it’s just the repricing of the Fed. There’s a broader issue here of some tarnishing of U.S. exceptionalism.”

Markets are currently pricing in around 64 basis points of rate cuts for the rest of 2025, up from 46 basis points expected just a week ago. Speculation is also swirling that President Donald Trump may install a more dovish Fed chair if he perceives monetary tightening as a drag on economic growth heading into the next election cycle.

At the same time, diplomatic progress appears to be calming global nerves. News of a rare-earth trade agreement between Washington and Beijing lifted equities worldwide this week. The pan-European STOXX 600 index rose 0.9% on the day and was poised for a 1.1% weekly gain, while Asian markets surged to their highest levels in more than three years.

Despite Bitcoin’s rally, some analysts caution that its correlation to the dollar isn’t perfectly inverse. Data from CryptoQuant shows that statistically significant negative correlations below minus 0.6 have appeared on fewer than 30% of trading days since 2021. Currently, the 90-day rolling correlation between BTC and the DXY stands at –0.34, suggesting a loose but noticeable relationship.

Diverging Views on Bitcoin’s Outlook

Some see the dollar’s decline as a tailwind for Bitcoin. Digital asset manager Bitwise maintains a $200,000 year-end price target for BTC, arguing that deliberate dollar weakening could push more capital into alternative stores of value.

Others remain skeptical. While corporations, institutions, and government entities are acquiring or holding Bitcoin now, on-chain activity is nowhere near 2021 levels. Active wallets, Lightning Network volume, and transaction numbers have all declined. Bitcoin in 2025 is not about everyday individuals using it for payments or even acquiring. Instead, we’re seeing a value transfer away from retail users to institutions, with a key focus on the United States.

Bitcoin’s price is not necessarily under threat from this on-chain apathy anymore. However, if Bitcoin becomes nothing more than a place for the wealthiest companies and individuals in society to park their wealth, then are we really doing justice to Satoshi’s legacy? ‘Number go up’ is great for all those who bought Bitcoin early, but should ‘freedom money’ really be hoarded by the billionaire class?

Outstanding Questions

The evolving BTC–USD story leaves key questions unresolved:

- What level of DXY decline historically triggers large Bitcoin moves?

- Are U.S. corporations adding Bitcoin to treasury reserves as a dollar hedge?

- Could a sharp rebound in the dollar spark a Bitcoin sell-off?

- How are stablecoin flows like USDT and USDC reflecting shifts in dollar sentiment?

For now, investors will be watching closely as the dollar’s trajectory and the Federal Reserve’s next moves shape the narrative for Bitcoin in the second half of 2025.

Key Figures (as of 27 Jun 2025):

- BTC Spot Price: $107,639 (▲ 9.8% YTD, ▲ 3.1% monthly)

- BTC All-Time High: $109,482 (21 May 2025)

- U.S. Dollar Index (DXY): 97.10 (▼ 10.0% YTD, ▼ 2.3% monthly)

- BTC–DXY 90-day correlation: –0.34

The post Bitcoin near all-time high as dollar slides to three-year low appeared first on CryptoSlate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

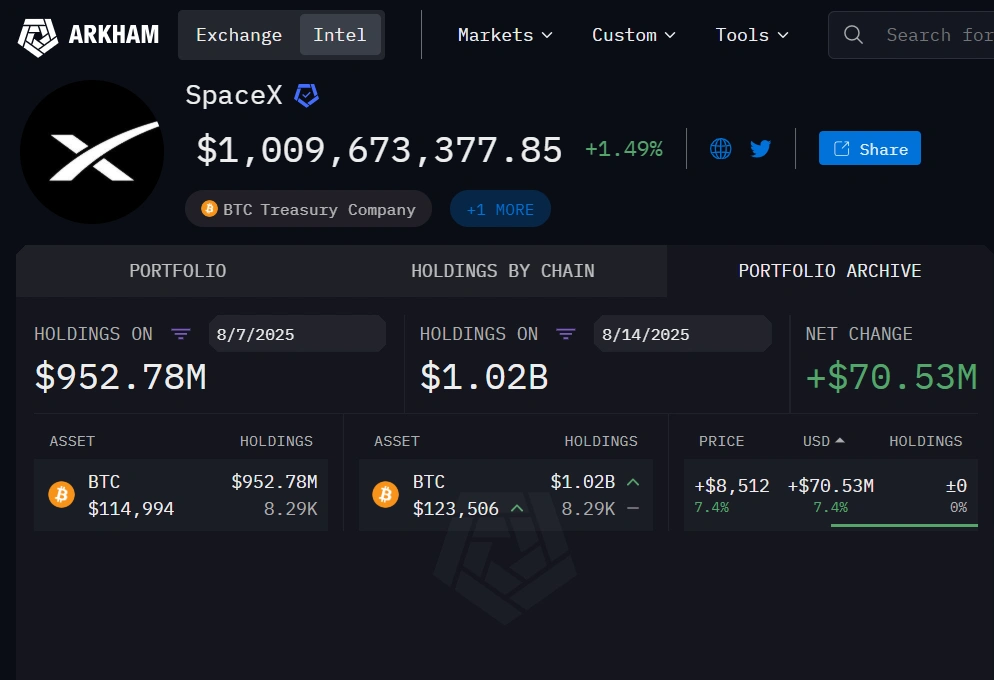

Norway hands Musk Tesla boost as SpaceX BTC holdings expand past $1B

Share link:In this post: Tesla’s sales in Norway have surged despite growing discontent among Norwegians regarding Elon Musk’s political stance. SpaceX’s BTC holdings have crossed the $1 billion mark again. Tesla’s deep ties in Norway influence its consistent sales numbers, but it is slowly losing its dominance as more rivals make headway.

Musk tips Google to dominate AI as it commits extra $9B to Oklahoma AI, cloud infrastructure

Share link:In this post: Elon Musk says Google currently has the highest probability of leading AI due to its compute and data advantage. Google will invest $9 billion in Oklahoma to expand AI and cloud infrastructure over the next two years. The plan includes a new Stillwater data center campus and expansion of its Pryor facility.

Nvidia partner Foxconn reports strong surge in AI server sales

Share link:In this post: Hon Hai Precision Industry (Foxconn) reported a 27% increase in Q2 profits, driven by sales in its AI server business. The company reported a net income of NT$44.36 billion for the period, surpassing an average analyst projection of NT$36.14 billion. It also expects significant growth in Q3 and the rest of the year.

US PPI beats estimates with 3.3% annual gain in July

Share link:In this post: US PPI jumped 3.3% in July, the highest annual gain since February. Monthly PPI rose 0.9%, blowing past the 0.2% forecast. Service costs surged, led by machinery wholesaling and portfolio fees.