Ripple CTO David Schwartz Reveals Ambitious Plans for XRP: “We Will Acquire Financial Giants, Will Have a Structure Similar to Ethereum…”

Bitget2025/06/27 07:40

Bitget2025/06/27 07:40As the company behind XRP, Ripple continues its acquisitions and technology investments in line with its goal of building a bridge with traditional finance.

The company attracted attention earlier this year when it acquired prime broker Hidden Road for $1.25 billion, but Ripple’s plans don’t stop there.

Ripple’s Chief Technology Officer (CTO) David Schwartz stated that the company is evaluating multiple acquisitions. “Our acquisition and merger team is working very hard. We have many potential acquisition processes at different stages,” said Schwartz, adding that the activity in this area is due to Wall Street still not fully realizing these opportunities.

Schwartz said that the slow pace of traditional financial giants in strategic acquisitions presents an opportunity for crypto companies. “We don’t have to compete with big banks to acquire strategically valuable companies like Hidden Road,” he said.

Ripple has previously acquired crypto custody firms such as Metaco and Standard Custody, and the company also plans to use its new stablecoin, RLUSD, as collateral for Hidden Road’s brokerage services.

Ripple is preparing to develop not only acquisitions but also the XRP Ledger (XRPL) infrastructure. XRPL, which is aimed to gain an Ethereum-like “programmability,” may soon be equipped with payment management systems that work similarly to smart contracts.

Schwartz said that while full programmability would not be possible in the near term, the goal is to “preserve security while providing flexibility.” For example, he said contracts could be put in place that allow a user to receive payment in their preferred digital asset instead of XRP.

In addition, Ripple is developing a lending protocol on the XRP Ledger. This system is planned to be launched if approved in the third quarter of 2025. Schwartz stated that this structure will bring together traditional finance (TradFi) and decentralized finance (DeFi), and said, “While the selection of borrowers and legal transactions are carried out off-chain, the tokenization and distribution of repayment rights will be done on-chain.”

Ripple made headlines in the industry in June with many announcements, including tokenized treasury bonds, a decentralized exchange (DEX) for institutional investors, and a partnership with Wormhole, which enables asset transfer between blockchains.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

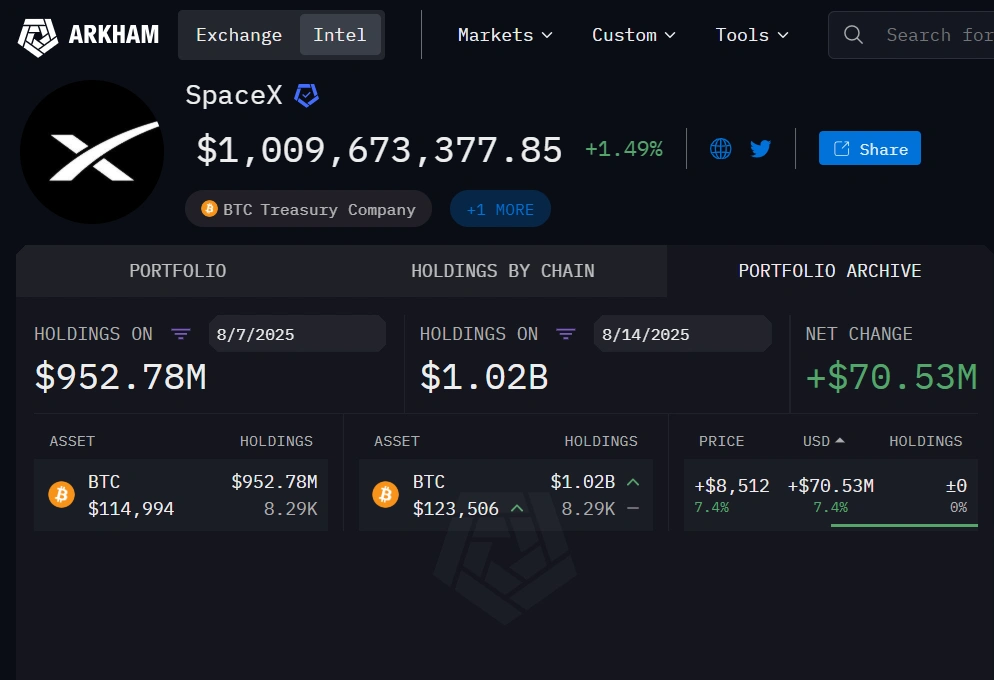

Norway hands Musk Tesla boost as SpaceX BTC holdings expand past $1B

Share link:In this post: Tesla’s sales in Norway have surged despite growing discontent among Norwegians regarding Elon Musk’s political stance. SpaceX’s BTC holdings have crossed the $1 billion mark again. Tesla’s deep ties in Norway influence its consistent sales numbers, but it is slowly losing its dominance as more rivals make headway.

Musk tips Google to dominate AI as it commits extra $9B to Oklahoma AI, cloud infrastructure

Share link:In this post: Elon Musk says Google currently has the highest probability of leading AI due to its compute and data advantage. Google will invest $9 billion in Oklahoma to expand AI and cloud infrastructure over the next two years. The plan includes a new Stillwater data center campus and expansion of its Pryor facility.

Nvidia partner Foxconn reports strong surge in AI server sales

Share link:In this post: Hon Hai Precision Industry (Foxconn) reported a 27% increase in Q2 profits, driven by sales in its AI server business. The company reported a net income of NT$44.36 billion for the period, surpassing an average analyst projection of NT$36.14 billion. It also expects significant growth in Q3 and the rest of the year.

US PPI beats estimates with 3.3% annual gain in July

Share link:In this post: US PPI jumped 3.3% in July, the highest annual gain since February. Monthly PPI rose 0.9%, blowing past the 0.2% forecast. Service costs surged, led by machinery wholesaling and portfolio fees.