New Metaplanet buy flips Tesla in Bitcoin holdings as shares slide 5%

Japan-based Metaplanet has overtaken Tesla among corporate Bitcoin holders following its largest single purchase to date.

On June 26, the firm confirmed that it acquired 1,234 BTC for approximately $132.7 million, paying an average of $107,557 per coin.

This brings Metaplanet’s total Bitcoin holdings to 12,345 BTC, now worth about $1.33 billion based on current market prices.

The company’s cumulative investment in Bitcoin is $1.2 billion, with an average cost of $98,407 per BTC. With Bitcoin trading above $107,700, Metaplanet is currently sitting on an unrealized profit of over $110 million.

Meanwhile, the latest purchase marks this month’s fourth acquisition and the largest since Metaplanet adopted a Bitcoin treasury strategy in April 2024.

Metaplanet CEO Simon Gerovich noted that these aggressive purchases have helped push Metaplanet ahead of Tesla, which holds 11,509 BTC.

The Japan-based company is now ranked the seventh-largest corporate Bitcoin holder globally. Meanwhile, market analysts have pointed out that an additional purchase of 1,000 BTC could move the firm into the fifth spot, overtaking Bitcoin mining firms CleanSpark and Galaxy Digital.

Notably, the latest acquisition comes a few weeks after Metaplanet surpassed its initial 2025 goal of 10,000 BTC. The firm has since raised its targets, aiming for 30,000 BTC by the end of 2025 and an ambitious 100,000 BTC by 2026.

Backing this expansion, Metaplanet recently secured $515 million through an equity offering supported by EVO FUND. That capital, like previous rounds, is earmarked for further Bitcoin purchases.

Earlier this month, the company unveiled a larger ambition of raising $5.4 billion to buy as much as 210,000 BTC by 2027. A portion of this fund will support its US operations, as the firm aims to cement its position among the top institutional Bitcoin holders worldwide.

Metaplanet stock performance

Despite the bullish trajectory in crypto holdings, Metaplanet shares slid over 5% 1,509 yen (about $10.40), according to Google Finance data. This extends a week-long decline of more than 15%.

Still, the firm’s broader trend remains strong.

Over the past month, Metaplanet shares have climbed nearly 60%, and year-to-date performance shows an impressive gain of 322%, suggesting rising investor confidence in the firm’s Bitcoin-first approach.

The post New Metaplanet buy flips Tesla in Bitcoin holdings as shares slide 5% appeared first on CryptoSlate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

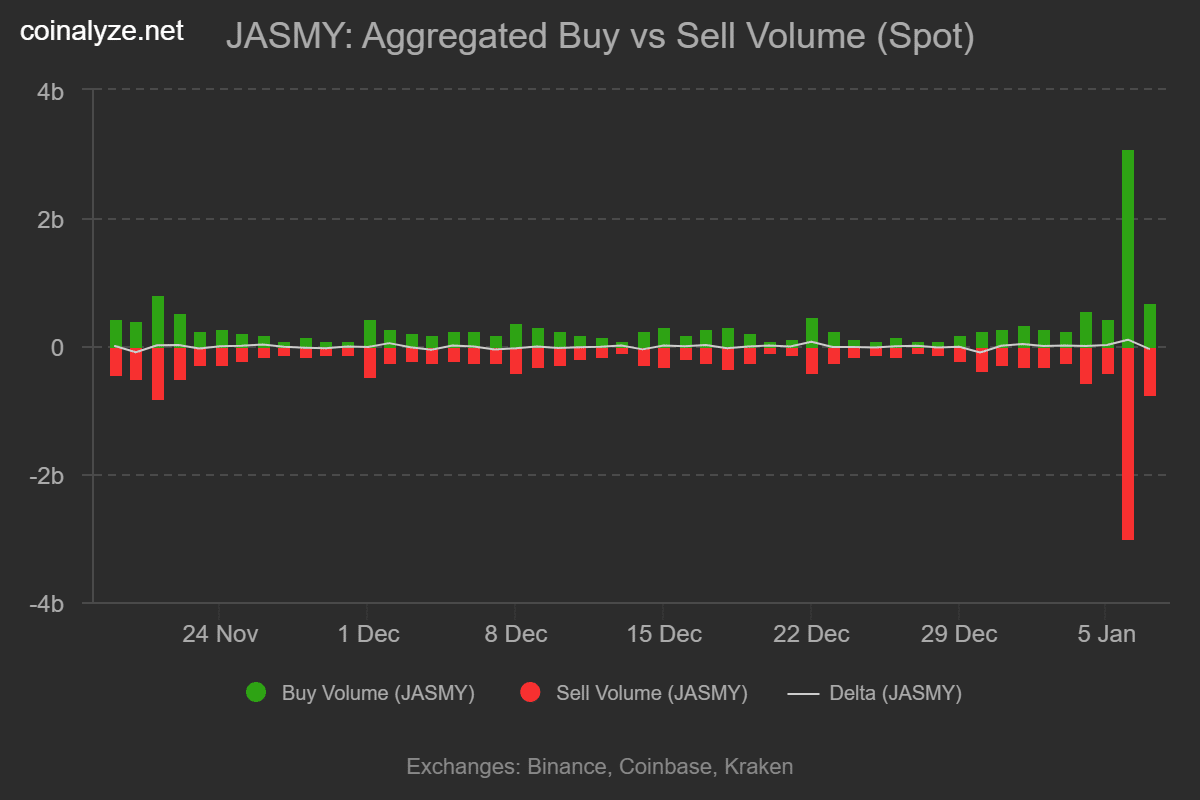

JasmyCoin surges 12%, breaks its range – Can this rise continue?

Metals Experience Profit-Taking Ahead of Crucial Data Release