Veda raises $18 million as stablecoin yield gains momentum

Decentralised finance protocol Veda has secured $18 million in funding to expand its vault platform that enables asset issuers to create cross-chain yield products, including yield-bearing stablecoins.

The funding round was led by CoinFund, with participation from Coinbase Ventures, Animoca Ventures, BitGo, Mantle EcoFund, GSR, Relayer Capital, PEER VC, Draper Dragon, Credit Neutral, Neartcore, and Maelstrom.

Angel investors include co-founders of Anchorage, Ether.fi, and Polygon (CRYPTO:MATIC).

Launched in 2024, Veda supports tokenisation across various DeFi applications such as liquid staking tokens, yield-bearing savings accounts, and stablecoins.

The protocol powers some of the largest vaults in crypto, including Ether.fi’s Liquid, Mantle’s cmETH, and the Lombard DeFi Vault.

According to DefiLlama, Veda’s total value locked (TVL) has surpassed $3.3 billion and continues to grow.

Veda’s CEO and co-founder Sun Raghupathi highlighted the rising demand for Bitcoin (CRYPTO:BTC) yield generation, noting that “harvesting even a modest few-percent yield is often complex and time consuming.”

Veda is addressing this through a partnership with Lombard, developer of liquid-staked Bitcoin on Babylon (CRYPTO:BABY).

CoinFund’s managing partner David Pakman emphasised the growing conviction that stablecoin adoption is accelerating and bringing more wealth onchain.

He described yield-bearing stablecoins as “inevitable” and “a much more convenient way of earning low-risk yield on fiat than traditional bank savings and money market accounts.”

Pakman added that “traditional bank savings accounts will be endangered and need to evolve” as yield-bearing stablecoins gain traction.

Circle CEO Jeremy Allaire recently predicted stablecoins are approaching their “iPhone moment,” signaling widespread adoption.

Circle’s USDC (CRYPTO:USDC) stablecoin holds over $61 billion in circulation, while Tether’s USDT (CRYPTO:USDT) remains the largest stablecoin with nearly $156 billion in value.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Stalls Below $90K as Traders Eye $86K Support, Says Michaël van de Poppe

Amazon’s AI assistant Alexa+ now works with Angi, Expedia, Square, and Yelp

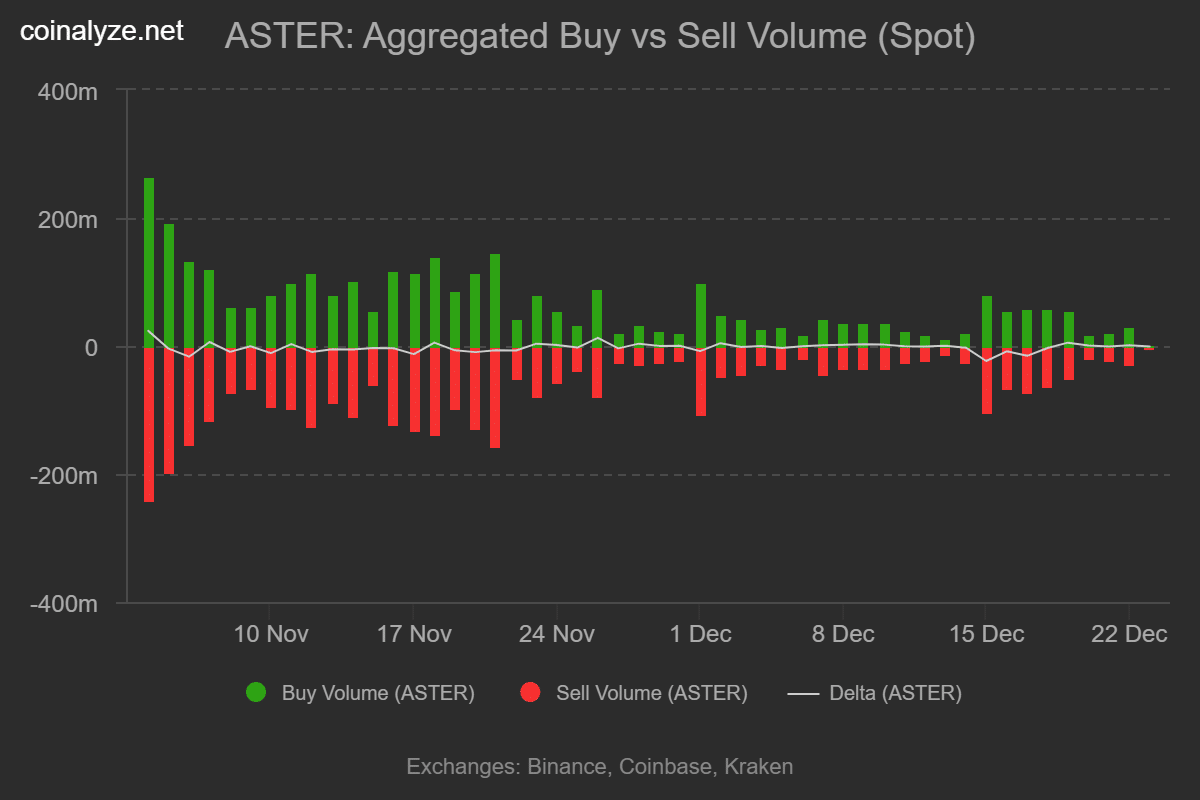

Aster DEX buys back $140M in tokens, yet prices stall – Why?

ETF data shows Bitcoin dominance held firm in 2025 as Ethereum gradually gained share