DeFi Development Corp stock valued at $25 to go onchain

DeFi Development Corp., formerly Janover, announced plans to tokenise its shares through a partnership with crypto exchange Kraken, using the xStocks platform built on the Solana (CRYPTO:SOL) blockchain.

The move will bring the company’s stock onchain, allowing investors to own fractionalised tokens that can be traded peer-to-peer on blockchain protocols.

Joseph Onorati, CEO of DeFi Development Corp., described the tokenisation as a “DeFi Lego block” that developers and institutions can build upon.

Kraken partnered with xStocks in May to offer tokenised shares of US-listed companies like Apple, Tesla, and Nvidia to investors outside the United States.

DeFi Development Corp.’s shares rose over 3% early in Nasdaq trading before settling with a 0.6% gain at $25.03.

The company has increased its focus on Solana, purchasing $11.5 million worth of SOL tokens and seeking an additional $1 billion in capital to expand its holdings.

Other publicly traded firms have also increased Solana exposure, such as Nasdaq-listed Upexi, which raised $100 million with over 90% allocated to SOL purchases.

Tokenised stocks remain a small segment of the real-world asset market, representing just $365 million of the $24.3 billion total market cap, according to RWA.xyz.

Kraken is among several firms aiming to expand tokenised stock offerings internationally.

Robinhood is reportedly developing a blockchain network to enable US securities trading for European investors.

Binance had similar plans in 2021 but paused due to regulatory challenges.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Stalls Below $90K as Traders Eye $86K Support, Says Michaël van de Poppe

Amazon’s AI assistant Alexa+ now works with Angi, Expedia, Square, and Yelp

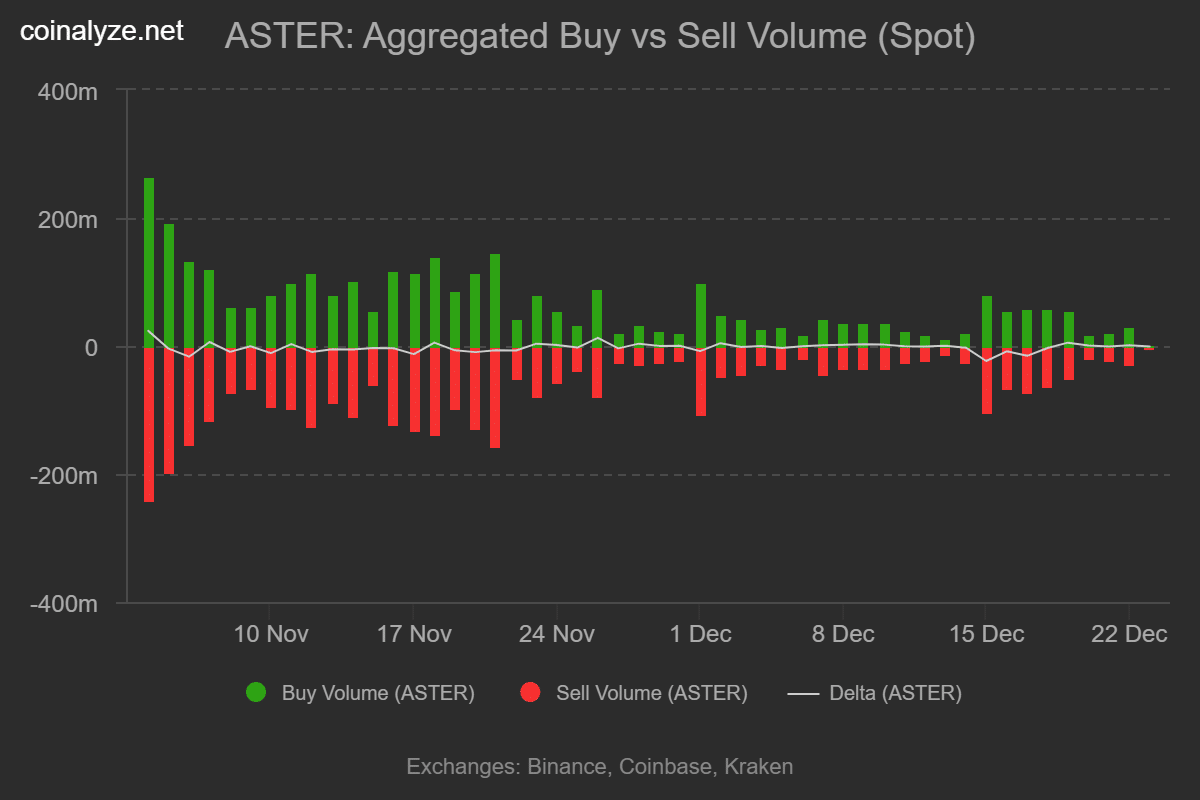

Aster DEX buys back $140M in tokens, yet prices stall – Why?

ETF data shows Bitcoin dominance held firm in 2025 as Ethereum gradually gained share